Global Mobility has been referred to as the decathlon of HR / Reward.

For the optimal employee experience, compliance, and cost management to be delivered, so many technical disciplines must work together.

Let us demystify some of the technical jargon that is prevalent in the domain.

We would welcome any suggestions you have for topics we should explore.

Country specific

The concept of Permanent Establishment (PE) is pivotal in the realm of transfer pricing, as it determines the tax obligations of multinational enterprises (MNEs) within a particular jurisdiction. The risks associated with PE are becoming increasingly significant due to the global mobility of businesses and their workforce. This article explores the intricacies of PE risks in transfer pricing, linking them to broader global mobility issues.

Understanding PE risks

The definition of PE has evolved, particularly under the Organisation for Economic Co-operation and Development’s (OECD) Base Erosion and Profit Shifting (BEPS) project. Action 7 of the BEPS project has expanded the definition of PE to prevent tax avoidance strategies that circumvent the establishment of a PE through agency or commissionaire arrangements. The expanded definition has large implications, as it can lead to increased tax exposure, compliance costs, and administrative burdens for businesses. Further information on considerations of expanding internationally from a UK perspective, including the PE definition and risks can be found here: Expanding your business internationally | Crowe UK.

Global mobility and its impact on transfer pricing

The global mobility of employees presents complex challenges for transfer pricing. The shift towards remote and hybrid working models has also blurred the lines of PE, making it harder for companies to ascertain their tax liabilities.

For instance, the presence of a significant workforce in a foreign jurisdiction could create a PE, thereby affecting the MNE’s transfer pricing policies. The functions of the employees of the PE should be understood from a transfer pricing perspective to ensure correct attribution of profits. The correct transfer pricing methodology will depend upon many factors, including whether the services performed are high or low-level risk and whether they could be considered routine.

Another example is when the senior leadership of a group is in different jurisdictions where they are not employed by the local entity. This could also lead to a PE risk and may require reassessment of the transfer pricing method used.

Several countries have been proactive in addressing transfer pricing issues related to PE. One way of doing so has been to adopt the Multilateral Instrument (MLI), which has further tightened the PE rules, impacting tax treaties and transfer pricing practices. This has been the case for the UK and its tax authority, HM Revenue and Customs (HMRC). In addition, HMRC has established the Profit Diversion Compliance Facility (PDCF) which encourages MNEs to reassess their transfer pricing policies and disclose any tax arrangements linked to diverted profits or the avoidance of a UK PE.

Conclusion

The intersection of PE risks and global mobility issues presents a dynamic challenge for MNEs in managing their transfer pricing strategies. Tax authorities are adapting to these changes, with a focus on ensuring compliance and preventing profit shifting. As businesses continue to navigate this landscape, staying informed and proactive in transfer pricing practices will be crucial to mitigate risks associated with PE.

What can we help with?

Being part of an MNE can sometimes feel daunting when it comes to compliance requirements in various jurisdictions. We can help you navigate the transfer pricing requirements of different countries using our specialists from our wide Crowe network. Our UK transfer pricing team can support you with setting up robust transfer pricing policies, preparing documentation and ensuring you are compliant with HMRC’s requirements. If you would like further help and assistance for your business, please contact Rafaela Oplopoiou-Chapman or your usual Crowe contact.

The non-UK domiciled individuals (non-dom) regime has been part of the UK’s tax system for over 200 years. In cases where specific criteria are satisfied, UK resident individuals whose permanent residence is located outside the UK have been able to take advantage of the remittance basis of taxation. This allows them to exclude their foreign income and gains from UK taxation, as long as these funds are not brought into the UK. Employers in the UK have been able to reduce costs for tax equalised employees by utilising tax planning strategies.

The UK government plans to replace the existing non-dom rules with a new four-year Foreign Income and Gains (FIG) regime from 6 April 2025. Under this new regime, individuals who become tax residents in the UK and have not been UK resident in the past 10 years, will not be required to pay taxes on overseas income and capital gains received for the first four tax years of their residency. The purpose of this new regime is to simplify the tax system and allow individuals to freely bring their overseas earnings into the UK, without being subject to the remittance basis concept. These changes will have a significant impact on both employers and their employees, particularly those who are non-domiciled and are already residing in the UK.

While the full details of the FIG regime will not be confirmed until 30 October 2024, both employers and employees can take steps now to prepare for these changes. We have listed below the key considerations and suggested actions.

Key Considerations

For Employers

Tax and Compensation

- Potential increase in employment costs due to potentially higher tax liabilities for non-domiciled employees.

- Tax Equalisation policies and Net Salary Agreements may need to be revised to ensure continued fairness.

Recruitment and Retention

- The new regime could impact the attractiveness of the UK for international talent, requiring employers to educate potential recruits on the applicable regime going forward.

- New transition and retention strategies may need to be implemented to help retain existing employees who might be adversely affected by the changes.

For Employees

Tax Implications

- Non-domiciled employees might face higher tax liabilities, particularly on worldwide income and gains. For instance, employees arriving in the UK from 6 April 2025, who haven’t been resident outside the UK for at least 10 UK tax years will not be eligible for relief on their overseas workday employment income. Currently, this relief is available to non-domiciled individuals who have been non-resident in the three UK tax years prior to arriving in the UK. Understanding how dual taxation relief and agreements with the UK, might mitigate this increased tax burden will be crucial.

Suggested Actions

For Employers

- Work with tax professionals to assess the impact of the new regime on costs and complexity for talent. Consider education for HR and payroll teams who are likely to be faced with questions and actions.

- Reassess compensation and benefits packages to mitigate the impact of the new tax regime on affected employees.

- Communicate clearly with non-domiciled employees about the changes and their implications.

- For tax equalised employees, consider the tax policy changes and/or clarifications required.

Summary

The new FIG regime from 6 April 2025, brings both challenges and opportunities for employers and employees. Early planning and action will be key to ensuring no surprises in the upcoming tax year and beyond.

If you have any concerns regarding the new FIG regime, please contact Kenny Law or your usual Crowe contact.

Changes to the 30% ruling have been proposed in parliament. After the already announced cap on the 30% ruling that takes effect on 1 January 2024*, two new amendments were adopted (still to be adopted by the Senate).

Degression percentage

The first amendment stipulates that as of 1 January 2024, the amount that can be provided as a tax-free allowance for costs of living outside the country of origin (the 30% ruling) for expats can be set at a maximum of:

- For the first 20 months 30% of the taxable income.

- For the next 20 months 20% of the taxable income.

- For the last 20 months 10% of the taxable income.

For employees who have the 30% ruling in December 2023, a transitional regime applies and the new rules do not apply.

Abolition non-resident taxpayer treatment

The second amendment that was adopted is the abolition of the possibility to opt as a non-resident taxpayer as per the 1 January 2025. Employees with the 30% ruling can opt to be treated as a partial non-resident taxpayer in their annual Dutch income tax return for their Box 2 and Box 3 income. As a partial non-resident taxpayer the employee is not taxable in the Netherlands on his Box 3 income for savings and investments, except for real estate located in the Netherlands. For Box 2 income the non-resident employee is taxable in the Netherlands on the income from substantial interest (>5% interest) only if this is held in a Dutch entity. As a consequence of the abolition, the personal tax liability of the expat may rise. For employees who have the 30% ruling in December 2023 latest, a transitional regime applies. They can still opt to be treated as a non-resident taxpayer up to the 31st of December 2026.

US nationals

For US nationals (or green card holders) with the 30% ruling, additional tax consequences may arise with the abolition of the possibility to opt to be treated as a non-resident taxpayer, due to the specific tax treaty policy with the US.

Conclusion

The limitation of the 30% ruling is a drastic change that will make the scheme less attractive for expats and will lead to an increase of the administrative burden in the salary administration. To benefit from the transitional regime, new upcoming employments with expats should preferably have a commencement date ultimately December 2023 rather than 2024 (if possible, preferable, and feasible). Please contact your contact person within Crowe for more information.

*The 30% ruling can only be applied up to until the WNT-cap of the applicable year. This will be € 233,000 for 2024. The capping measure will be applied from January 2026 instead of January 2024 for employees who already had the 30% ruling included in the December 2022 payroll administration. For employees who applied and were granted the 30% ruling in 2023 the capping measure should be applied in the payroll administration as of January 2024.

|

|

|

|

Roeland van Esveld Partner, Global Mobility |

Rens van Oers Partner, Global Mobility |

This week Deepika Chandak from Crowe UAE, evaluates the impact of Double Taxation Agreements (DTAs) on individuals in the UAE in an evolving Global Mobility context.

Why are DTAs important for individuals in the UAE?

As businesses face the lasting effects of the ongoing COVID-19 pandemic, they have witnessed a fundamental shift in how global workforces operate. What they are currently experiencing is a redefinition of how and where employees work. In this highly unstable global context, tax treaties play an ever-important role in the protection and enforcement of taxpayers’ rights.

Among the key relevant considerations for workers performing their duties abroad, we find the issue of determining how their income will be taxed. DTAs help individuals to avoid issues related to double taxation, to provide tax advantages in both contracting States and to serve as an effective solution to international tax evasion. Finally, DTAs provide individuals with tax certainty of treatment for cross-border trade and investment.

Sample case: Protocol Amending the UAE-Austria DTA

What is the Protocol’s impact on the individuals in the UAE?

The most recent amendment of the DTA between the UAE and Austria, was made through the Protocol signed on 1 July 2021. The Protocol will enter into force on the first day of the third month after the ratification instruments are exchanged and will generally apply from 1 January of the year following its entry into force.

For the purposes of this article, we will only mention those amendments that are specifically relevant for individuals working in the UAE:

- Article 24: Method of Elimination of Double Taxation

- Article 28A: Entitlement to Benefits.

Article 24: Method of Elimination of Double Taxation

This article is updated in respect of Austria, providing that Austria will apply the credit method for the elimination of double taxation instead of the exemption method, as provided under the original DTA. As such, the UAE-sourced income will be subject to tax in Austria, but the taxes paid in the UAE will now be allowed as a deduction against the tax payable in Austria.

Until now, Austrian tax residents did not have to pay taxes in Austria for income that was only taxable in the UAE. With the new Protocol, Austrian tax residents are allowed to deduct the tax paid in the UAE from the income tax paid in Austria. However, as there is currently no Federal Income Tax in the UAE, this translates to a 0% deduction and full taxation in Austria.

Article 28A: Entitlement to benefits

This is a new provision in the DTA which introduced the Principal Purpose Test (PPT). The benefits provided by a DTA will not apply if there is evidence to conclude that the application of those benefits was the principal purpose of the transaction. Therefore, the tax authorities could deny its application if the purpose of the taxpayer was to obtain a benefit from the application of the Tax Treaty.

As such, individuals will not be granted the benefits under the UAE-Austria DTA if it is reasonable to conclude, that obtaining that benefit was one of the principal purposes of any arrangement or transaction that resulted directly or indirectly in that benefit. This is unless it is established that granting that benefit in these circumstances would be in accordance with the object and purpose of the relevant provisions of the Treaty. Individuals should therefore maintain sufficient documentation to justify the genuineness of their arrangement or transaction.

What’s next?

DTAs are particularly important for individuals living and working in foreign countries and jurisdictions. Most DTAs are updated and/or amended periodically. Therefore, companies with staff who may be affected by this change, should ensure that they monitor the developments in the relevant DTAs and see how they can impact them.

Crowe can help in determining the impact of any DTA changes onto individuals and in analysing how individuals can benefit from the amended DTA. Get in touch with Deepkia Chandak or your usual Crowe contact.

Deepika Chandak |

Background

Remember Brexit? It was once one of the most talked about news item in the UK, until the pandemic.

Brexit had an impact on the operation of social security for globally mobile employees to/from the UK and EU. With the UK no longer in the European Union, employers and employees in the UK could no longer rely on the EU Regulations 883/2004 and 987/2009, to manage and simplify their social security liabilities, albeit that these rules broadly remained in place under transitional rules until 31 December 2020. This included employees working and moving between the UK and Switzerland.

From 1 January 2021, the EU Regulations no longer applied to employees working and moving between the UK and Switzerland and it was therefore necessary to manage such cross-border working under the pre-existing 1969 Convention on Social Security, between the UK and Switzerland. The main difference between the EU Regulations and the pre-existing Convention, is that there was no provision for multi-state workers, i.e. employees that worked in the UK and Switzerland on a split basis. Instead, a split workplace principle applied, meaning that employers and employees could have their social security contributions split between the UK and Switzerland based on the employees’ workdays spent in each country.

However, A1 Certificates applied for or in place before 31 December 2020, which had an expiry date beyond that date, remained valid for the duration of the Certificate (unless there has been a substantive change to the secondment).

The New Agreement

On 9 September 2021, the UK and Switzerland signed a new social security agreement which will be in force once it is fully accepted by the UK and Swiss Parliaments (provisionally set as from 1 November 2021).

The new agreement clearly states, as a general rule, that employees will only be subject to the social security legislation in a single State. It also determines the applicable legislation between the States when an employee’s employment activities are pursued in both States, either as a detached worker or as a dual State worker.

A detached worker can remain within their home State legislation, if they are sent by their employer to work in the other State for an anticipated period of up to 24 months. So long as they are not being sent to replace another detached worker.

It is important to understand what is meant by a worker being ‘sent by their employer to work in the other State’ to ensure that this condition is fulfilled. Not all situations are regarded as detached workers.

A worker who works in dual States (i.e. UK and Switzerland) can remain within their State of residence legislation while also working in the other State, so long as they spend a substantial part of their employment activity in their State of residence. Where the worker does not spend a substantial part of their employment activity working in their State of residence, the applicable State legalisation will be guided by where their employer has a place of business.

Notwithstanding the above, multi-State worker scenarios involving an EU country in addition to the UK and Switzerland should be reviewed closely as there is a possibility that a single State liability cannot be achieved.

The new agreement gives employees broadly equal treatment and the same access to social security benefits in each of the States ensuring they are able to receive healthcare cover and state pensions amongst other benefits.

Summary of legislation and period:

- EU Regulations 883/2004 and 987/2009 - From 1 May 2010

- Transitional rules following Brexit - Ended 31 December 2020

- Old agreement 1969 UK/Switzerland Convention on Social Security - From 1 January 2021

- New agreement 2021 UK/Switzerland Convention on Social Security - From 1 November 2021 (tbc)

Next steps

With potentially different sets of legislation that can apply to a single secondment, our recommendation is to review all situations where you have employees working and moving between the UK and Switzerland. Check that you understand which legislation they are covered by for social security purposes and, determine whether or not it is still applicable or if it needs to be revisited with the relevant authority.

For further advice on how to check you are compliant, contact your usual Crowe contact.

Background

In addition to the general provisions of Art. 15 of the OECD Model Tax Convention concerning income from employment, the double taxation treaties between Austria and Germany, Liechtenstein as well as Italy contain a special provision for so-called "cross-border commuters", which as a "lex specialis" takes precedence over the general standard of Art. 15/1 of the OECD Model Tax Convention. The OECD Model Tax Convention does not contain any special regulations for cross-border commuters.

Definition and Right of Taxation

Cross-border commuters are workers who work in the border zone of one state and return daily to their place of residence in the border area of the other state.

The place of work is the place where the employee carries out his daily work. Cross-border commuters are only persons who have their sole residence in the relevant border zone. The establishment of a secondary residence in the border zone is not sufficient. Even if the employee works only one day a week and travels to the neighbouring state for the purpose of performing work on that day, he is a cross-border commuter.

A secondary residence outside the border zone in the state in which the work is carried out does not exclude the applicability of the cross-border commuter regulation except it can be shown that the secondary residence cannot be used in such a way that the worker will return daily to the state of residence.

If a double taxation treaty contains the cross-border commuter regulation, the right of taxation on income from employment is left exclusively to the employee's state of residence. However, Art 15/4 of the Austrian double taxation treaty with Liechtenstein grants the other state a withholding tax in the amount of 4%, which can be credited against the tax levied in the State of residence.

Border zone

It was agreed with Germany that the border zone would be defined as the location in a zone of 30 km on either side of the border. The cross-border commuter's home and place of work must therefore be within a 30-km-wide strip on both sides of the border.

The border zone is not defined in the Austrian double taxation treaties with Italy and Liechtenstein. According to Austrian administrative practice, all places of work are still to be regarded as being located near the border which – taking into account modern traffic conditions – allow a daily commute to the place of work from the place of residence within a reasonable travel time. If, therefore, no second residence is maintained at the place of work and a daily return to the place of residence does in fact take place, the cross-border commuter status would be fulfilled. However, the mere possibility of a daily return to the place of residence would not be sufficient to qualify as a cross-border commuter. With regard to the cross-border commuter regulation in Art. 15/4 of the Austrian Double Taxation Agreement with Liechtenstein, the Austrian tax authorities took the legal view that the cross-border commuter status can also be granted if the place of work is 70 km away.

Critic

In literature, cross-border commuter regulations are criticised, also for reasons of EU law. The justification for this special standard – the cross-border commuter clause serves to avoid disadvantages for persons with limited tax liability – appears to have been overtaken by the ECJ ruling in the case Schumacker (ECJ 14.2.1995, C-279/93). Arguments such as the improved enforceability of taxes and the freedom of movement for workers required under EU law also argue in favour of reconsidering these regulations.

Conclusion

There is a large sum of regulations in Austria that apply on cross-border employments. Nevertheless, also a wide range of simplifications apply. Because of the complexity of this topic we recommend that professional assistance and advice should be obtained in advance.

Christina Eder |

Thomas Folly |

Dinesh Jangra

Cross-border remote working is here to stay. More and more programmes are being announced, formalised or reviewed, adopted and integrated as part of organisational agile working. We’ve covered the compliance aspects in detail, as attention is needed to avoid compliance problems and penalties.

To deliver the win-wins for the employer and the employee, focus is needed to ensure that employees and teams can thrive as part of cross border virtual teams. Dr Phil Renshaw discusses some key issues and techniques that make the difference.Dr Phil Renshaw

Workforce mobility, like workforces themselves, has always been evolving. Over the decades we’ve witnessed shifts in the countries sending people to live and work elsewhere, the types of people they send (women, younger, less experienced) and what they send them to do (share knowledge, learn from others). We’ve also seen shifts in the way in which they are ‘sent’, from the traditional ‘expatriation with your family’ model, to commuting, to frequent-flying, and many combinations thereof.

And yet, the pandemic has been a huge accelerant in bringing changes to workforces everywhere. In particular, it has brought attention to models where less physical travel and work in other countries occurs, and also within the same country, is done virtually. These types of activity which affect the globally mobile workforce are not new. Yet the numbers of organisations and countries affected has magnified suddenly. More and more businesses are announcing cross border programmes: the ‘work from anywhere’ time is upon us. This brings focused attention on issues from compliance and tax to productivity and effectiveness.

Furthermore, organisations have started to focus more clearly on which types of global working are of most value to them. Can they be successful with less travel? What types of cross border working will be their competitive advantage? This question as to what is the most effective way to deliver work that crosses borders, has been a thorn in many an organisation’s side for a long time. Organisations know why they send someone to live and work overseas (to run a new factory, to learn new practices, to establish new businesses in cheaper locations), but rarely do they know if their chosen approach was the best one – the most valuable one. Now they are focusing on this issue. How much does travel and face-to-face contact improve productivity and the bottom line?

Now, as the ‘return to work’ conversation is starting to develop in many countries, and with financial questions being raised about the need to have employees located in different parts of the world versus working virtually, so companies are starting to assess more deeply the true value of their Global Mobility decisions. The innovators and first-movers are determining what may be both a preference and a competitive advantage.

Step one in this, is understanding the tax, compliance and process management issues of new decisions. Step two, and probably more fundamental to all this, is understanding the role of your employees’ leadership skills. We need to equip our employees with the leadership skills that will deliver success in complex global environments. Where the identification and management of the similarities and differences between people is a precursor to that success.

The role the soft skills play

Achieving win-wins in globally mobile workforces is dependent upon human skills - how teams and individuals work together, across borders. Whether physically together or not.

One of the things that the pandemic has drawn attention to, through significantly increasing online working, is that all people are different. This may seem to be a ridiculously obvious, if not mundane point, and yet, not everyone has addressed it. What we hear all the time about working online, from home, every day, is how challenging it is to understand what motivates other people, to understand how others are feeling and how to help them succeed. How do we work successfully together? Understanding the differences between people, as individuals, is what enables this success. Of course, people have considered this when sending employees to work in new countries, but now they are realising that was not enough.

Most organisations, and definitely those working in Global Mobility, are familiar with the importance of training around cultural differences when an employee is moving to live and work in another country. (Although, regrettably, we know that lots of organisations do not yet invest in this.) The principle of this training in cultural differences is to understand how people from another cultural or geographical background may behave and act in ways that differ to the norms you are used to. The problem here, that is often overlooked, is that cultural differences exist even when people work in the same country or even the same city. And they exist when you work on the phone or online. Hence training/teaching people about specific potential differences will, by definition, be inadequate unless it opens up people’s eyes and ears to looking for difference, whatever that may be, and adjusting appropriately. Training needs to shift from telling people what the differences may be, to developing skills that enable people to identify differences for themselves.

Organisations may invest in broader skills training, say in leadership development programmes, but rarely is this directly associated with working cross border with global workforces. And yet it is here that these skills become fundamental. And this is where the skills of coaching play a part.

Why Coaching Skills play an unexpected key role in all this

Often people familiar with the practice of management coaching will traditionally describe it in a particular way. A model where someone (the coach) sits with their team member or colleagues (the coachee) and follows a prescribed process. A process in which the coachee is encouraged to think for themselves and find their own solutions to their own challenges. The coach does not direct, offer advice or give solutions. While the principles involved here are excellent, the problem with this model is that it fails to recognise the fluidity and complexity of leadership in practice. Most of the time employees do not have the time to dedicate to following such a defined process.

An alternative model is to separate out the core skills that together add up to create this activity we call coaching. This is what we call Coaching On the Go. The core skills of coaching are individually beneficial practices that generate effective leadership. Most importantly, they help us to learn and understand how others behave, what is important to them and what they are thinking. In other words, they help us to identify differences so that we can adjust our actions and behaviours to achieve greater success. Perfect for global workforces, working across borders and working virtually. Here are just three examples.

- Generative listening describes when we give our full attention when listening to others in such a way, that others can truly hear and learn what they say and think; it helps them to understand themselves. Hence when working with others, this also allows you to truly hear and understand what others think, without placing your own assumptions and biases in the way, enabling you to work more effectively with others. Listening in this way is a skill and it needs practice. If you find that you keep interrupting others or waiting for your turn to speak, you are probably not very good at this type of listening.

- Powerful questioning describes how we use open, respectful and curious questions to draw out others’ views and thoughts. It places a focus on the other person’s opinions. Too often we are expected to provide solutions and to solve problems, so much that we fail to stop and ask these types of questions, to gather information and learn about different perspectives. And, we fail to listen carefully to the answers. Again, this skill requires practice.

- Finally. consider delegation, which is rarely considered a coaching skill. And yet, the most effective delegation allows team members to grow and develop, to build new skills to support the team and the boss. Fully in line with coaching principles. Giving the boss more time to manage and lead the team to greater effectiveness. Delegation in this way (as distinct to just allocating work like a supervisor might) is challenging even without crossing borders and considering cultural differences. So, once again, the skills of carefully listening to your team member’s preferences, asking the right questions and delivering the right support, will result in more effective delegation.

Conclusions

Whether working in Mumbai, Madrid or Manchester the skills of coaching allow employees and teams to adapt and thrive. It’s the same when working with remote colleagues only a few miles away! The central and very vital role of coaching builds resilience at individual and team levels in the new ways of working that are now taking shape. Highly effective workforces operating across borders and across boundaries rely on these skills. Your Global Mobility function needs to consider how to support these factors in order to ensure you have the most effective workforce and deliver value to your organisation.

.png?h=100&w=100&rev=4006e1e5464d40858919acb0cfdbc44b&hash=FA42D64CE2567A70322AEF3DF7E7DE43)

Cranfield School of Management |

Background

A visa is a permit to enter, transit or stay in a country of which the visa holder does not have the citizenship or right to stay, based on other types of permanent residence permit. A visa is usually issued for a limited period and must be in place before entering the country of destination.

A visa covers one country or a group of countries such as for example in the EU, EFTA states, also known as the Schengen states. Countries that are not part of the Schengen area are Ireland, Croatia, Romania, Bulgaria and Cyprus but the area does include Switzerland, Lichtenstein, Norway, Island, Monaco, San Marino and the Vatican. The Schengen agreement provides free movement of citizens within the Schengen countries, in harmony with the conditions for entering a country and rules on short stay visas (up to 90 days).

This article reviews the concept of work visa (work permit) in Switzerland, regarding inbound work activities. Switzerland does have 26 political sub regions (also known as cantons), each with their own migration authorities. Although the regulations are based on federal law, mainly on the Act on Foreigners, there might be a slight difference in the cantonal handling procedure for migration issues.

Business trip to Switzerland

For business trips of up to eight days per calendar year, foreigners (EU/EUFTA and third country nationals) can work in Switzerland without a work permit or the notification procedure described below. This exemption only applies if the business trip was initially not planned to be for more than the eight days. For EU/EFTA-employers the eight days do include business and personal presence, while for non-EU/EFTA employers the eight days are counted on personal level only. Exemptions do apply in certain industries such as construction, cleaning, personal services, etc., here a notification or work permit is required from the first day in any case

EU/EFTA Nationals

EU/EFTA nationals do have a right to obtain a Swiss work permit, when employed by as Swiss domiciled employer. To avoid abuse of migration law, the Swiss migration authorities do verify the economical substance of the employer (e.g. own space, sustainable gainful activity).

For EU/EFTA nationals on assignments for up to a maximum of 90 working days per calendar year (no employment with a Swiss domiciled company), the notification procedure can be applied. With the 90 days notification procedure, a permit to work in Switzerland can be granted by online notification to the Swiss labour market authorities (cantonal authority is responsible). No extensive documentation and formal application procedure are required for this procedure. Nevertheless, labour law regulations and minimum salary or market comparable salary must be paid. A notification must be made eight days prior to the first day of assignment. The notification is always limited to the project or place of work.

For non-EU/EFTA nationals with a valid work permit in an EU/EFTA country for more than 12 months, the EU/EFTA rules do generally apply (e.g. 90 days notification procedure is applicable).

Business travel up to eight calendar days per company and employee are not subject to the registration duties.

Client meetings and contract negotiations are not subject to registration duties, however on the job-training, internships and project related work are subject to registration duties.

Assignments of more than 90 working days per calendar year are not falling under the free movement agreement, hence the same rules as for non-EU/EFTA nationals do apply (see hereafter).

Since 1 January 2021, UK nationals are considered as non-EU/EFTA nationals and respective rules do apply. EU/EFTA rules may remain applicable if the project/work situation was already existing before this date.

Non-EU/EFTA Nationals

Non-EU/EFTA nationals including UK nationals since 1 January 2021, are subject to a work permit approval process when hired locally. Employers must prove that no adequate employee has been found on the Swiss and EU/EFTA job market. Usually job advertainments shall be published on a common job portal for three months.

Assignments to Switzerland of Non-EU/EFTA nationals and EU/EFTA/UK nationals (for assignments of more than 90 days per calendar year) do require a formal work permit. Work permits are usually granted for four months/120 days up to 24 months. The work permit is granted for a specific project or work site and is usually restricted to this specific location or canton.

Both the local employment as the assignment of respective nationals does require compliance with Swiss market comparable salary, requires economical relevancy and is granted for employees with excellent professional experience and/or executive personal.

Exemptions may apply for intra-group transfers.

Swiss work-permit

The work permit is granted for a specific project by the respective canton. Change of the project is subject to a full re-application and will not be approved by the cantonal authorities in most of the cases. Assignments of executive personal may be structured in a way that various job sites can be covered if a local entity of the group is in place (management transfer rules).

Work permits are subject to quotas allocated to the cantons on quarterly basis. If one of the general criteria for obtaining a work permit is not met (i.e. professional experience, salary level, economic relevance) and/or if the quota for a certain type of permit is fully used, the cantonal authority can refuse to grant a work permit for a specific worker.

The application process:

- Verify the local salary and identify any potentially applicable Collective Labour Agreements (https://entsendung.admin.ch/Lohnrechner/home). A written secondment agreement is a mandatory part of the filing. All salary components must show all salary components separately and in Swiss Francs (CHF). In addition to the Swiss market comparable salary, a per diem of CHF 55 per day or CHF 1,000 per month shall be paid.

- File the work permit including at the cantonal labour market authority. The whole work permit procedure takes usually between three to six weeks. It may take up to eight weeks in more complex situations or if the economical relevance and educational/professional background becomes subject to further investigation.

- If the required criteria are not met or if the quotas are fully used, the permit application will be refused. Usually the authorities do grant a chance to file an objection with further proof of relevancy, adjustment to the salary etc.

- The labour market authority approves the permit application. Depending on the nationality of the employee and type of permit, further approval of the cantonal and federal migration authority may be required before the employee is entitled to work in Switzerland.

- The employee needs to register at the local municipality and only then is allowed to work (not applicable for the 120 days permit). Swiss medical health insurance or proof of medical health coverage must be available.

Swiss work permit overview

|

120 days permit

|

4-month permit / 120 consecutive days

|

|

L permit

|

|

|

B permit

|

|

|

C permit

|

|

|

G permit

|

|

This overview does not include business travel of up to eight days and the 90 days notification procedure, because these are not considered as work permits.

Action steps and conclusion

When planning international assignments, the employers must consider the following factors:

- Nationality of the employee - EU/EFTA or third country national?

- Residency of the employee – within an EU/EFTA state or outside?

- Home country – where is the employer domiciled?

- Host country - where will the work being performed during the assignment?

- Duration of the assignment?

These considerations do apply for international assignments in general. Nevertheless, to protect domestic markets and local labour market countries have implemented national regulations for cross-border workers, assigned workers, and worker on foreign country employment contracts. Although the EU/EFTA free movement agreement is in place, each host country’s immigration rules must be verified prior to the assignment.

Non-compliance can be subject to penalties and/or ban from future work in a respective country.

Planning ahead of the assignments is key to successful assignment of workers.

|

Raphael Gaudin Zurich - St. Gallen |

For those working in the global mobility area, the deployment of talent into and out of the area can present different challenges to those they may be used to in other locations.

It’s generally understood that there is no income tax in the UAE but it’s worth noting that despite this there are significant other local compliance requirements. Do you know what they are?

Home tax issues don’t always go away

Even with the ‘no tax status’, a key aspect itself in attracting talent into UAE roles, it’s worth remembering that global mobility taxes aren’t a single location issue.

Care needs to be taken to ensure that ‘no tax’ status is communicated and expected only after considering whether the home country of the employee will actually stop taxing the individual. The difference between no tax and taxes can be very significant based on the country so compensation issues arise if an employee is expecting ‘tax free’ status when it is not available.

For example, a UK based employee going to Abu Dhabi for nine months will still be subject to UK income taxes and social security. This means employer payroll obligations continue too. US nationals and green card holders continue to have US tax returns and taxes to consider regardless of where they work. Similar principles apply for other countries.

Income tax, social security and payroll issues in the home country have to be carefully reviewed to avoid any compensation surprises or employer payroll non-compliance down the line.

So what are the key UAE aspect to work through?

In the remainder of this article below, my colleague Markus Susilo of Crowe UAE explores some key non tax issues to consider.

No tax in the UAE does simplify that aspect of assignment administration. However, there are other local compliance requirements that do need to be worked through and considered across the employment life cycle. These include jurisdiction, immigration, employment regulations, social security, labour laws, national pension schemes and health insurance.

Jurisdiction

Broadly speaking, the UAE divide their economic and legal jurisdiction between the onshore sector, dominated by local business interests with restrictions on foreign ownership, and the offshore sector, which consists of free zones. As of now, there are more than 45 such free zones successfully operating within the UAE. They are exempt from the laws of the UAE, unless the respective free zone authority has regulated otherwise.

Immigration regulations

For a non-UAE national to be officially employed by and working for a company in the UAE, he/she must obtain a residence visa and/or work permit. As most of the workforce in the UAE are expatriates, the process of obtaining a work visa is much more transparent than in other countries. This does not mean, however, that the process is not complex and dynamic and highly dependent on the location of the company (onshore/ free zone).

Visas and work permits are usually valid for two to three years and must be renewed at expiry in order to keep employing the foreign employee. Visa holders can sponsor the visa of their dependents (direct family members) provided that they meet certain criteria such as the amount of salary earned.

Federal labour law

UAE labour law regulates matters related to working hours, vacation and public holidays, sick leave, maternity leave, employee records, safety standards, termination of employment and end of service gratuity payments. UAE labour law applies to all employees working in the UAE, whether UAE nationals or expatriates.

Most free zones have opted to adopt UAE labour law and, in addition, also have to consider other employment regulations for companies operating in their zone. However, employees employed in financial free zones in the UAE can be exempt from UAE labour law and subject to a different set of regulations.

Social security

At the end of an employment relationship, companies are usually obliged to pay a gratuity to the employee which needs to be accrued for during the employment of the employee. Furthermore, in the Emirates of Dubai and Abu Dhabi it is mandatory for companies to provide private health insurance (from authorised health insurance providers in these Emirates) to their employees. Additionally, contributions to the state pension and the social security system is mandatory for companies employing UAE nationals.

Conclusion

There is no doubt that no tax status of the UAE can be a key inventive in attracting talent into the Emirates. It’s important that employers check that this tax free status actually is real, i.e. the home country doesn’t continue to tax.

For UAE based employees that travel on business out of the UAE, it’s important to review whether their duties and activity are taxable in the locations they are working. Depending on roles and countries, tax and employer payroll obligations can arise.

Global mobility professionals deploying talent into the region should always carefully consider local compliance obligations in the areas of jurisdiction, immigration, employment regulations, social security, labour laws, national pension schemes and health insurance.

Careful review and planning around these issues is key and can prevent non-compliance and penal consequences for employers and businesses.

How to face uncertainty and adapt to Individual Income Tax rule changes in China?

With the continuous boom of the People’s Republic of China (PRC) economy, not only more and more seconded foreign employees start to work in China, or extend their work permission, but also young generation with foreign citizen becomes entrepreneurs and starts to run their own business in China. Those of us that work in HR, payroll, finance, and tax areas and each foreigner himself/herself in the PRC have been urged to catch up with newly announced Individual Income Tax (IIT) regulations since the end of last year. A lot of supplementary and detailed rulings were quickly rolled out following the new PRC IIT law and its implementation rule set forth in the second half year of 2018. How do you plan to deal with each specific IIT issue in this year without a clear understanding of detailed IIT rulings? Simply by surfing the internet and calling the tax hotline (12366) of your city? We believe this may not be enough.

The employers located outside China may navigate through a difficult path when seconding foreign employees to work in China where its IIT rulings are constantly changing recently. Normally speaking, immigration, tax, social security and foreign exchange control of host countries are major factors impacting an overseas secondment arrangement. The employer outside China must ensure the seconded individuals to start working in China timely, legally and their relevant secondment arrangement is compliant with local tax rulings as well as to ensure the overall secondment costs are not high.

So, what’s the Chinese immigration rules look like now?

For short-term business travelers who would spend for no more than 90 days in China, they are required to apply for M visa rather than L visa. Unlike L visa granted for the purpose of social communications and visit, M visa is granted to those who would take business and trading activities in China. M visa is also called short-term work visa. For those who would spend for more than 90 days in China, they need to apply for Z visa (known as work visa). The good news is that expatriates can apply for Z visa from their home countries since year 2017. With these in mind, are you making the right application towards different types of visas for your seconded employees?

For example, if your local Shanghai entity is going to hire a localized foreign employee who needs to move from another city to Shanghai after accepting your offer. How are you going to alter his work and residence permit to Shanghai? Does he/she need to go back to his home country to start a new round of immigration cycle? The answer is no. If you know how it works, it will definitely ease the administration burden and not delay his/her onboard date.

What’s the current PRC IIT filing schedule under the new PRC IIT regulations?

For the first time, the new IIT law consolidated four different types of incomes, i.e. salaries and wages, independent incomes, incomes from author’s remuneration and royalty incomes received by PRC tax residents into one annual integrated income subject to aggregate IIT rate(s). While for the said incomes received by Non-PRC tax residents, they are still subject to PRC IIT under different income categories. Except for the said incomes, other incomes like operating incomes, interest incomes, dividend incomes, capital gains from rental income/property transfer and occasional incomes, are still subject to PRC IIT under different income categories.

The comprehensive income received by PRC tax residents is subject to PRC IIT on annual basis; If there is a withholding agent, the relevant PRC IIT should be calculated and remitted to in-charge tax authority by the withholding agent on monthly basis or upon a tax event occurs. If there is no withholding agent in China, these individuals are required to file PRC IIT returns by their own. An annual tax clearance should be performed within the period from March 1 to June 30 of the following year if a tax adjustment is required.

Unlike IIT filing is proceed jointly sometimes in other countries/jurisdiction, the PRC IIT return is filed individually no matter on monthly basis or when the annual one is submitted. As a reference from other foreign countries, i.e. SSN for US citizens and tax file number for Australian citizens, the Chinese identification number (for Chinese nationals), passport number (for foreign nationals), home visit card number (for Hong Kong and Macau residents) and travel permit number for Taiwan residents) are used as individual tax filing number when filing PRC IIT returns through tax on-line filing system. It becomes a unique and unchangeable number by which the Chinese tax bureau would easily supervise the tax filing status of each individual.

How can you have your expatriates not being taxed based on their global income?

The new PRC IIT reform gave more lenient treatments to foreign employees working in China now. One key change is the residence rule changes from ‘Five-year rule’ to ‘Six-year rule’ effective from January 1, 2019. Disregard of how long they have resided in China prior to year 2019, 2019 is the first year of the ‘Six-year’ calculation cycle. The other change is about 'one-full year tax resident' rule. Foreign employees are considered as one-full year tax residents in China if their physical presence days in China exceed 183-day threshold in a calendar year. Keeping these changes in mind, will you review the current secondment arrangement for your employees and see if any changes needed? If they have to be seconded to China, are you aware of the potential double tax issues from improper secondment arrangement? It is suggested that you have a conversation with your employees to remedy their potential tax costs arising from secondment arrangement in China.

Are dual employment and split payroll still workable in China nowadays?

The dual employment and split payroll arrangements have been implemented in China for many years and never been forfeited thus far. It is not compliant if only China-paid portion to your foreign employees are reported for IIT calculation purposes in China. The correct way is to declare both portions in China as both of them constitute China-sourced income. For those who have regional/non-China duties and responsibilities, both of their incomes paid in and outside China should be reported prior to year 2019 and then, a time-apportionment calculation formula at tax level is available. Effective from year 2019, the time-apportionment calculation formula at income level is applied which is closer to the 'income exclusion' rules implemented in other countries/jurisdictions.

Where should the foreign employees make statutory social security contributions while on secondment arrangement?

The China social security law requires foreign employees who legally work in China, i.e. obtaining work and residence permit, should make Chinese social security contributions. The contribution base and ratio vary from city to city. In practice, its implementation has not been strictly followed at city level. For example, no fine or penalty is imposed if the employers in

Shanghai failed to make any contributions for their foreign employees working in Shanghai while making Chinese social security in Beijing is compulsory. For budgeting purpose, you have to understand different practices of social security contributions in different cities before assigning your foreign employees to China.

Furthermore, you also need to know more about which countries have signed the ‘totalization agreement’ with each other to explore the opportunity to waive social security tax in host country.

Most of seconded foreign employees prefer to continuously maintain their social security contributions in their home countries rather than host countries. An allocation of certain portion of their salary income could fulfil this purpose in home countries. That’s why dual employment and split payroll are always applicable in modern world, not only for non-RMB salary payments but also for social security maintenances.

Can the home-country employer cross-charge relevant compensation cost to host-country employer in China?

Sometimes, the home-country employer would cross-charge relevant compensation cost to the host-country employer in China as the latter one is the economic and beneficial employer. Such remittance is made at the company level. Under the strict foreign exchange control implemented in China, theoretically speaking, it is feasible for cross-charge as long as relevant PRC IIT has been paid. However, due to the strict foreign exchange control implemented in China, there are a lot of processes you need to undergo with the in-charge tax bureau and the remitting bank especially when dealing with a backlog charge for past months or even past several years. Have you planned ahead on how to make cross charges at the beginning of global assignment and what’s the frequency?

Furthermore, at individual level, an individual may purchase or sell foreign currency up to USD 50,000 respectively per person per year. It is allowed to exceed such limit for salary income once its relevant PRC IIT has been paid. With the PRC IIT payment certificate, a foreign individual is permitted to convert after-tax salary from RMB to USD and remit out of China.

Preferential tax treatments on Annual Bonus and Non-taxable Benefits?

In order to make a smooth transition from old IIT law to the new one, the preferential tax treatments on annual bonus and non-taxable benefits have been retained for another three years, i.e. from Jan 2019 to Dec 2021. Before the end of the transition period, annual performance bonus is still subject to the preferential tax treatment, that is, it is not required to be combined into annual comprehensive income and the applicable tax rate of which is determined by 1/12 of the total amount of annual bonus. If your foreign employees become one-full year tax residents in China and receive such annual bonus payments for this year in February 2020, the said treatment is still applicable.

During the transitional period, foreign employees may opt to enjoy current tax exemption treatment (i.e. housing subsidy, language training subsidy and children education fees, home leave, meal and laundry) mentioned in the old tax Circular No. 35 issued in 1997 if certain conditions are met. If you have never heard of such exemption rules in the past, why don’t you best utilize it for the last chance for your foreign employees working in China?

In today and tomorrow’s constantly changing world, if you cannot adapt yourselves to face those uncertainties, you will bring some troubles, pains and extra costs to your organizations. We are compliant if we follow the tax rules. We can alleviate a lot of surprises and financial cost more than compliant if we closely catch up with the rapid tax rule updates. We should have a good process at the beginning of seconding someone to go abroad and during the process, we need to think fully, act quickly and finally achieve more.

Please feel free to get in touch if you want to discuss any of the issues raised or need our tax services.

African nations provide some of the greatest opportunities to multi-national organisations. With this opportunity comes complexity, and it is imperative that those managing employee mobility into and out of the region understand the specific differences. Through understanding these differences, mobility professionals can the increase speed of talent deployment and the return on investment for their organisations.

Why is Mobility in Africa growing?

Rich in natural resources, with a comparatively young workforce, booming populations and rapid urbanisation that is creating incredible mega cities, are all factors that are serving to accelerate more African nations to become powerhouses of the global economy.

These factors all contribute to growing economies and markets that are ever more important on the global stage. There is no doubt about it, Global Mobility in Africa is on the increase. Getting talent into and out of Africa has long been a feature of certain sectors (natural resources), but it is an increasingly important part of global mobility and workforce plans across more and more organisations.

Geography

Africa is an amazing place. Geographically, its longest coastline is in Mozambique and it has the world’s largest hot desert the Sahara, in North Africa (3.3 million square miles), roughly the size of the USA. It also has the longest river, the Nile, which has a drainage basin in 11 countries and which stretches 6,650 kilometres from Burundi in the South to Egypt in the North. Africa is the second largest land mass and the second most populated land area on earth (6% of the earths surface and 20% of its land area).

People

The continent has 55 countries with an estimated population of almost 1.4 billion people (2017). This population is expected to reach three billion by 2050. Languages spoken in Africa include, amongst others, Arabic (by 170 million people), English (130 million), (Swahili 100 million), French (115 million), Portuguese (20 million) and (Spanish 10 million).

Economics

Africa is the world’s fourth largest oil producer (Nigeria produces 2.2 million barrels a day), and has 30% of the world’s natural resources. Africa still has the world’s largest remaining reserves of precious metals i.e. gold reserves 40%, cobalt 60% and platinum reserves 90%. Although not the world’s largest deposit, Zimbabwe has a sizeable store of lithium reserves.

Potential

The continent and its nations have vast potential and Africa is, as a result, very attractive from a business perspective. The movement of people as a result of this economic development across the continent is of particular interest to Global Mobility professionals.

Together with Africa’s vast natural reserves and its economic acceleration, it is reasonable to foresee that there will be vast economic development across the region, which will bring yet more increased trade activity, industry and foreign investment. Trade and industry will naturally result in further increases in people movement, as skills and professional services are procured to satisfy needs.

What is different about mobility in Africa?

It’s certainly not easy to generalise across 55 countries, but some areas mobility specialists will want to keep sharp in focus could include:

Immigration: The immigration process can be less predictable than elsewhere and the timing and documentation requirements can be more case dependent. For this reason, it’s important to start this process as early as possible. In certain countries (for example in Nigeria and Ghana), quotas are in place and this can involve a separate process. Special rules may also apply to different types of employer, such as NGOs and Oil and Gas companies.

Cost: Employers are often surprised by the cost of mobility into Africa. Employees need different types of support and benefits with security, healthcare and housing being more important and costly than often expected. Assignment costings after liaison with benefits and destination services with specific local knowledge are must!

Tax: It is essential that the concept of an assignee/expatriate be fully understood so that the tax and other pitfalls are not missed entirely. We often find that tax liabilities are missed completely, simply because nobody identified that the entity in question had in fact engaged the services of expatriates/ assignees. The major cause of this, in our experience, has been misunderstandings around what precisely constitutes tax residence in a particular tax jurisdiction.

The tax systems across Africa, with a few exceptions (the most notable being Angola) are all on a residence, as opposed to a source, basis of taxation.

How does residence based tax work?

In most of the countries in Africa the concept of ordinary residence forms the basis and cornerstone of tax residence. In South Africa (SA), for example, a person is tax resident if his/her ordinary residence is in SA (there are a number of indicative factors which indicate ordinary residence). If a person is physically present in SA, the South African ‘Physical Presence Test’ applies to that person. This test is a specific test that effectively counts the number of days present in SA. After having spent a definitive number of days in SA, regardless of what that person’s ordinary residence status is, that person will be tax resident in SA.The obvious danger here is that from the time of becoming a SA tax resident, that person’s worldwide income falls to be taxed in SA and the expatriate tax and/or benefits, which may have been applicable up to that point fall away and become non-applicable. This change over point is very often missed, thereby creating a multitude of complexities including penalties, interest and stress.

Each country in Africa has its own specific legislation and requirements concerning its ‘physical presence’ test. The SA presence test is an annual test over a multiple tax year period, and it effectively takes a number of years to become physically tax present in SA. Many countries in Africa have a much shorter time period for physical presence. In many cases, tax residence commences after an initial 183 days.

Conclusion

The movement of employees into, across and out of Africa, as can be seen, clearly does not come without its complexities. We recommend that professional assistance and advice be obtained prior to the deployment of assignees into the region.

Michael McKinon

Michael McKinon

Crowe |

Today we cover US Nationals and Mobility. Without doubt, given the huge size of the US economy and the US talent pool, US Nationals are probably the most populous of all globally mobile employee nationalities. However, as a result of the US tax system, they can probably also be the most challenging from a tax and payroll perspective. The issues discussed here apply to mobile employees but, can also apply to US nationals who are hired on local employments too.

It’s important for those managing global mobility to understand why US Nationals are different and potentially more challenging so they, and the business can be prepared for additional complexity and plan ahead.

So what's the basic issue here?

The issue is one of multiple tax systems or double taxation, which is constantly at play. Almost all countries provide a temporary fix through which the link to their tax system can be temporarily broken. This results in tax and payroll for long term assignments becoming focused primarily on one country.

The US tax system for US Nationals and permanent residents is not like this. US taxes will always need to be considered. By US taxes, I mean US Federal taxes, and then on top of that we also have State and City taxes. US tax returns are usually required every year regardless of where the employee lives and works.

Apart from tax return filings, we also have:- Complex related bank account reporting.

- The need to consider special tax filing extensions for those working overseas.

- A tax payment system which requires thoughtful, detailed review by the usual payment date of 15 April, and probably also ahead of every 31 December. The 31 December date is vitally important because if the right amount of non-US taxes have not been paid, or accounted for through payroll, there can be some significant cash flow and reporting complexity issues

- Exposure to what can be significant penalties and interest, if these obligations are not carefully managed

For those managing mobility and deploying or hiring US Nationals, they need to recognize that the employee will always have at least two tax systems to consider. As an employer, this results in more payroll, compensation and policy complexity to work through.

Seeking tax advice in the US and the host country location prior to the move can prevent unpleasant surprises in both tax jurisdictions. Certain parts of the world have NIL or low income tax regimes, for example in Dubai. Mobilising a US National to work in Dubai doesn’t result in the tax free status it can for others. This is a key point.

Which employees are impacted?

Although this article references US Nationals, the issues discussed actually impact a wider population.

- US citizens or US permanent residents (‘Green Card holders’ or GCH).

- Individuals physically born in the US (citizens of birth) - even if neither parent is a US citizen.

- Individuals born outside the US with at least one parent having US citizenship.

- Dual nationals of the US and another country?

What are the requirements for US citizens/GCHs?

A. Tax Return Filings

In general, all US citizens and GCHs (even if they never lived in the US), are required to file US Federal income tax returns annually. They are required to report their worldwide gross income regardless of the source or location of the payment. With the new tax legislation introduced for the 2018 tax year, there is no minimum income threshold for filing.

A US person is required to file a US income tax return even if the individual permanently lives in a foreign country, or temporarily resides in another country, and their wages are within the FEIE (foreign earned income exclusion). This filing requirement applies whether there is a US tax liability or not.

The FEIE allows the taxpayer to deduct $103,900 (for 2018 adjusted to inflation each year) of foreign earned wages from being taxed on the US Federal income tax return. However, in order to take this exclusion, a person must file a US income tax return.

B. Reporting Requirements - bank accounts

US citizens, US Tax residents and GCHs are required to disclose the highest balance(s) of their non-US financial accounts (i.e. foreign bank accounts) to the Department of the Treasury when the aggregate value of their bank account(s) exceeded US$ 10,000 during the calendar year.

The Report of Foreign Bank and Financial Accounts (FBAR), also known as FinCEN Form 114 is required whether the individual owns the account (solely or jointly), as well as if you have signatory authority on accounts where you are not the account owner. This reporting applies to children as well as adults.

The signatory authority scenario can arise simply because of responsibilities the employee has as part of their role for their employer.

C. State/Local Income Taxes

Depending on the State and Local tax residency, the employee (and therefore the employer for payroll purposes) may also continue to be subject to state/local income tax while on assignment. Influencing factors include the duration of the international assignment and connections maintained in that state (active local bank accounts, voter registration as well as intentions to return to that state, etc.). Tax laws vary by state and local tax jurisdictions. A tax advisor can review the specific situation to determine if an employer will need to continue withholding state/local taxes while the employee is working overseas.

Why is this all important?

All US persons, regardless of where they are living, may be subject to tax filing requirements. These obligations can exist even if the individual has not obtained a US passport, or even set foot within the US. The US Internal Revenue Service (IRS) is aware that many US persons are not compliant with the filing of US Federal Tax Returns and the reporting of FBARs. In many cases, people are simply not aware of their US filing requirements, which places them at risk of being seriously delinquent in their US filing obligations with exposure to substantial penalties and interest.

As at least two tax systems will inevitably be at play, there will be additional complexity. Where this complexity is created as a direct result of a globally mobile work arrangement, or assignment, we see that these issues over time, will result in the employer becoming involved. Where the employee is tax equalised, it is in the employer’s best interests to manage US nationals carefully at the beginning for the following reasons.

- Tax cash flow and double taxation is mitigated so there are lower overall costs.

- Employees meet their filing tax filing obligations so penalties and interest do not arise.

- Employees understand their “after tax” compensation and payment obligations.

- US payroll reporting and deductions are accurate.

- Related compensation and tax issues are managed carefully and ‘tax surprises’ are prevented.

Conclusion

It's important to understand that US nationals are different because their tax system is different. This means the taxation of their compensation and the related tax reporting requirements are also more complex.

- Find out nationalities of employees early, is the employee a US national or Green card holder?

- Engage expert assistance early to establish the obligations for the employee, and for you as employers.

- Where employees are tax equalised, focus on tax payments and payroll compliance before the 31 December date each year. We usually advise clients to start reviewing this as the final quarter of each year starts.

- If those with US tax filing obligations will not be tax equalised (local hires for example), ensure they understand how the US and their host country tax system interact, and what that means for their net pay after taxes. Often this is not reviewed in sufficient detail and downstream tax surprises then arise. Inevitably, these are then often transferred to the employer to resolve.

- Don’t expect deployments to NIL or low tax countries to automatically result in NIL or low taxes for US Nationals. Careful review is required.

Intra-country mobility compliance

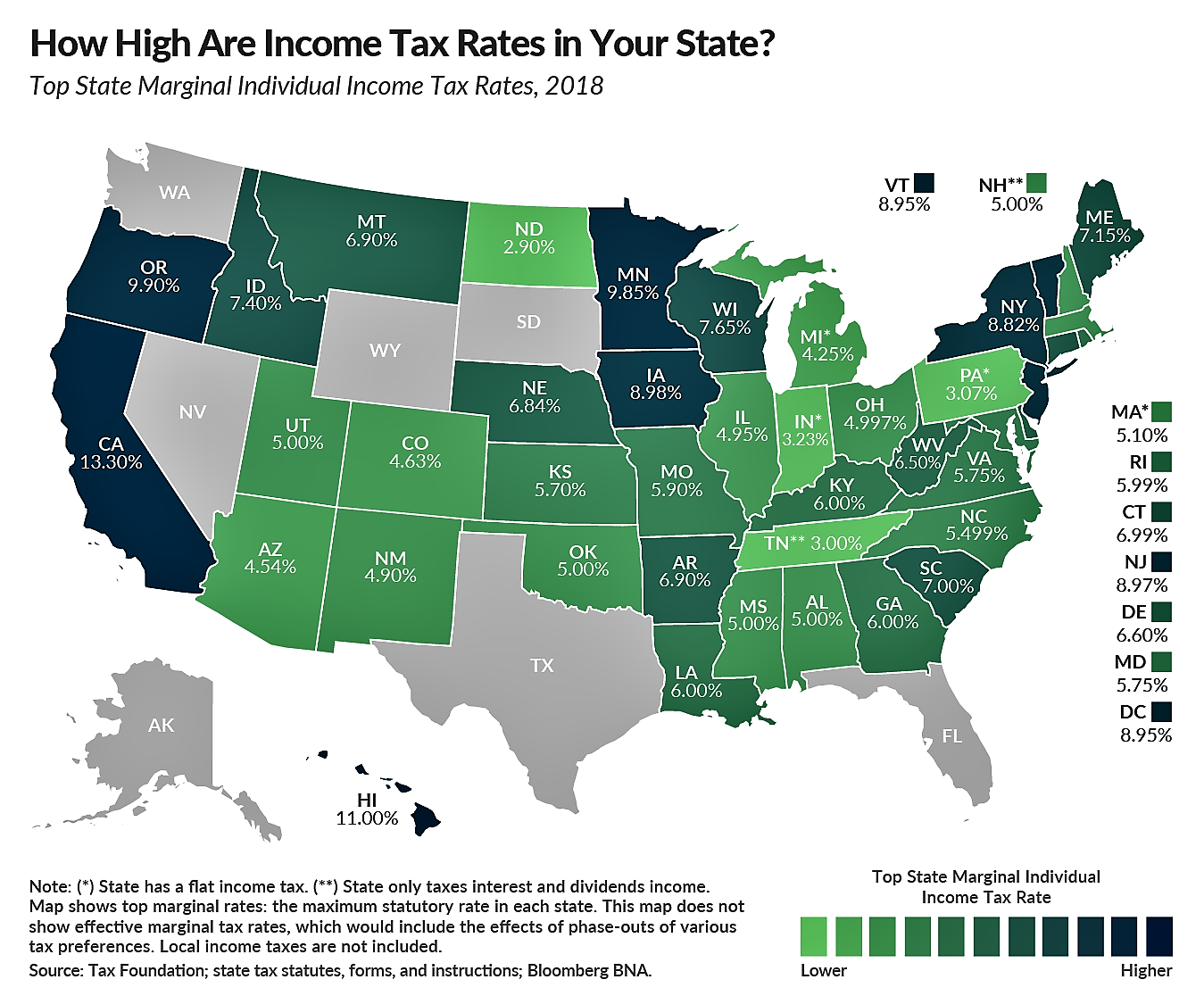

Mobility and tax professionals will be aware that as employees work across borders they may give rise to changes in compliance obligations such as payroll and income tax filings. What’s not always as well understood is that intra-country mobility can also do the same. Working in different places in the same country can change compliance obligations for the employer. In the UK, we have Scottish Income Tax as an example but the best example of this is probably the USA.

US state to state compliance

The US Tax and payroll system works in two parts. There is Federal tax as well as State and Local Taxes often referred to as ‘SALT.’ If a domestic employee, or even a globally mobile employee, is working in more than one US city or state it can mean payroll and income taxes to those cities or states are triggered. Employers need a process to monitor where their employees are working to mitigate risk.

Employees working outside of their 'home state' can give rise to payroll related compliance challenges for their employers as well as personally add to their own individual tax compliance burden … with a need to file extra state or city income tax returns. These employees are 'non-resident' because although they work in one state they live in another. As businesses expand, using 'just in time' service delivery methodology and broaden the use of flexible work arrangements, the employers's vulnerability to payroll tax compliance gaps grow.

Why is State Payroll Tax so complicated?

Well, let's start with the 50 state jurisdictions plus the District of Columbia.D.C. does not tax non-residents and nine states do not impose individual income tax on wages, which leaves us with 41 state tax jurisdictions that apply their own sets of rules to non-resident taxation.

The rules then vary from taxation on day one as applied by 24 states … to taxation based on the number of days per individual, the number of days by legal entity or varying wage thresholds to be applied to an employee in a quarter or calendar year. Once you have these rules sorted out, we then have to consider the Reciprocity agreements between certain states to see if there is an overriding agreement that presents taxation to the 'resident' or 'home' state. Now that you get the gist of the rules, or at least how complex they can be – let’s look at implementation.

For a select few sectors that use time and attendance/ timesheet systems (like professional services) then perhaps daily physical work location details are readily available? If so, it’s then a matter of applying the rules for each of your employees. Alternatively, if the physical work location data does not exist, alternatives include employee self-reporting, analysis of preferred or travel suppliers’ data as well as GPS smart phone related apps that can help facilitate the process. Gather the data, apply the tax rules and then integrate with company policies that reflect your corporate culture.

While today’s rules combined with the expanded use of a mobile workforce present payroll tax compliance challenges there are cost effective solutions for employers to mitigate their compliance risk. Another key point is having a solution in place to track employees’ workdays can of course can enable compliance but it can also be proactively used to prevent that same compliance from being triggered.

Note: The Mobile Workforce State Income Tax Simplification Act of 2019 was reintroduced with bipartisan support last week with the aim to universally apply a 30-day taxing threshold for non-residents working outside of their home state. Similar legislation aimed at State Tax Simplification was introduced in 2007, 2009, 2015 and 2017.

Global Mobility – key concepts

Shadow payrolls are a key concept for those involved in mobility to become familiar with and comfortable with.

They are an essential mechanism through which payroll compliance is delivered. An understanding of why they are used is essential so that those managing mobility can partner with the business to ensure it remains compliant and explain how the process will work.

Increasingly, fiscal authorities are very well aware that globally mobile employees receive compensation from a number of sources (which makes compliance more complex), so this is often an area of specific scrutiny in payroll audits.

When might a shadow payroll be required?

The scenario that gives rise to a shadow payroll is usually as follows:

- an employee is working in, or is assigned to, a new country or even state

- they continue to be paid, ‘on payroll', in their home location. However, a payroll obligation for the employer is triggered in the new country or location.

- a solution is now needed to ensure the employer can meet its obligations in the new location - that solution is usually shadow payroll.

What is a shadow payroll?

Essential to understanding what shadow payrolls are is reflecting upon what role traditional payrolls perform first. A payroll probably performs five key functions:

- pays the employee money into their nominated bank account

- determines and deducts tax and social security amounts due by the employee

- determines the employer payroll taxes due - for example, employer social security

- reports wages, taxes and social security to the local tax/ fiscal authority - the employer then pays these over

- provides a mechanism to maintain participation in certain benefits (for example, a pension).

A shadow payroll is used in a country where there are payroll obligations (B, C and D above), but either no payment is made locally or only part of the overall payment to the employee is made locally. Often, no payment is made; for this reason, the terminology 'shadow' is used, it’s not a real payroll, as no payment is made, but tax reporting and payroll taxes compliance is delivered. Essentially, what has happened is we’ve recognised that the physical payment (A above) and the compliance aspects (B,C,D) can be split.

What should shadow payroll include?