What is basis period reform?

Basis period reform was introduced to simplify the taxation of self-employed individuals and as an enabler for Making Tax Digital (MTD). HMRC felt that there were self-employed individuals that did not understand the basis period on which they were taxed on and the concept of overlap profits.

The new rules are in place for the 2024/25 tax year, with a transitional year occurring in the 2023/24 tax year.

(Throughout we have discussed a partner and a partnership/LLP, however, it will also apply to sole traders and self-employed individuals that have their own unincorporated business.)

Old rules up to and including the tax year 2022/23

Before broaching what is changing, it is worth reviewing what rules were in place up until the 2022/23 tax year.

Historically, the tax year in which the final date of an accounting period fell, dictated when taxable profits from that accounting period were taxed.

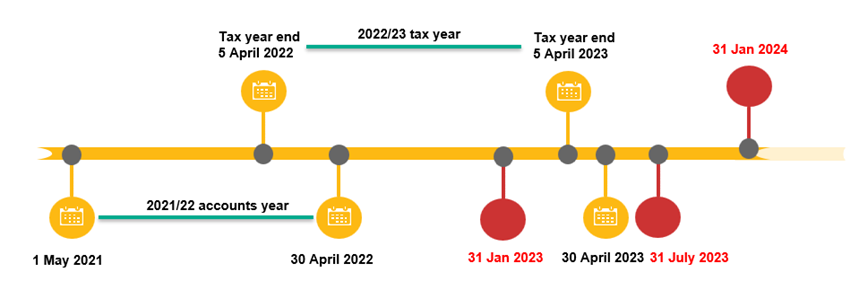

Looking at the above example of a continuing partnership with a 30 April year end:

- 30 April 2022 falls in the 2022/23 tax year

- taxable profits from the 2022 set of accounts would be taxed in full in that tax year on the partners

- the partner would be responsible for making two payments on account in advance, on 31 January 2023 and 31 July 2023, with a final balancing payment being made on the 31 January 2024.

When a partner starts a new self-employment role and the year end is not co-terminus with the tax year there were special opening year rules, which in essence taxed a partner on an element of their first year’s profits twice and these profits are called overlap profits.

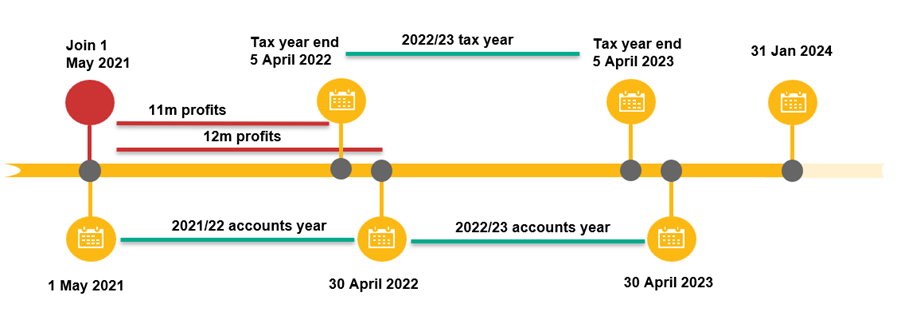

For a new partner commencing on 1 May 2021, where the firm has a 30 April year end.

- The partner will be treated as starting their self-employment on 1 May 2021.

- For the 2021/22 tax year the partner will be assessed to tax on circa 11/12 of their taxable profit share for the year ended 30 April 2022.

- For the 2022/23 tax year the partner will be assessed to tax on their taxable profit share for the accounting year ended 30 April 2022.

- The result of 2 and 3 is that, over the two tax years, 11 months of taxable profit from the accounting year ending 30 April 2022 will have been taxed twice.

- These taxable profits which have been taxed twice are called overlap profits.

- The overlap profits are carried forward until a partner leaves the firm or there is a change in the accounting date, at which time the overlap profits are deducted against the taxable profits for that final tax year.

The calculation of overlap profit varied depending on the accounting year end date, however, the general premise was consistent whereby partners would typically be taxed twice in their opening years, giving rise to overlap profits which were usually relieved when they ceased their self-employment.

The new rules from 2024/25 and onwards

For the 2024/25 tax year and onwards, basis period reform will see partners in partnerships and LLPs taxed on taxable profits arising in the tax year.

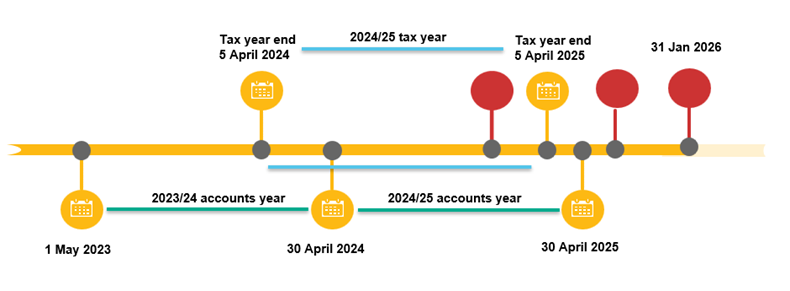

For those partnerships with an accounting year end date unaligned with the tax year, this will result in pro-rating taxable profits from two sets of accounts to arrive at the assessable taxable profits for the tax year in question for each partner.

Again, using the example of a 30 April year end, in the 2024/25 tax year, assessable taxable profits would be calculated by taking circa 1/12 of taxable profit from the 2024 accounts and circa 11/12 of taxable profit from the 2025 accounts.

Transition year, 2023/24

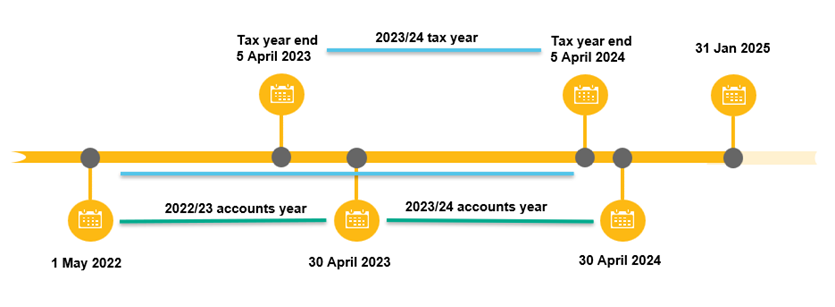

The 2023/24 tax year is a transitionary year enabling the shift from the old to the new basis in 2024/25. Taxable profits are calculated from the day after the accounting period relating to the 2022/23 tax year, all the way through to 5 April 2024, less any overlap relief brought forward.

For the tax year 2023/24 the partners of a firm with a 30 April year end date will be assessed as follows:

- Taxable profits arising in the accounting year ending 30 April 2023.

- Plus 11/12 of the taxable profits for the year ending 30 April 2024.

- Less brought forward overlap profits.

The net figure of 2 and 3 are known as the Transitional Profits.

For a number of partners, the overlap profits will be relatively low, and so the transitional profits may be particularly high with the tax liability being paid by 31 January 2025. As a result, HMRC have included an automatic election to spread the transitional profits over a 5 year period. The election can be disapplied either in 2023/24 or in a later year. There will be an automatic crystallisation of the untaxed transitional profits in the tax year a partner leaves the firm.

What’s the impact?

Partners will be taxed on additional profits over a five year period. Where firms reserve tax on behalf of partners, this acceleration of tax will erode tax reserves and impact on a firm’s working capital. Additional tax will be required to be paid from 31 January 2025 and every six months until 31 January 2025 to 31 July 2028

In addition, tax returns for a number of partners will need to be filed on a provisional basis initially, simply because finalised information will not be available in respect of taxable profits.

FAQs

In most cases, no. For the vast majority of partners, basis period reform will be a cashflow issue, due to the acceleration of tax.

However, for partners whose transitional profits for a tax year result in straddling a tax rate band (including the start of the abatement of the personal allowance), they could find the unintended consequence is paying more tax.

Tax planning may alleviate or limit this by making pension contributions, Gift Aid payments or accelerating the spreading of the transitional profits.

There are no limits in terms of accelerating the taxation of transitional profits, however, it is not possible to defer.

Any untaxed transitional profits will crystalise in the tax year that you retire.

HMRC acknowledge that some firms may not realistically be able to complete the necessary compliance in time to provide their partners with pro-rated taxable profits for the period to 5 April. In particular a firm with a 31 December accounting year end, where there is less than a month before the filing deadline.

HMRC allow provisional figures to be used in a tax return that are to be amended once the finalised figures are available. Amendments will need to be made within 12 months from the original filing deadline. Submission of an amended tax return will extend the 12 month window where HMRC can launch an enquiry into the tax return

Partners should ensure provisional figures are as accurate as possible, as underestimates may result in interest charges arising on late paid tax.

With the additional compliance burdens discussed above, which will undoubtedly result in increased adviser fees, changing the firm’s year end so that it is co-terminus with the tax year is certainly worth considering.

However, there are of course, non-tax reasons and unintended consequences to consider before deciding on whether it is beneficial and works for the firm to change its’s accounting year end date.

Taxable profits from each accounting period is pro-rated, in most cases on a day count basis, although an alternate, reasonable calculation can be used (e.g. weeks/months).

HMRC offer an online service to request overlap profit figures, where an individual has not kept a record. If no record is held, HMRC will provide the relevant profit figures from opening years to enable the overlap profit to be calculated.

For those partners currently paying off a student loan debt, the transitional profits will effectively increase taxable profits and, in turn, increase student loan repayments.

For partners with children currently applying to university, higher taxable profits reported on their tax returns, as a result of basis period reform, could impact the level of grants that a child may qualify for.

The thresholds for both the High Income Child Benefit Charge and tax-free childcare will not take into consideration additional transitional profits and will, therefore, be unaffected by basis period reform.

Insights