TCFD good practices for large banks

As of 6 April 2022, Taskforce on Climate-related Financial Disclosures (TCFD) reporting is mandatory for all public companies, large private companies and larger limited liability partnerships. In addition, banks are encouraged by the Prudential Regulation Authority (PRA)’s Supervisory Statement SS3/19 and the Financial Conduct Authority (FCA)’s Listing Rules to disclose in line with the framework.

The Financial Stability Board (FSB) created the TCFD to help organisations to disclose climate-related information. The FSB has published guidance for sector-specific analysis in addition to TCFD recommendations, supplemented by additional supporting guidance.

We have compared the TCFD reports published for the years 2021 and 2022 of 10 of the UK’s leading banks. Collectively, they have the highest market shares in the UK or were selected to participate in the Bank of England (BoE)’s Climate Biennial Exercise Scenario (CBES) exercise. We have identified the good practices currently seen across TCFD’s four key pillars.

Production and publication

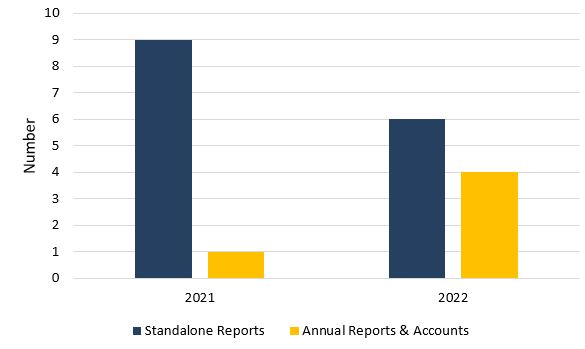

Our review shows an increasing trend for TCFD reports to be published as part of the Annual Report & Accounts:

Figure 1: TCFD reports as part of Annual Report & Accounts or as standalone reports

The main impact of this is the level of assurance required; annual reports are subject to audit, and whilst it is good practice to seek assurance over disclosures, there is no requirement for external review if publishing outside the annual report. Seven banks have appointed a third party to provide independent assurance over certain sustainability metrics. Demonstrating confidence in the data used via reasonable assurance is better practice; two banks opted for a combination of reasonable and limited assurance performed over a range of metrics, while the rest obtained only limited assurance.

| Type of assurance services | Number of banks | Metrics covered |

| Combination of reasonable and limited assurance | 2 |

Reasonable assurance performed over:

|

|

Limited assurance performed over:

|

||

| Limited assurance | 5 |

|

Table 1: Types of independent assurance that banks opted for their TCFD reports.

Further examples of good practices will be discussed in the context of the four pillars of TCFD framework (shown below), and the Supplemental Guidance for Banks.

Governance

This section leaves little scope for variation, however, some banks have clearly put more thought into their disclosures than others. Some good practices include:

- four banks elevated climate risk to a principal risk within their risk management frameworks, which ensures monitoring the risk against a risk appetite statement and constraints, and regular informing of the board

- eight banks linked sustainability objectives to executive remuneration. Banks opted for one or both practices below:

- eight banks allowed for approximately 10% of potential annual bonus to be linked to climate metrics.

- three banks are considering or have already included performance against climate targets in their long-term incentives plan (the better practice, given the long-term nature of climate targets).

Strategy

Climate risks faced by the banks were clearly articulated by eight banks using Table A1.1 from the TCFD Implementation Guidance, which provides a list of risk drivers and potential impacts applicable to all sectors. Table 2 illustrates the detail of reporting by banks, the better amongst our sample aligned to TCFD supplemental guidance and disclosing exposure to high-carbon sectors:

| Elements | Number of banks |

| Risk type (physical, transition, liability) | 10 |

| Climate risk drivers (technology, reputation, etc) | 9 |

| Time horizons (short, medium or long) | 8 |

| Potential impacts | 8 |

| Traditional banking risks impacts (credit, market, etc) | 7 |

Table 2: Elements included by banks in their TCFD reports when describing climate-related risks.

Articulation of climate opportunities was more nuanced, with all banks conducting their own research and analysis. A good practice adopted by half of the banks is splitting climate-related opportunities by client segments or geographies.

Whilst all banks described how they plan to achieve their climate strategy focusing on (1) achieving net zero operations, (2) financing transition to a low-carbon economy and (3) reducing financed emissions, none of them explicitly described the actual potential impacts of climate risks on their businesses, strategies, financial planning, and financial position. Readers can only infer the impacts from the climate strategies.

Another good practice implemented by six banks was disclosing plans for transition to a low-carbon economy and specific activities to reduce emissions for organisations that have committed to reducing GHG emissions. Two banks even included their climate transition plans consistent with the Transition Plan Taskforce (TPT) guidance, which is deemed a leading practice implemented ahead of the publication of the Disclosure Framework and Implementation Guidance in autumn 2023.

Most banks used a range of climate-related scenarios to determine the resilience of their strategies, typically relying on the Network for Greening the Financial System (NGFS) scenarios. However good practice incorporated by seven banks, is to recognise that each group of scenarios has its strengths and weaknesses, and therefore to use a range of industry-recognised climate scenarios, related scenario pathways and methodologies, such as:

- European Central Bank's (ECB) Climate Risk Stress Test (CST)

- International Energy Agency (IEA) Net Zero Emission by 2050 (NZE)

- Climate Change Committee’s (CCC) Balanced Net Zero Pathway (BNZP)

- Intergovernmental Panel on Climate Change (IPCC) Representative Concentration Pathways (RCP)

Running these exercises not only provides a better understanding of how climate risks manifest across sectors and their potential impacts on banks but also supports the development of their own internal scenario exercises and climate risk modelling capabilities. One bank has already deployed its own custom scenario exercise in 2022, which is a leading practice.

Risk management

Risk Management processes were described by all banks through the lens of traditional banking industry risk categories, such as credit, market, liquidity and operational risks. A good practice, covered by all banks, is including climate risk considerations in their Internal Capital Adequacy Assessment Process (ICAAP). Therefore, climate risk is considered when deciding the amount of capital banks need to hold.

Metrics and targets

The metrics and targets recommendations have been addressed by the banks with the caveat on data availability, quality, lags and/or internal capabilities. A good practice highly regarded in the TCFD framework, is splitting the overall figures by geography, sector, product.

Even though banks disclose metrics and targets in different formats, they include various combinations of the following climate-related metrics:

- exposure to transition and physical risks

- impact of climate-related risks on each portfolio

- value of climate-related opportunities

- percentage of carbon-related assets

- percentage of mortgages that have a C or above EPC rating

- resource usage for internal operations.

A good practice is to research and expand the climate metrics calculated (e.g., Implied Temperature Rise, Weighted Average Carbon Intensity (WACI)) once data capabilities allow it.

This is the first year when all banks started to partially disclose scope 3 GHG emissions, following the changes made to the TCFD Implementation Guidance. Scope 3 emissions are more challenging to measure than scope 1 and 2, so understandably those banks focused mostly on easier categories to measure, as noticed in Table 3.

| Scope 3 emissions categories | Number of banks |

| Category 15: Investments | 10 |

| Category 16: Business travel | 9 |

| Category 1: Purchased goods and services | 7 |

| Category 2: Capital Goods | 6 |

| Category 4: Upstream transportation and distribution | 5 |

| Category 5: Waste generated in operations | 3 |

| Category 3: Fuel and energy-related activities (not included in scope 1 or 2) | 2 |

| Category 7: Employee commuting | 2 |

| Category 13: Downstream leased assets | 2 |

| Category 8: Upstream leased assets | 1 |

| Category 9: Downstream transportation and distribution | 1 |

| Category 11: Use of sold products | 1 |

| Category 12: End-of-life treatment of sold products | 1 |

Table 3: Scope 3 Categories disclosed by banks in order of priority

We expect over the coming year that the lagging banks to catch up with their scope 3 reporting, although this will remain a major challenge for the next round of reporting.

The climate-related targets as expected align with the common focus areas in the banks’ strategies:

- achieving net zero operations - reduction of absolute scope 1, 2 and 3 GHG emissions, reduction of energy consumption, percentage of renewable energy sourced

- financing transition to a low-carbon economy – sustainable financing & investing, portfolio alignment to net-zero.

- reducing financed emissions by sector.

Financed emissions fall under the scope 3 Category 15 Investments and refer to the GHG emissions associated with lending, investments and advisory services. Whilst measuring financed emissions is important as they form a high proportion of the total emissions, data quality makes measurement challenging. Nonetheless, most banks disclosed financed emissions alongside the basic GHG emissions in line with Partnership for Carbon Accounting Financials (PCAF)’s GHG Accounting and Reporting Standard for the Financial Industry. A common practice is breaking down financed emissions by sector (energy, power, cement) in line with the banks’ strategies. A good practice that seven banks implemented, is setting financed emissions targets for an additional 1-4 sectors in their latest TCFD reports.

Good practices in regard to targets, adopted by some banks, are introducing new targets as banks progress/achieve existing targets, and including interim targets for 2030.

Future developments

Two major upcoming frameworks and disclosure standards are the Taskforce on Nature-related Financial Disclosures (TNFD) and the International Sustainability Standards Bureau (ISSB) S2 Climate-related disclosure standard. While both build on the TCFD recommendations, the TNFD framework is meant to allow organisations to report and act on nature-related risks and opportunities and the ISSB S2 aims to provide global consistent climate disclosures. The TNFD and ISSB S2 will very likely supersede TCFD recommendations and that is why organisations, including banks, should stay up-to-date with the latest developments in climate disclosure.

Conclusion

This TCFD comparison exercise was carried out to understand the current practices of the banks surrounding climate-related financial disclosures and to derive good practices for the banking sector. This analysis could be used as a guide, especially for banks that have just begun their climate journeys. Although our sampled banks are in the top tier, they are at different maturity levels and none managed to ‘tick’ all the boxes as set out in the TCFD Implementation Guidance yet, which makes looking across many banks a valuable exercise.

The major challenge for the next round of reporting for banks will remain the calculation of the scope 3 emissions, especially financed emissions if they do not invest in better quality data and climate modelling solutions.

Start the conversation

Our ESG team has significant experience supporting organisations on their climate-reporting journey. For more information, please contact Justin Elks, Alex Hindson or Lloyd Richards.

Insights