Science-Based Targets for financial institutions – what does the route map look like?

The SBTi is the gold standard for setting carbon emission reduction targets, and is consistent with the Paris agreement objectives of restricting global temperature rises to 1.5oC. However, being able to sign up to this initiative is particularly challenging for financial institutions and this article explains why.

The transition to net zero is not a simple process and demands senior level investment because it forms as part of a wider sustainability ambition. We suggest outlining your objectives and creating a route map on how to build towards this over an 18–24-month period.

Following the approval of Crowe UK’s own SBTI near-term science-based targets in June 2023, we have been speaking to a wide range of clients about our own experience of managing this project. Inevitably common questions arise.

- How challenging was it?

- How long did it take?

- Would you recommend that we consider an SBTi application?

To be transparent, it is both a demanding and time-consuming process and there must be a clear business case for seeking this accreditation. In Crowe UK’s case it was to meet growing stakeholder expectations amongst current and future employees, as well as its clients. We outline in this article our recommendations for how an insurer or asset manager should approach it.

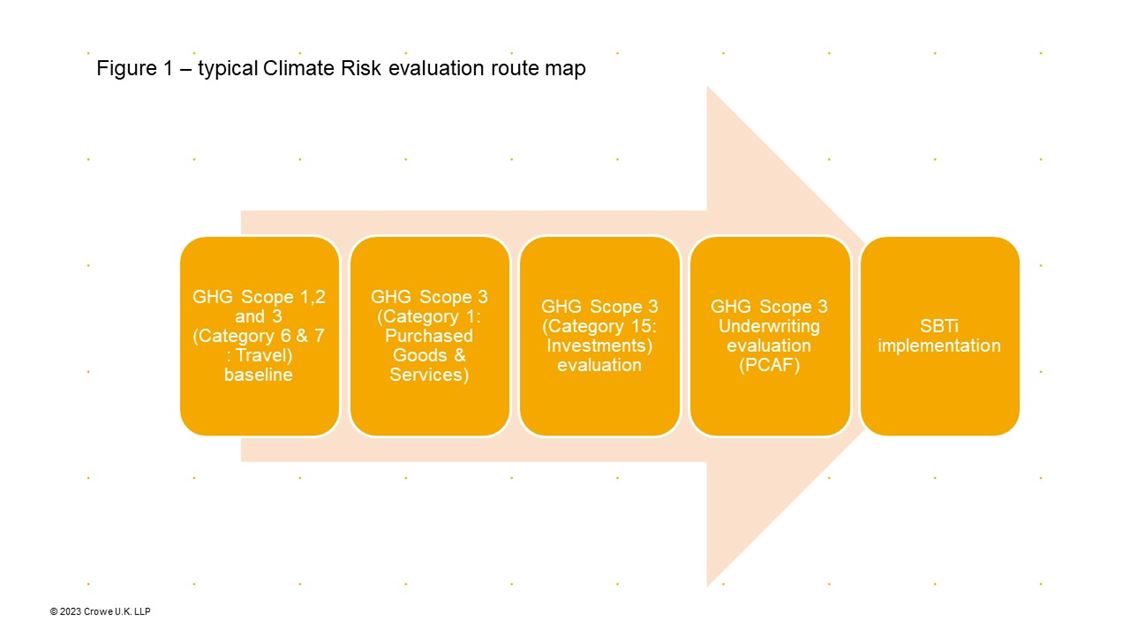

In our view, an SBTi application within financial services only comes at the end of a five-step route map

- Get the basics under control – Scope 1 and 2 emissions.

Most organisations have made a start on seeking to understand their greenhouse gas (GHG) emissions. This typically starts with their operational footprint in terms of their own offices, purchased utilities and any company vehicles. Allied to this, many organisations have addressed their travel footprint associated with business travel and employee commuting. The challenges we see in practice, are with data capture, particularly for overseas rented office space and the need to formalise the data capture processes themselves and ensure appropriate controls are in place to support robust external disclosures.

However, for most financial service organisations, these elements represent less than 10% of their total emissions, so this phase results in them realising they have only scratched the surface. - Address your supply chain Scope 3 emissions.

The next phase of development is to recognise that a significant portion of operational emissions are associated with the organisation’s external supply chain. For insurers and asset managers, this typically means IT vendors, cloud storage and/or data centres and offshored outsourcing operations. Depending on the organisation’s business model, there may be significant dependencies on managing general agents acting as coverholders.

Seeking to understand external emissions implies close working with the procurement function and the implementation of a Responsible Procurement framework. Initial estimates can be made by applying externally published sector intensity factors to different categories of spend. Ultimately, there is a need to start to engage major suppliers to understand their transition plans and whether these will support your organisation’s goals. Despite adopting a risk-based approach, this is a complex and time-consuming process, which may necessitate changes to the procurement onboarding and monitoring processes, including data system changes. - Integrate your investment Scope 3 financed emissions.

From an investment perspective, asset managers have typically sophisticated and mature approaches to capturing and analysing the emissions associated with their portfolios. As most insurers rely on outsourced asset managers to manage their portfolios, this is a relatively advanced area for GHG emission data capture. Challenges remain for asset classes such as sovereigns, private equity, and securitised securities where data is less widely available. The overall picture is broadly positive, with asset managers able to support their clients’ growing needs.

The remaining barriers to reporting are in integrating the data from different asset managers where a multi-manager strategy is employed, and therefore collecting consistent data sets. - Addressing your underwriting Scope 3 financed emissions.

For most insurers, their most significant current challenge is getting their arms round their Insurance Associated Emissions (IAE). A major step forward in addressing this was the publication by Partnership for Carbon Accounting Financials (PCAF) of a methodology for commercial and motor insurance associated emissions, in November 2022.

In our Important things Insurers need to know about Net Zero underwriting: The PCAF methodology, we outlined our approach to implementing this guidance. Our view is that insurers are best placed, by calculating an initial baseline of their portfolio footprint, by using PCAF average industry intensity factors. This will help in getting a top-down view of which lines of business are contributing the greatest exposure. In some cases, this may be surprising because high-intensity sectors may have relatively small associated premiums.

Armed with this information, it is then possible to determine whether to invest in an environmental, social, and governance (ESG) data system to refine the capture of client emission data, or whether to selectively engage key clients directly to understand their emission profiles and transition plans.

As with many aspects of climate risk management, it is hard to implement these processes in one go. Inevitably the process will become iterative, which allows the organisation to refine its approach and target its resources on the most material issues. - Implementing an SBTi application.

So, your organisation has worked through the first four steps and is now ready to consider an SBTi application. You are now well placed to document and provide evidence on your emissions and demonstrate robust controls and processes around these calculations. But what does SBTI expect of the financial services sector?

The SBTi financial service-specific exposure drafts issued in June 2023, including their draft “Financial Institution Net Zero Standard Conceptual Framework” (FINZ) sets out three challenges:

- to incentivise, engage and enable the decarbonisation of existing activities

- to stop financing further development of high emitting assets

- to support the growth of a net-zero aligned economy.

It is helpful to understand that this represents a balanced approach, helping organisations seeking to transition, enabling new industries arising out of the opportunities created by transition, but ultimately cutting off the sources of finance to those organisations unable to transition.

Their draft “Fossil Fuel Finance Position Paper” sets out specific commitments and timelines required to meet these objectives. For example: for developed economies, the expectation is insurers and asset managers cease financial new thermal coal project immediately and stop supporting all thermal coal assets by 2030. For the oil and gas sectors, the same moratorium on new projects applies, but the expectation is to reduce the facilitation of existing assets by 74%, as early as 2030, and to implement a complete withdrawal of capacity by 2034. Equally SBTi’s definition of what constitutes a fossil fuel organisation Is challenging as the threshold is set at >5% of their economic activity.

The wider implications of SBTi

We observe that many sustainability teams are struggling to deliver what they are currently being asked to do. The two challenges we are seeing include:

- complexity: organisations are often faced with multiple reporting expectations; an international entity might be regulated by multiple supervisors with varying reporting requirements. Being listed on a major stock exchange brings additional requirements, as do any voluntary commitments the organisation has chosen to make

- speed of change: the rapid evolution of requirements places significant burden on climate teams, forced to focus on short-term deadlines. Teams have in some cases been moving from reporting deadline to deadline, without any time to step back and think about how best to be organised.

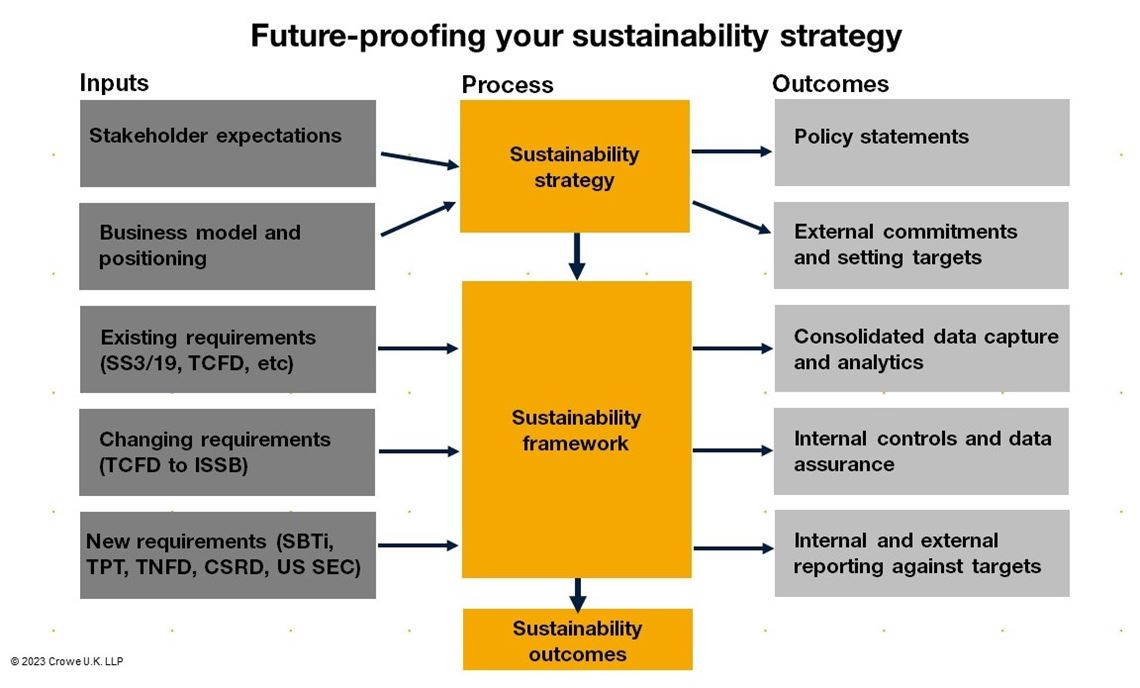

Figure 2 – Crowe’s approach to addressing rapidly changing sustainability reporting expectations.

The first instinct would be to establish a stand-alone SBTi project team and we recommend taking a step-by-step approach. This also presents opportunity to think more broadly about the organisation’s sustainability strategy and its related reporting structure.

Figure 2 outlines an example where an organisation firstly puts in place its own sustainability strategy, driven by its strategic context, related to stakeholder and business model. This defines what external commitments and targets are felt to be appropriate. As requirements are modified or expanded on, the framework is simply adapted and expanded to cope. Now is the time for organisations to step back and think about how best to be organised to manage these requirements.

Determining how to respond to the increasingly challenging climate-related reporting environment is a growing issue for many organisations. At Crowe, we support our clients’ climate journey by:

- providing an overview of the existing frameworks and initiatives, as well as the current market and industry insights

- assisting in the development of their climate risk route map

- reviewing their draft disclosures and providing informal and/or formal feedback.

For further information, please contact Alex Hindson or your usual Crowe contact.

Insights

Contact us