Responsible underwriting

Reflecting on progress and challenges in the insurance sector

Integrating sustainability into an insurance company’s underwriting is a significant change management task. It’s crucial to recognise that underwriters must shape this process in line with their culture and processes for it to succeed.

While working with a range of insurance companies, we’ve observed the evolution of corporate sustainability programmes. While many organisations have been focused on addressing external reporting requirements like the new International Sustainability Standard Board (ISSB) climate reporting requirements, insurers are increasingly realising the importance of embedding sustainability into their core underwriting operations for their programmes to make an impact.

Most insurance companies will have insurance associated emissions (IAEs) which equate to over 50% of their total greenhouse gas emissions. When it comes to underwriting, carbon intensity is important but only one aspect of understanding sustainability performance. Insurers are used to understanding their portfolio’s exposure to physical climate risk and natural catastrophes. Wider considerations are now being factored in, both in terms of wider environmental impacts, but also the social and ethical dimensions of insurance clients’ risk profiles.

Stating that sustainability should be integrated into underwriting is simple, but we’ve closely examined how organisations manage this significant change management challenge. We’ve relied on three key data sources for our work in this area:

- ongoing work with our existing clients, through live engagement

- discussions in our quarterly Sustainability Risk Forum roundtable meetings

- surveys on areas of topical interest, to test market sentiment.

Coming out of this work, we have concluded there are six building blocks to success:

Building from a strategic perspective on sustainability at board and executive level, it is worth spending time as an underwriting leadership team, to clearly articulate what the organisation is seeking to achieve in terms of integrating sustainability considerations into the underwriting process.

In support of this, the business case as to why this is important for key stakeholders is an important component. This will serve to provide clarity and direction to the organisation and reduce middle management and staff frustration as they seek to respond to this change.

It is also important to recognise that this type of project takes time, so it is very worthwhile to set short- and medium-term objectives around what success looks like, so the organisation can celebrate the milestones on the way.

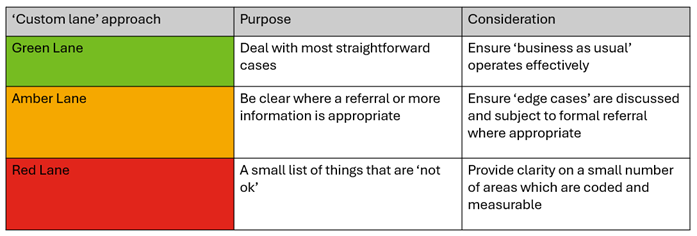

There is a need to decide, based on the strategy and objectives whether responsible underwriting in your organisation is primarily about defending against bad things happening, or whether it is also about seeking out clients with aligned approaches to sustainability and climate-related transition plans. In many cases, this will mean creating ‘custom lanes’ for different risk types to allow underwriters to know where they stand and use existing referral mechanisms.

Figure 1 – example of a ‘custom lane’ approach

Inevitably, this may change over time, but if the primary focus is on protecting the organisation’s reputation, then a defensive stance is most likely, and the focus will be on implementing strong controls and processes. Where the focus shifts towards innovation and new product opportunities, clearly controls are also important, but the commercial opportunities need to be carefully evaluated.

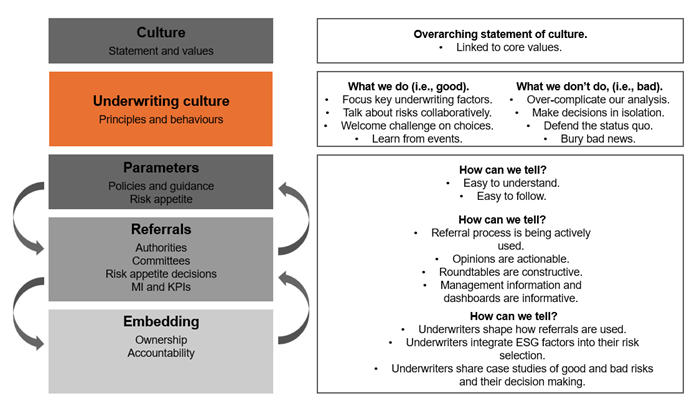

It can be tempting to write down detailed manuals outlining the process for embedding sustainability within underwriting, particularly where underwriters ask for detailed guidance on which risks can and can’t be written. However, in many organisations, balance between process controls and culture is very firmly tilted towards empowering underwriters in their decision making. That means inevitably taking a more nuanced approach, which works ‘with the grain’ of the existing culture and ensures that the appropriate conversations are happening while keeping the process as light as possible. Figure 2 outlines many of the factors that need to be balanced in such a situation.

Figure 2 – integrating sustainability into underwriting culture.

Having decided on the relative importance of controls and culture, expectations still need to be communicated. So, does everyone know what they are expected to do and how they are expected to behave? Underwriting frameworks exist in every insurance organisation and some guidelines around sustainability can be incorporated into these. However, in practice, it is often the case that the factors under consideration are heavily nuanced and require judgment to balance several competing factors.

We are seeing organisations work increasingly with case studies to describe what represented a good risk from a sustainability perspective, particularly where individual environmental, social and governance (ESG) factors may point to different conclusions. Using real examples of insurance clients that have been considered can help to inform underwriters and build corporate knowledge and experience, particularly in dealing with new and emerging challenges.

This led us to discuss approaches to communication with the underwriting community. Much of the initial focus has been on education, in terms of basic background information about sustainability, its importance, and the different ESG factors in play. In some cases, ESG data sources have been used to provide insights for underwriters.

However, we are seeing insurers take a step back and start to focus more on engagement rather than education. Underwriters are generally well informed about their sectors and lines of business and in many cases are more interested in sharing experiences with peers as well as discussing how to engage with clients in practice. Clients are increasingly aware of the need to communicate their sustainability credentials to insurers, alongside their investor and community communication. Underwriters are, however, faced with trying to untangle the key facts from an increasingly complex green marketing exercise.

Many insurers are seeking to understand the nature of the Scope 3 greenhouse gas emissions associated with their underwriting portfolio. This may be driven by anticipated reporting requirements, or simply a desire to understand the carbon footprint of the organisation privately, to allow a portfolio-wide review to be undertaken. However, we are seeing that these exercises can be potentially unsettling to underwriters unless put into context; as they don’t always understand how the information may be used by senior management in steering the business.

It’s crucial to dedicate time to explain to underwriting management how sustainability integration aligns with broader plans. Their role in engaging with clients to discuss transition plans and developing insurance solutions for high carbon intensity sectors needs emphasis.

Underwriting forms the backbone of an insurance company's business model, making it essential for any sustainability program to tackle this challenge to truly impact the organisation's strategy and net-zero targets. Investing time in considering the cultural and communication aspects of implementing this change proves to be a valuable investment.

Through our practical and experienced team, Crowe continues to support our clients in setting their own agenda to address rapidly changing sustainability and climate-related reporting requirements. We maintain a dialogue with clients and contacts through our regular Sustainability Risk Forum meetings. Please contact Alex Hindson or your usual Crowe contact for more information.

Contact us

Insights