Hospitality is at the heart of real estate repositioning across the UK

Repurposing and repositioning properties to hotel and alternative uses in towns and cities across the UK makes sense for innovative investors, however careful due diligence and planning is critical to offset risks and optimise returns.

Hotel revenues have bounced back

One of the stand-out stories in the real estate sector last year was the remarkable rebound of hotel occupancies and rates in the UK and worldwide. Despite widespread fears that the hotel industry might never recover from the devastation of COVID-19, the sector has once again demonstrated remarkable resilience and adaptability.

Domestic leisure travel in particular has boomed as towns and cities relaunched packed event calendars and lockdown weary families took the opportunity to travel. Revenue per available room (RevPAR) recovery has continued into 2023 in most markets around the UK. As international arrivals and corporate event demands gradually build back to pre-pandemic levels, hotel stakeholders appear confident in the future of the sector.

No return to business as usual

Behind the top line revenue optimism, significant structural change is underway across the hotel industry. The return to lockdown top line revenues will not necessarily translate into trading profit. Hotel owners throughout the UK are scrambling to optimise operating efficiencies while inflation is eroding real growth, and increasing operating costs and rising interest rates increase pressure from lenders.

The coming months and years will present a unique opportunity for investors and operators to re-focus their businesses to adapt to consumer demand and adopt smart technologies.

Uncertainty continues to cloud investment decisions

Despite strong trading performances in 2022 and cautious optimistic 2023, RevPAR forecasts, higher taxes, rising interest rates, inflation, regulatory changes and a new banking crisis are weighing heavily on hotel real estate investment decisions.

The development pipeline is slowing

While new hotel build supply has been steady (as projects funded pre-pandemic have been built out) and is set to continue into 2023 and 2024, there are signs that a slowing of construction has started in the face of rising project and finance costs, which will flatten supply growth in many markets in the medium term.

There is also a limited stock of quality operating hotels available to buy. Investors looking to pick up well located operating hotels at a discount may be disappointed. Despite their ongoing challenges relatively few high quality hotels have come to market in recent months. Where prime assets do come to market, there is inevitably keen competition from prospective buyers, ensuring pricing resilience.

Additionally, ongoing government contracts to accommodate asylum seekers and refugees are taking up a significant amount of economy and midscale hotels, thus boosting occupancy and supporting many properties which may otherwise have struggled to stay in business.

Over time uncompetitive hotel properties and those which are simply no longer fit for purpose will inevitably close and be repurposed or rebuilt. Well over 20,000 hotel rooms have permanently closed over the past three years, many having been converted to alternative uses. Subsequently, to put their capital to work and achieve a reasonable return, investors are increasingly looking for projects where they can add value.

The case for repositioning real estate to hotel and alternative accommodation

Footfall to town centres across the UK collapsed during the pandemic and has struggled to recover as consumers cut back on town centre shopping and have embraced working from home. While accommodation demand (and therefore hotel revenue) rebounded impressively in 2022, other real estate sectors, particularly physical retail (including bars and restaurants) and offices, have struggled to re-invent themselves to remain relevant.

Having seen a growing list of successful projects, and with an eye on Net Zero targets, local authorities are recognising that repurposing existing properties to accommodate visitor demand is key to bringing town centres back to life. While planning and licensing processes continue to be challenging for many projects, there are signs of increasing flexibility and support from national and local planners.

Across the UK an increasing number of hotels created in repurposed properties are seen to have been instrumental in the regeneration of their respective neighbourhoods, creating value in neighbouring properties and across the community as a whole.

Examples of successful repurposing projects include; The Wesley Camden Town (former church), Cheval Edinburgh (former bank), Malmaison Manchester Deansgate (former warehouse), The Ned (former midland bank headquarters), NoMad Hotel (former Bow Street Magistrates Court) and OWO London (former old war office).

Repurposed properties in town and city centres have typically targeted leisure and ‘bleisure’ guests mixing business and pleasure, while many offer residential or limited service which maximises sales flexibility and operating efficiency.

Major groups, recognising demand worldwide, have launched a plethora of lifestyle brands in recent years, many of which specifically target potential conversion of existing hotels and have the flexibility to accommodate unique features of repurposed properties. Major brand group involvement should enhance marketing efficiencies, induce demand and provide comfort for prospective investors.

The devil is in the detail

Although there is clear potential to repurpose suitably located properties for hotel use, every asset is unique and presents specific challenges and opportunities.

Full analysis and due diligence are critical to identify and assess suitable properties. Such research should include market analysis, planning reviews and technical and structural studies, but should also involve a full assessment of tax position of the assets and their potential.

Capital allowances

One element which is often insufficiently assessed, but can have a major impact on project viability, is capital allowances. Capital allowances allow the deduction of certain spending on capital assets against taxable profit as set out in the Capital Allowances Act 2001.

To stimulate annual investment and expenditure, HMRC and HM Treasury periodically announce long term and short term tax relief acceleration, the latest of which, introduced in the Spring 2023 Budget, includes a provision whereby companies can identify qualifying expenditure and claim 100% capital allowance (in one go) on qualifying plant and machinery investments from April 2023 to March 2026. This means that, for a limited period, for every £1 a company invests on qualifying assets, their taxes can be cut by up to 25p of qualifying expenditure.

Capital allowances are not limited to ongoing operations but can be pooled over time, allowing the owner to elect to transfer or retain value where not already used against taxable profit. As such, the value of pooled capital allowances in the acquisition, repurposing and renovation hotels is substantial but poorly understood by agents, owners and investors.

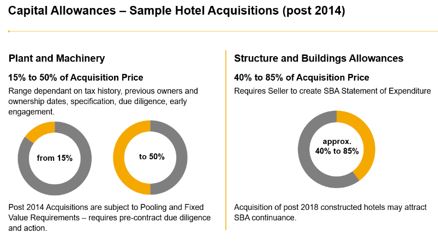

From our experience, sellers often report that they are not aware of capital allowances relating to the subject property, when it is typically possible to identify them. Knowledgeable parties can easily have the upper hand in transaction negotiations. The following charts show the typical range of the proportion of spending which may quality for capital allowances:

Assessing the potential value of applicable capital allowances is complex and unique to each property based on its investment and tax reporting history. Early engagement of a specialist advisor allows stakeholders to assess values and support acquisition, ongoing investment and sale of properties.

Further information

For further information on any of the services that Horwath HTL UK can provide, please contact Malcolm Kerr. For any further information on capital allowances, please contact Stephen Metheringham.

This was published in Hotel Management Magazine June 2023.

Insights

Contact us