Portfolio companies and corporation tax quarterly instalment payments

Many people are aware of the well-advertised change in corporation tax rates which came into effect from 1 April 2023. Companies deemed to have ‘small profits’ continue to pay tax on profits at 19%, while all others pay the new main rate of 25%.

For these purposes, a company with ‘small profits’ is one whose augmented profits fall below £50,000 and those with profits exceeding £250,000 are use the main rate. For those companies with profits falling between these thresholds, the 25% rate applies with marginal relief available.

However, the accompanying change in legislation used to apply these thresholds, the associated company rules, is often overlooked, with the impact being that the majority of companies will fall into the ‘large’ category for corporation tax rate purposes, due to the relatively low profit threshold of £250,000. The new associated company rules replace the 51% group company rules and should be considered thoroughly, not least because they also apply to the thresholds concerning quarterly instalment payment requirements where the changes can have profound impacts.

From 1 April 2023 many companies have unwittingly entered the quarterly instalment payment regime who previously would have paid their corporation tax nine months and one day after the end of their accounting period. This has two main potential outcomes; suffering the cashflow impact of paying corporation tax up to 18 months earlier than under the old rules, and the knock-on impact that if such quarterly instalments are missed/underpaid interest on late paid corporation tax at a current interest rate of 6.25% applies.

The quarterly instalment rules

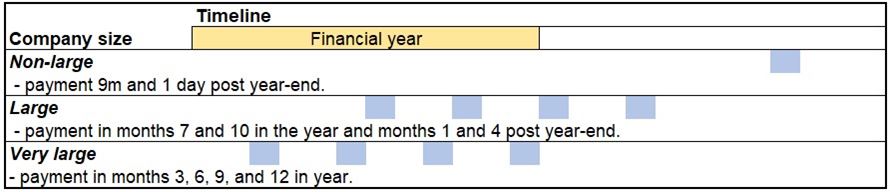

A ‘non-large’ company is due to pays its corporation tax nine months and one day following its year end. This gives the company plenty of time to calculate its tax payable and make the payment. However, for those companies deemed to be ‘large’ or ‘very large’ the tax is payable by four instalments. For ‘large’ companies these instalments start seven months into the accounting year and end four months after. For ‘very large’ companies these instalments start in month three of the accounting year and end in month twelve. Instalments are not required where the tax liability is less than £10,000.

Thresholds

A company is considered large if its profits for a twelve-month accounting period exceed £1.5 million and very large if they exceed £20 million. The first year a company breaches the £1.5 million threshold it will not be considered large, provided the profits do not exceed £10 million. There is no equivalent period of grace for the ‘very large’ threshold. These thresholds used to determine a company’s size have not changed, however the rules governing how they are applied to companies have.

From 2015 until 1 April 2023, these thresholds were divided between the number of 51% group companies. However, from 1 April 2023, they are divided between ‘associated companies’, the definition of which is explored in more detail below. Consequently, the more associated companies a company has, the more likely it is to be ‘large’ or ‘very large’ and be required to pay its corporation tax by instalments. Accordingly, identifying the number of associated companies a company has is fundamental to determining its due dates for the payment of corporation tax.

Associated companies

A company is associated with another company if one controls the other or both companies are under common control. Companies are deemed to be under common control if they are controlled by the same person or persons. For these purposes, a person includes an individual, a company, a Trustee of a Trust or partners in a partnership.

Not all companies under common control are included when calculating the number of associated companies. The following companies are ignored:

- dormant companies

- holding companies (however the definition is rather narrow)

- those which are associated only because of the existence of fixed rate preference shares, if the following conditions are met:

- the company in question is not a close company

- the person who would have common control takes no part of the management of the company

- the subscription was made in the ordinary course of the company’s business.

For the avoidance of doubt, the following companies will count as associated companies if they are under common control:

- all worldwide companies, the residency of the company does not prevent its inclusion

- any company which has been associated at any time in the accounting period

- subsidiaries of subsidiaries are included. The effective/diluted holding percentage is not relevant, it is sufficient that they have common control.

While the total number of associated companies in a year is relevant for determining the applicable corporation tax rate, it is specifically the number of associated companies measured as at the end of the preceding tax period which is relevant for determining whether payment is required by quarterly instalments.

Discerning the number of associated companies for these purposes can be complex due to various technical points and definitions, some of which are considered below.

The definition of control for these purposes is widely drawn, making it possible for two companies to be associated without the shareholders being aware. For these purposes, a person’s current and future ability to control the company are considered. Consequently, a person is deemed to have control if they hold present or future rights to the following:

- more than 50% of the voting rights of the company

- more than 50% of the ordinary share capital

- sufficient share capital to receive more than 50% of the distributable profits on a liquidation of the company

- sufficient assets to be eligible to more than 50% of the company’s total assets on a notional winding up.

It is important to note that assets include loans as well as share capital. Consequently, the entire investment a person has in a company should be considered.

The principle of a minimum controlling combination has been explored in the courts and it was determined that all possible controlling combinations should be ascertained, with any unnecessary persons ignored. Each of these combinations should be compared for each company to identify any shared combinations.

For companies that have sufficient commercial interdependence, the rights of a person’s ‘associates’ are attributed to them as though they held these rights themselves. A person is associated to the following:

- an individual’s relatives (immediate family and linear descendants and ancestors)

- business partners

- Trustees of Trusts where an individual or an immediate family member is a settlor

- Trustees of a Trust which holds shares in a company which the individual has an interest in

- Trustees of a Trust which holds shares in a company which the person being a company has an interest in.

The three main factors to be considered when establishing if companies have Commercial interdependence are detailed in Statutory Instrument 2022/1203 and are summarised below.

- Financial interdependence

- An example of this is where one company has provided financial assistance to another company, or where two companies are both heavily invested financially in the same third company.

- Economic interdependence

- This includes instances where companies have the same customers, or interests in the same economic outcomes.

- Organisation interdependence

- Examples of this would include two companies who share employees, business premises, management, or equipment.

Difficulties for Private Equity Investments

For the vast majority of privately owned companies, establishing the number of associated companies will be straightforward. However, for those companies who have a PE investment, it may be complex or even unachievable. The difficulty arises due to the potential for all concurrent investments made by a PE house to be deemed to be under common control.

PE funds are commonly structured as limited partnerships. Under the previous 51% group companies test, the various investment stacks owned by the same partnership wouldn’t have been associated with each other. Now, they will be if the partnership has a controlling interest, as it is inevitable that the investment stacks will have the same control.

The impacts could go even wider than this and bring the investment stacks held under different partnerships together as associated companies. A partner is deemed to be associated with their fellow partners for these purposes. Consequently, any commonality in partners, between two partnerships, or involving relevant relatives of the partners could cause investment stacks in which those two partnerships have controlling interests to be associated with one another. However, this extension requires there to be substantial commercial interdependence between the companies for these companies to be considered to be associated.

It is commonplace for PE houses to appoint directors or management to the company they have invested in to protect their investment. Although these individuals will not usually be involved in the day-to-day management of the company, they will have an input into the more strategic decisions made by the company. This could constitute a substantial commercial interdependence where there is Board commonality between two companies. Let’s assume this Board level commonality exists between two companies which are portfolio companies of two different fund partnerships, but with some degree of commonality or family connection in the partner make-up of the two fund partnerships – these two companies could now be considered to be associated with one another. Currently there is insufficient guidance on how the appointment of management would be considered in reference to this point.

Currently, the advisors for the portfolio companies of PE houses face a range of uncertainties when asserting the relevant number of associated companies. In summary, these include:

- A lack of knowledge at portfolio company level in respect of how many other companies the PE house have control over. Whether this be by virtue of the holding of ordinary shares, preference shares, debentures or other financial instruments. Those advising the company would not have the necessary information available in respect of the other investments made by the PE house.

- The lack of certainty over what would constitute commercial interdependence, would make it difficult to be certain whether other companies would be deemed to be associated, even if all the information regarding the PE house investments was available to the advisors.

- The potential for the associates rules to bring in other interests such as those involving family members of the partners and even other investments which have been made outside of the PE house, which, again, would not be information available to the advisors of the company.

What action can companies take?

When it cannot be ascertained how many associated companies a company has, they will be unable to accurately determine whether or not the company is or will be large or very large for the purposes of paying their corporation tax. As mentioned above, the company will have two choices:

- pay the estimated corporation tax by instalments, either on the ‘large’ or ‘very large’ scale (noting that if they report as ‘large’ and should have been ‘very large’, interest costs could arise), or

- wait and pay the corporation tax nine months and one day after the year end and risk the payment of interest at HMRC’s late payment interest rate, which is currently 6.25% and tracks at 1% above the BOE base rate.

The first option means that the company, which may not have a sophisticated internal finance function, will need to forecast its corporation tax regularly, which would include frequent management accounts with tax adjustments to accurately estimate the corporation tax liability and therefore professional fees to get the right support. The cost of paying the corporation tax upfront could be expensive; either meeting expensive finance costs or sacrificing cash available for investment in business growth.

The second option is currently expensive due to the current interest rate of 6.25%. There is also the risk of penalties, which are legislated for, although we haven’t seen these being used by HMRC.

Case study

The impact of the new legislation can be illustrated by looking at a potential scenario involving a small company, Company A with a new PE investment of £3 million in FY23.

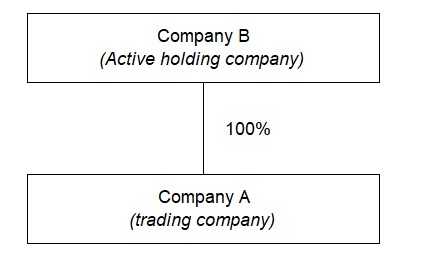

The company is in a small group, as shown in the diagram below. Both companies are active.

Company A has a year end of 31 March and is forecast to make taxable profits of £25,000 in FY23, £400,000 in FY24 and £600,000 in FY25.

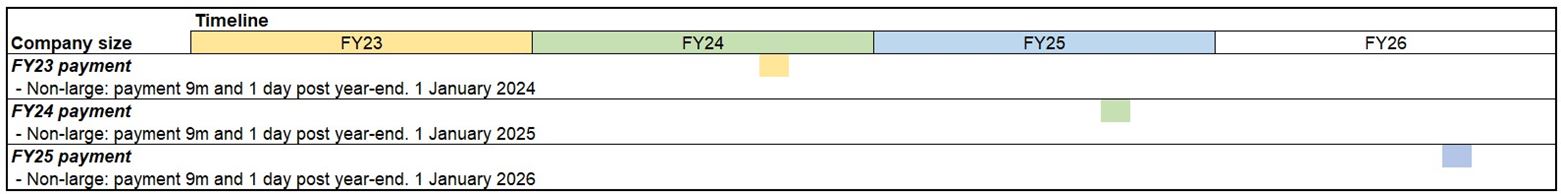

The forecast cashflows prepared prior to the investment are as follows:

£4,750 on 1 January 2024

£100,000 on 1 January 2025

£150,000 on 1 January 2026

Prior to the investment, the company would have been small for quarterly instalment purposes. This is based on there being two associated companies (Company A and B).

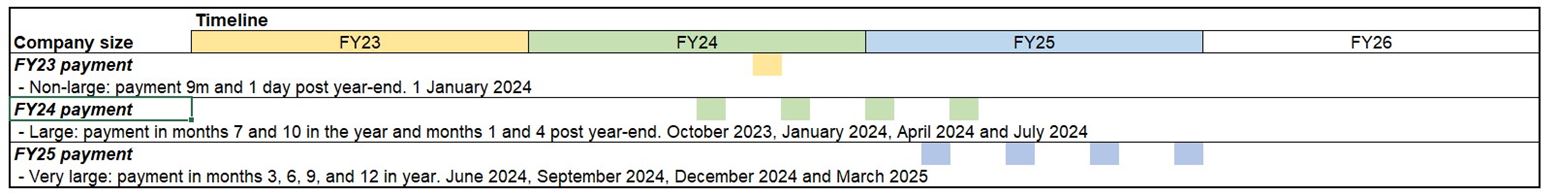

However, once the PE has invested in the company, the company’s advisors adjust the cashflow projections after making some enquiries with the PE house. The corporation tax payment schedule has been updated to the following:

This is based on the PE investment being 40% of the ordinary share capital, with a right to acquire a further 15% of the ordinary shares in one year’s time. The PE house has 19 other investments. 10 of these have a 51% shareholding, three have a 40% of the ordinary share capital of the companies and an additional 15% of preference shares, the remaining six have 30% of the ordinary share capital and loan notes which represent a further 30% of the companies’ total net assets. These 19 companies are all holding companies of trading groups of varying sizes. The total number of companies in these groups is 37. The PE house has a policy that they appoint a director to the board of all companies for which is has an investment.

Ignoring any other potentially associated companies (due to other investments from the PE partners outside of the PE house), company A would have 38 associated companies and the thresholds would be divided by 39.

The thresholds for quarterly instalment payments would be adjusted to £38,461 for ‘large’, £256,410 for automatically large and £512,820 for ‘very large’.

Based on the forecast taxable profits, the company would not be large for FY23 and would pay the tax on 1 January 2024. However, due to the number of associated companies the rate of tax changes from the forecast 19% to main rate of 25%.

For FY24 the company becomes large for the first year, but it doesn’t get a year of grace on the basis that its profits exceed the automatic threshold. Instalment payments are therefore due October 2023, January 2024, April 2024 and July 2024.

However, for FY25, the company would be ‘very large’ based on forecasts and subsequently, it would be due to pay its tax in June 2024, September 2024, December 2024 and March 2025. As you can see from the timeline, the first payment for FY24 would be due before the payment for FY23, with payments for FY25 overlapping with those for FY24. This could represent a significant cashflow problem with the tax payments considerably accelerated against the pre-deal anticipated timeline.

Frequently asked questions

Contact us

Insights