FRS102 – Financial Reporting changes and impact for Social Housing Providers

The Financial Reporting Council (FRC) issued comprehensive improvements to financial reporting standards applicable in the UK and Republic of Ireland resulting from the second periodic review of FRS 102 and other Financial Reporting Standards.

In developing the revised standards, the FRC has considered:

- Changes to revenue recognition, based on the five-step model for revenue recognition from IFRS 15 ‘Revenue from Contracts with Customers’, with appropriate simplifications.

- Changes to lease accounting requirements, based on the on-balance sheet model from IFRS 16 ‘leases’, with some simplifications.

- Changes to fair value measurement definitions to reflect the principles of IFRS 13 ‘Fair Value Measurement’.

- Stakeholder feedback in response to the FRC’s 2021 request for views and other developments in corporate reporting.

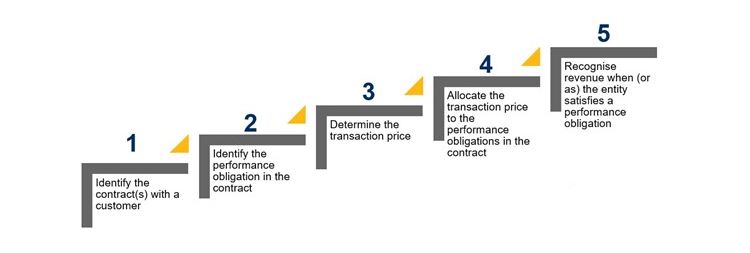

Section 23 of FRS102 has been replaced to introduce the five-step revenue recognition model, which originates from IFRS 15 Revenue from Contracts with Customers. Previously under UK GAAP, revenue recognition fell into two areas – revenue from the sale of goods, and revenue from the rendering of services with additional guidance around construction contracts.

This new model will require Housing Providers to consider the individual terms of revenue-generating contracts to appropriately recognise revenue. To apply the model, an entity shall take the following steps:

It is worth noting that this model does not apply to lease contracts within the scope of Section 20 leases. Rental income as a lease component will be accounted for under Section 20 Leases on a straight-line basis or other systematic basis which is more representative of the pattern in which benefit is derived. As such rental income recognition is unlikely to change.

The lessor is however required to separate out non-lease components (such as services) and account for these under Section 23 Revenue from contracts with customers. As such variable service charge accounting may need reconsideration for your organisation. “The transaction price is the amount of consideration to which the entity expects to be entitled in exchange for transferring goods or services promised to a customer.” FRS102 para 23.41.

RPs should therefore review their service charge arrangements and understand the performance obligations and the transaction price as in the case of variable consideration (as is the case for variable service charges) the RP is required to predict the amount of consideration to which it will be entitled.

As such if you haven’t done previously you may need to accrue for any over or under charge to leaseholders at the reporting date.

"Bundle" of Services?

A practical expedient may be to bundle the services provided under a service charge agreement.

“If a good or service promised to a customer is not distinct, an entity shall combine that good or service with other goods or services in the contract until it identifies a bundle of goods or services that is distinct. In some cases, this will result in the entity accounting for all the goods or services in a contract as a single performance obligation”. FRS102 para 23.25.

For example, lease may state: “The leaseholder shall pay to the Landlord, in addition to the ground rent, a service charge calculated on the basis of the actual costs incurred by the Landlord in providing and maintaining the following services within the building – cleaning of common areas, maintenance of lifts, landscaping of gardens, building insurance, and security services.”

The RP may conclude that the performance obligation is the bundle of services rather than the individual aspects such as cleaning, mowing the lawn etc and recognise this as a single performance obligation.

Transition

RPs do not need to restate comparatives. The amendments will be applied as an opening balance adjustment for the cumulative impact. However, as a practical expedient RPs does not need to apply retrospectively to contracts completed at the initial implementation date.The biggest change is the removal of the distinction between a finance lease and an operating lease for lessees. All leases, subject to certain limited exceptions, will be brought onto the balance sheet in a manner consistent with the current treatment for a finance lease.

Where an RP has, for example, significant property leases, these will need to be recognised on the balance sheet as a ‘right of use asset’ (ROUA) with a corresponding lease liability.

Previously, such leases would have been an operating lease accounted for on a ‘pay as you go’ basis, with future liability only a disclosure within the financial statements.

The effect on reported profit will be to remove the rental charge and replace it with amortisation of the ROUA, and an interest expense on the lease liability. Although the total effect on profit for the duration of the lease is the same, the accounting will change the timing of the expense, it becoming front end loaded with a higher total expense recognised in earlier years of the lease arrangement which is illustrated in the example below.

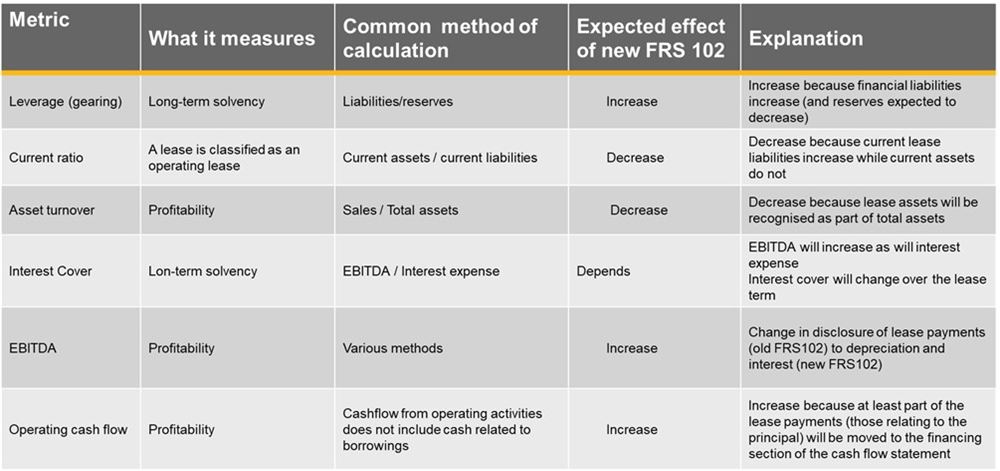

As the expense is accounted for as amortisation and interest rather than rent, this will change key performance measures such as earnings before interest, depreciation and amortisation (EBITDA) and the interest expense. Reported EBITDA will increase under the proposals, as the rental will move out of operating expenditure and into interest and depreciation but with an increase in the interest expense which may impact on loan covenants.

Considerations for metrics is outlined in the table below:

In the cash flow statement, the rentals, previously treated as part of operating cash flows, will be replaced with an interest cash flow and liability repayments, the latter being classified as financing cash flows. The net effect is that a business will report higher cash generated from operations, but with an increase in financing cash flows. The overall net cash flow will be the same.

The lease liability should be discounted using the interest rate implicit in the lease – this is the rate of interest that causes the present value of:

- the lease payment

- the unguaranteed residual value.

To equal the sum of:

- the fair value of the underlying asset

- any initial direct costs of the lessor.

If that rate cannot be readily determined:

- Lessee’s incremental borrowing rate - The rate of interest a lessee would have to pay to borrow over a similar term, and with a similar security, the funds necessary to obtain an asset of a similar value to the right-of-use asset in a similar economic environment.

- Lessee’s obtainable borrowing rate - The rate of interest a lessee would have to pay to borrow, over a similar term, an amount similar to the total undiscounted value of lease payments to be included in the measurement of the lease liability.

And if none of these can be determined, Public Benefit Entities are able to fall back on the interest rate obtainable on deposits held with financial institutions.

The accounting for lessors remains broadly the same as existing requirements, with the distinction, and different accounting applying, depending upon whether the lease is an operating lease or a finance lease. Most leases with tenants will be classed as operating leases.

The changes to lessee accounting will have consequences for lessors where they enter into back-to-back arrangements, or sale and leasebacks.

There are also disclosure requirements for lessors which is likely to be consulted upon by the SORP working party.

Transition

RPs do not need to restate comparatives. The amendments will be applied as an opening balance adjustment for the cumulative impact. However, as a practical expedient RPs can measure the ROUA and Lease liability at the same value only adjusted where you have prepaid or accrued lease payments in the reporting period immediately before the date of initial application.

- Decisions made today on leases could result in significant changes in accounting.

- Almost all leases come on Balance Sheet.

- Lease Accounting inherently more complex likely requiring system changes.

- Be wary of so called ‘off Balance Sheet’ structures.

- Scenario plan for impact.

- ‘Higher costs’ earlier on in the lease period – potential impact on Loan covenants to consider.

- Interest cover – impacted by higher financing costs.

- Gearing – impacted by net liability brought on Balance Sheet.

Definition of asset and liability

The amendments also introduce a new definition of an asset:

“An asset is a present economic resource controlled by the entity as a result of past events. An economic resource is a right that has the potential to produce economic benefits.”

Compared to the extant definition of an asset in FRS102, this definition removes the direct linkage of benefits to cashflows or equivalents. Extant FRS102 states “The future economic benefit of an asset is its potential to contribute, directly or indirectly, to the flow of cash and cash equivalents to the entity. Those cash flows may come from using the asset or from disposing of it.”

Similarly, the definition of a liability has been updated and removes the requirement for the settlement to be “measured reliability”.

We understand that as a result the SORP working party is expecting to consult on areas such as:

- capitalisation of costs particularly related to decarbonisation

- provision for works on leasehold properties not recharged

- accounting for regeneration

- exchange of assets (including stock swaps) including treatment of grant.

- Identify who in your organisation is responsible for implementing changes.

- Are relevant individuals in the organisation fully trained and updated on the changes?

- Develop an impact assessment and project plan.

- Understand impact on loan covenants and any need to discuss with lenders.

- Are there any new systems or changes needed to manage the accounting going forwards?

FRS102 amendments are effective for periods commencing on or after 1 January 2026.

This will mean RPs will prepare first period financial statements for the year end 31 December 2026 or 31 March 2027.

Alongside the FRS102 periodic review is the re-write of the Housing SORP, consultation on planned changes is expected Summer 2025. Crowe UK are technical advisors to the Housing SORP Working Party responsible for authoring the Housing SORP.

For further information, please get in touch with Julia Poulter or your usual Crowe contact.

Contact us

Insights