Financial Institution Notices - a power too far?

Worryingly, there is no permission needed from the taxpayer or the tribunal, so only the bank can resist such a request if appropriate.

The relatively new power was meant to be used to contribute more effectively to the global drive to tackle tax non-compliance when overseas tax authorities need assistance.

How have the powers been used so far?

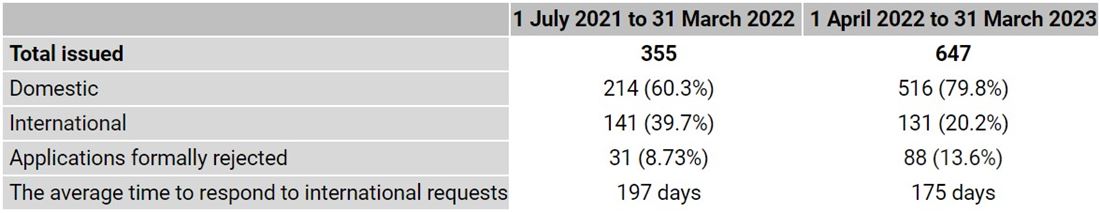

Published data confirms the use of FINs is increasing, but the vast majority have been used for domestic purposes, which clearly deviates from initial claims.

The government has commented the increase is due to HMRC staff being “more aware of the FIN process” and training of additional FIN authorised officers. We can almost certainly expect more FINs as time marches on.

Safeguards

There are opportunities for banks to challenge the validity of notices which need to be considered and managed by those institutions. Current data shows that no issues, concerns or complaints have been raised by any financial institutions. This is surprising, as we all too often see other types of notices with overreaching requests for information and documents.

Individuals will usually receive a copy of the FIN with an explanation of why it is being sent to their bank. The tribunal can be asked to disapply this requirement if notification could prejudice the assessment or collection of tax. An individual could therefore be kept in the dark that HMRC is reviewing their bank statements. It is not clear how many times this requirement has been disapplied so far.

Failure to comply with a FIN will result in penalties, against which there is a right of appeal.

Was it really necessary?

Before FINs, where a genuine suspicion of discovery of a loss of tax existed, there were (and indeed still are) powers to issue information notices to the taxpayer and / or third parties such as banks; the latter had to be approved by the tribunal if the taxpayer refused permission.

FINs are an additional power, similar to third party notices, but without opportunity for the taxpayer or tribunal to intervene.

How we can help

Most people are reserved about who, if anyone, can look through their bank statements and so it is an unpleasant thought that HMRC might do this without permission.

If you are told a FIN has been issued to your bank, we can advise on whether there are legitimate grounds for your bank to resist the request and liaise with the bank on your behalf.

Financial Institutions should also put checks in place to ensure FINs have been properly issued and resisted where appropriate, otherwise they are open to claims from disgruntled taxpayers.

HMRC often push the boundaries of what can be demanded. Anyone in receipt of a FIN should take advice from a professional.

For more information, get in touch with a member of Crowe’s Tax Resolutions team or your usual Crowe contact.

Contact us