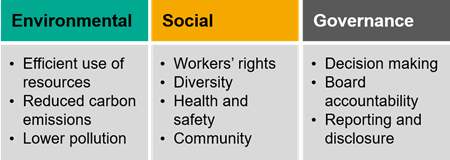

Kickstarting ESG

ESG (Environmental, Social and Governance) has become the generally accepted term to describe ethical and responsible investments, activities and practices. The range of topics, or elements, within each of the three areas is quite broad, each with varying degrees of complexity. Often the focus in the media, by governments, organisations and other stakeholders is on just a small number of the elements. Do boards, for example, commonly and regularly discuss the full range of ESG matters and express a view on those areas that are most important to them and the organisation they represent?

Example ESG elements

Although we have seen quite a lot of focus on individual elements over recent years, it’s not clear whether ESG is gaining traction as a joined-up force for good. However, it’s worth looking at each of the main areas and highlighting what progress has been made.

Governance

There have been considerable advancements in governance over the last few years, not least due to the publication of the Financial Reporting Council’s Corporate Governance Code in the UK. In the financial services sector we have also seen the Prudential Regulation Authority and Financial Conduct Authority place additional focus on the need for effective governance. This has included the introduction of the Senior Managers and Certification Regime, and increased usage of the Skilled Persons regime to assess in detail the extent to which governance arrangements are as effective as they should be.

Companies are now demonstrating greater accountability, by publishing more detail on their governance arrangements in relation to ESG (for example diversity, executive compensation and climate change) and more commonly having these independently reviewed by an external party. There is also a trend towards forming more of a long-term view, beyond the natural business planning horizon.

Despite the good progress, there is undoubtedly some way to go, before good governance can continually and consistently be relied up to help steer organisations through the good times and the bad. Practice makes perfect!

Environmental

|

Recently we have seen a great deal of momentum on environmental issues, particularly over the last couple of years or so. There seems to have been, in most countries, a recognition that climate change is a pressing issue which needs a refreshed mindset and radical action in order to reduce carbon emissions. Many countries have introduced targets for when they will be carbon neutral, signalled the end of vehicles powered by internal combustion engines and encouraged schemes such as tree planting and carbon capture. |

During the Coronavirus outbreak we have seen pollution levels reduce considerably, consistent with businesses temporarily shutting down, workers staying at home and airlines running far fewer flights. Even when we have emerged from the pandemic, there is likely to be a recognition that remote working and the effective use of video calls will reduce the need for travel, contributing to a longer-lasting impact on pollution, relative to pre-COVID-19 levels. |

These developments have not only been driven by the science but also a groundswell in public opinion, led by environmental activists such as Greta Thunberg, and powered by social media.

There is a real sense that there has been a fundamental shift in the Environmental component of ESG, tipping the balance from “greenwashing” into something much more practical, effective and enduring.

Social

As yet, there does not seem to have been the same “macro” lens applied to the Social component of ESG. There have been numerous “micro” initiatives, notably in relation to serving the needs of customers as well as shareholders. But, while organisations are more in-tune with their customers’ needs, do they perceive they have a role to play in helping to ensure a better society, beyond the confines of their traditional business plan? Do organisations all too often pay lip service to big society, unwilling or unable to have an impact? Maybe we need a large-scale external influence to kick start the Social component.

Will the COVID-19 outbreak ultimately prove to be this influence? Even in the relatively early stages of the pandemic, we saw a huge range of activities to help tackle the range of very real challenges that it presents. Traditionally laissez-faire governments have acted quickly to pump unprecedented sums into the economy and taken extreme measures to protect the public, support businesses and bolster health services. Likewise, aside from media reports of people flouting government advice on staying at home, the overwhelming majority are doing just that, to help slow the spread of the virus and help their communities to stay safe. In the UK, more than 750,000 people signed up as volunteers (more than three times the number anticipated), to assist the National Health Service, by delivering medicines and food to the vulnerable and regularly speaking on the telephone with those who may welcome some companionship. On a more international level, governments are increasingly working together to ensure that collectively, we have the resources we need to help protect the welfare of the global community.

Perhaps it is a case of rose-tinted spectacles, but there is a chance this is the tipping point for the Social component of ESG.

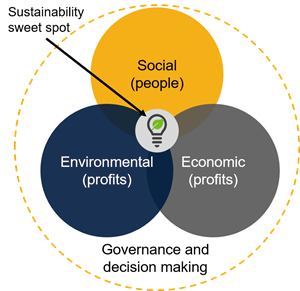

How does this link to sustainability?

Sustainability is closely related to ESG, and indeed the term is sometimes used interchangeably. Investopedia’s definition is “sustainability focuses on meeting the needs of the present without compromising the ability of future generations to meet their needs.” Further, that it is made up of three pillars, social, environmental and economic. However, the more informal “people, planet and profits”, coined by John Elkington in 1994, is more accessible and would no doubt fare better under the scrutiny of the Plain English Campaign.

Few could argue with the theoretical benefits of sustainability, but to extract those benefits, sustainability itself needs to be sustainable, ensuring an enduring and balanced focus on people (social), the planet (environmental) and profits (economic), supported by robust and effective decision making (governance).

Arguably, there is generally too much focus on profits as representing value, being the traditional measure of success. The more recent focus on environmental issues is overwhelmingly for the right reasons but perhaps there is an element of being swayed by activists, social media and the desire for organisations to protect their reputation – to be seen to be doing the right thing.

If there was a genuine and permanent shift towards the planet and people being equal to profits, then this would be a force for good and, as studies have suggested, could actually increase profits.

Balance

As with most things in life, it is all about balance. Perhaps there should be a new definition of value, aligned closely to sustainability.

Around 15 years ago, I recall reading the excellent “Good to Great” (Jim Collins), which researched companies which had consistently outperformed their peers. Unfortunately, a number of the “Great” firms did not cope well with the financial crisis of 2008 (e.g. Fannie Mae, Wells Fargo). If the measure of Greatness had been one related to sustainability, rather than profits, the list may have been different, and a larger proportion of the “Great” companies may have fared better during the crisis. A global pandemic provides a different set of challenges and again, perhaps we will see those companies who already have a more developed and embedded approach to ESG prove to be more resilient than their peers who do not.

The theory has it that people, planet and profits should all be equal in an organisation’s thinking. In practice, it is reasonable that there is some ebb and flow, depending on external factors. When the need arises, though, the ESG culture is such that the balance never veers too far from parity, such that where necessary the organisation can easily and efficiently revert to its equilibrium. If ESG is embedded into decision making, companies will be more resilient, be trusted more and deliver better results for all stakeholders, whether that is their customers, shareholders or society as a whole.

Conclusion

For ESG to gain further traction, the concepts and benefits need to be better understood by people and the organisations they represent. It needs to be consistently employed, as part of an organisation’s strategy and culture.

We all need to live and breathe ESG.

If you are looking to improve your organisation’s approach to ESG, then please contact Justin Elks or your usual Crowe contact.

Insights