Employment Status or IR35?

The changes to the off-payroll working rules (also referred to as IR35) for medium and large private sector organisations and all public sector bodies, coming into effect from April 2021, have prompted employers to review their off-payroll working engagements. When doing this, many have conflated engagements that are in scope of IR35, and those where normal employment status rules need to be considered.

The current IR35 rules for public sector bodies, introduced in April 2017, place the responsibility for determining whether the IR35 rules apply on the public sector body (i.e. the end client),

From 6 April 2021, broadly, these changes will be rolled out to all medium and large private sector (and charity sector) organisations. However, there will be other tweaks to the rules for all clients from 6 April 2021, including public sector bodies.

So while responsibilities under IR35 do not move to the engager until April 2021 for non-public sector bodies, the normal employment status rules have not changed and, therefore, there is a risk that engagers may miss the need to deduct PAYE and NIC from payments made under direct engagements.

Here, we will discuss when to consider the IR35 rules and when to consider the employment status rules, and how the implications may differ under each scenario.

When the IR35 rules may apply

The key characteristic of a labour supply chain to watch out for is whether the worker works through an ‘intermediary’. It the vast majority of cases, this intermediary will be a limited company in which the individual holds shares, often referred to a ‘personal service company’ or ‘PSC’. However, it can also be a partnership or even another individual.

HMRC have recently announced that they will be tweaking the definition of what an ‘intermediary’ is before April 2021 to clamp down on avoidance, but the current definition can be found in step 2 of our insight on IR35: The steps to take to prepare for April 2021.

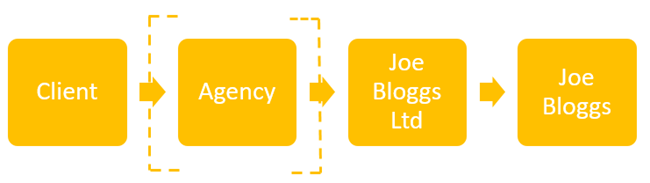

A typical labour supply chain where the IR35 rules could apply is as follows:

In some labour supply chains there will be an agency (or maybe multiple agencies), but in others the client will contract directly with the ‘intermediary’ (Joe Bloggs Ltd in this example). This won’t impact on whether the IR35 rules apply or not.

Where the labour supply chain resembles the above and where the worker performs the work via an ‘intermediary’, the IR35 rules could be in scope and a Status Determination Statement should be issued. This should be done using employment status principles (see step 4 of IR35: The steps to take to prepare for April 2021).

When the normal employment status rules apply

Many organisations will hire the services of individuals in other ways. Where the organisation hires the services of an individual directly, i.e. without an intermediary, the engagement will not be in scope of the IR35 rules. However, this doesn’t mean that clients can just engage individuals in this way without considering employment status.

Where an organisation contracts directly with an individual (including with an individual’s unincorporated business), the organisation must consider whether that individual should actually be an employee, rather than self-employed. This is based on the usual employment status principles (see step 4 of IR35: The steps to take to prepare for April 2021). Please note that this is the current position and there are no currently proposed changes to the relevant legislation.

The consequences for the client of IR35 and employment status

The consequences and implications for the client under each scenario are different, depending on whether the engagement could be in scope of the IR35 rules or the normal employment status rules.

IR35

If an organisation (the client) determines that, from April 2021, the IR35 rules do apply to an engagement, the consequences will be as follows:

- The client must issue a Status Determination Statement to all parties in the labour supply chain.

- If the client is the ‘fee-payer’ (generally the party who pays the ‘intermediary’), they will be responsible for operating PAYE and deducting income tax and NIC before paying the intermediary.

These consequences will only apply from April 2021 if the client is in the public sector, or if it is a medium or large organisation. For non-public sector bodies that are small from April 2021, or for any non-public sector organisations before April 2021, the client won’t have any tax responsibilities relating to the off-payroll working engagements.

In addition, even from April 2021, clients will not have any employment law or employment rights responsibilities in regards to off-payroll workers in an IR35 scenario.

Direct engagement

If the client contracts directly with the individual providing the services then in all cases the client must determine whether the individual should be an employee or self-employed.

If the client determines that the individual should be an employee, they must treat them like any other employee for tax purposes by processing payments through the payroll.

Even though employment law is separate to tax law, if an individual is an employee for tax purposes, it is likely that they could be an employee for legal purposes too. Legal advice should be taken.

What is possibly more significant is that, if an individual has been providing services for the client in that way since before April 2021, it is likely that the employee should have been an employee since they were first engaged. This could mean that the client is liable for income tax and NIC going back to when the individual started providing their services, unlike under an IR35 scenario.

If the client contracts with an agency (or other third party) who then contracts directly with the individual (i.e. there is no ‘intermediary’) then usually the client will not have any employment taxes obligations as the agency legislation will need to be considered by the agency instead.

Summary

Clients must first identify the make up of the labour supply chain and the parties in it before determining whether the IR35 rules could apply or whether normal employment status rules could apply.

If the IR35 rules are potentially in scope, the labour supply chain will determine the responsibilities of the client, but these responsibilities will not apply until April 2021 and will only apply if the client is medium or large or a public sector body.

If the normal employment status rules are in scope, the client will need to consider whether the individual is an employee or not. If the individual should be an employee, the client will be required to treat them as an employee for tax purposes and will need to identify whether there are any employment tax obligations in prior years.

If you have any other queries relating to the off-payroll working rules, please take a look at our IR35 Hub or speak to your usual Crowe contact.

Insights

Contact us