Investing showdown

Active vs Passive

Investing is a fundamental aspect to financial planning, helping to preserve and grow wealth throughout your lifetime.

Choosing the right strategy can have significant implications on returns, making investment decisions daunting for both non-experienced and experienced investors, especially given recent market volatility (‘Liberation Day’, for example).

A good place to start is to consider the approaches taken by investment managers, which can be either active or passive. There are plenty of sources out there that will argue the case for each, but it is important to first understand what they are, as well as their advantages and drawbacks.

Active investing

Active investing involves a hands-on approach where investment managers make decisions about buying and selling assets based on research, analysis and market forecasts/perceptions. The goal is to outperform the market by selecting investments that are expected to perform better than the overall market.

Benefits

- Potential for returns higher than the market: Active managers aim to outperform the market by identifying undervalued securities or taking advantage of market inefficiencies, regardless of market conditions.

- Flexibility: Active investors can adjust their portfolios in response to market conditions, economic trends or company-specific events. They can take retrospective action as well as being proactive in asset selection.

- Risk management: Active managers can employ various strategies to mitigate risk, such as hedging.

Drawbacks

- Higher costs: Active funds generally have higher management fees due to the resources required for research, analysis and frequent trading.

- Inconsistent performance: While some active managers may outperform the market, many do not. Consistently beating the market is challenging and not guaranteed. This is an area that really divides opinion when comparing the two strategies.

- Tax implications: If investments are not held in a favourable tax wrapper (pension or ISA, for example), active trading may result in a capital gains liability as assets are disposed of and replaced.

Passive investing

Passive investing involves holding a security (or securities) that are designed to mirror the performance of an underlying benchmark, such as market indices (the FTSE 100, for example) or commodity prices. The goal is to achieve similar returns to the benchmark by holding assets that represent its components. This strategy is based on the belief that markets are efficient and that it is difficult to consistently outperform the market through active management.

Benefits

- Lower costs: Passive funds typically have lower management fees compared to active funds. This is because passive investing requires less frequent trading and fewer resources for research and analysis.

- Simplicity: Passive investing is straightforward and easy to understand. Investment managers do not need to constantly monitor the market or make frequent trading decisions.

- Consistent performance: By tracking a benchmark, passive investments often deliver consistent returns that match the overall market performance.

Drawbacks

- Limited flexibility: Passive investors cannot take advantage of short-term market opportunities or react to changing market conditions.

- Market risk: Since passive funds are designed to replicate the performance of an underlying benchmark, they are subject to the same market risks as the index itself.

- Lack of personalisation: Selection of securities within a portfolio is based on a broader index, rather than discretionary individual decisions.

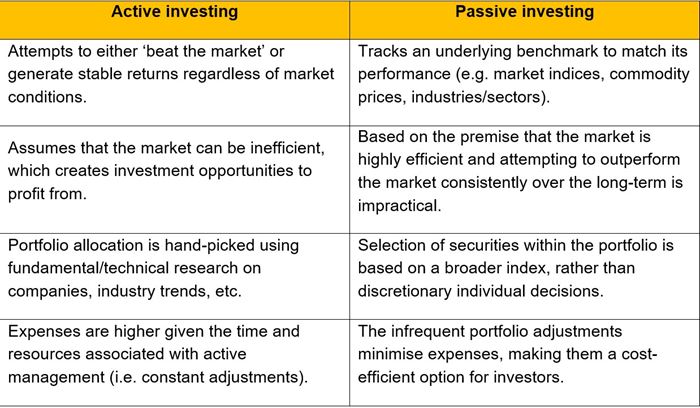

The table below provides a quick summary of these points.

As highlighted, both passive and active investing have their advantages and drawbacks, and it should be mentioned that it is possible to have a mixture of these approaches as part of an overarching strategy or portfolio.

The ultimate choice between passive and active investing will depend on various factors, including, but not limited to, investment goals, risk tolerance, time horizon and personal preferences. There are many solutions available, which can make choosing the right one for your needs quite challenging.

Considering the above, any decisions regarding your investments should not be made lightly. Seeking professional financial advice to aid and guide you through this process could prove the difference between successfully meeting your financial objectives or falling short of your goals.

Get in touch

Meet our financial planning team

DisclaimersCrowe Financial Planning UK Limited is authorised and regulated by the Financial Conduct Authority (‘FCA’) to provide independent financial advice. The information set out on this page is for information purposes only and is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. It does not constitute advice to undertake a particular transaction. Appropriate professional advice should be taken on specific issues before any course of action is pursued. Any advice provided by a Crowe Consultant will follow only after consideration of all aspects of our internal advice guidance. Past performance is not a guide to future performance, nor a reliable indicator of future results or performance. The value of investments, and the income or capital entitlement which may derive from them, if any, may go down as well as up and is not guaranteed; therefore, investors may not get back the amount originally invested. The Financial Conduct Authority does not regulate Trusts, Tax or Estate Planning.

Please be aware that by clicking onto any links to third party websites you will be leaving the Crowe Financial Planning website. Please note that Crowe Financial Planning is not responsible for the accuracy of the information contained within the linked sites. |

Related insights