Discounted Gift Trusts

Having your cake and eating it

Following the UK Labour government’s Budget announcement in October 2024, many view the scope for Inheritance Tax (IHT) planning to be shrinking, with unused pension funds being brought into a person’s estate from April 2027, the introduction of a cap on Business Relief of £1million and the reduction in IHT relief provide by AIM investments from 100% to 50%.

However, in this article, we provide an insight into how a Discounted Gift Trust (DGT) works and how it remains an attractive and viable option in planning for IHT mitigation.

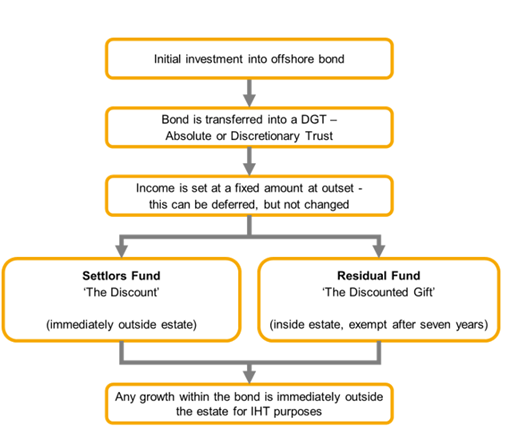

How a DGT works

A DGT allows individuals (a Settlor) to gift a lump sum into Trust while retaining the right to fixed regular payments and reducing the amount of Inheritance Tax (IHT) that might eventually have to be paid from their estate.

When establishing the DGT, the Settlor requests regular capital payments payable for their lifetime, or until the fund is exhausted. These payments are generated from partial withdrawals from an investment bond via the 5% withdrawal facility.

The DGT provider will calculate how much of the bond’s value will be needed to provide these withdrawals, which will involve an estimation of the Settlor’s life expectancy via medical underwriting, health questionnaires and a GP report.

The capital needed to provide the required withdrawals is known as the discount and this reduces the value of the Settlor’s gift to the DGT for IHT purposes.

The reduced value of the ‘gift’ may remain within the Settlor’s estate for seven years, dependent upon the type of underlying Trust structure used.

The value of the discount and any investment growth in the Trust is considered to be immediately outside of the Settlor’s estate and should not be subject to IHT.

Types of DGT

There are two types of Trust which may be used.

Bare/Absolute Trust

Absolute Trust, the gifted amount is considered a Potentially Exempt Transfer (PET) by the Settlor. After seven years it is considered to be exempt from the Settlor’s estate for IHT purposes. The value of the DGT (less the discount) is considered to be held within the estate of the named beneficiaries.

When using a Bare/Absolute Trust, once beneficiaries have been named, they cannot be changed.

Discretionary Trust

A gift to discretionary Trust is considered a Chargeable Lifetime Transfer (CLT) by the Settlor. The CLT may cause an immediate IHT charge on the Settlor if the discounted value of the gift (together with any other CLTs made in the previous seven years) is more than the Settlor’s IHT nil rate band (currently 20% on the excess).

Using a Discretionary Trust structure is more flexible and beneficiaries can be altered and removed at the behest of the Trustees.

Benefits of a DGT

The main benefits of a DGT are:

- the Settlor immediately reduces their IHT liability by removing the value of the discount from their estate

- the remaining value of the ‘gift’ can potentially fall out of the settlor’s estate after seven years

- the Settlor retains access to capital via regular withdrawals

- future growth on the value of the Trust is outside of the Settlor’s estate for IHT purposes

- since the settlor retains the right to regular payments, there is no gift with reservation for IHT purposes. This means the gift is considered complete and effective for IHT planning.

|

Financial planning uses of the DGT – a case study Mrs Smith is aged 67, has £500,000 to invest and requires income from it of 4% per year. She would like to reduce her estate’s potential liability to IHT and be able to pass it to her two children. She invests £500,000 in a DGT Absolute Trust for the equal benefit of her two children. Outcomes The DGT provider calculates that the discount will be £250,000. This immediately falls outside of Mrs Smith’s estate and will no longer be considered when calculating any potential IHT liability. Immediate IHT saving: £250,000 @ 40% = £100,000 The residual £250,000 is considered a PET. After seven years, this will also be considered outside of her estate for IHT purposes. Potential IHT saving after a further seven years: £250,000 @ 40% = £100,000 Assuming Mrs Smith survived for 20 years she could receive regular withdrawals from the bond of £20,000 per year (4%), totalling £400,000. Assuming Mrs Smith survived for 20 years she could receive regular withdrawals from the bond of £20,000 per year (4%), totalling £400,000. Investment growth in the Trust is considered to fall outside of Mrs Smith’s estate. As an example, if the value of the Trust grew to £800,000, investment growth would total £300,000 and the potential IHT savings on the growth in the fund would be: Growth of £300,000 @ 40% = £120,000 In the event of her death at this point, Mrs Smith’s children can inherit the value of the Trust, free from IHT with a total potential IHT saving of £320,000. |

Things to consider

DGTs can be inflexible. Gifted capital cannot be reclaimed and once set, withdrawals cannot be changed IHT.

Withdrawals are usually capped so as not to exceed the 5% tax-deferred annual withdrawals allowable from an investment bond.

Income Tax may be due in the event of an international bond being surrendered as explained in our article ‘The top five benefits of international bonds.’

If you would like to discuss how Discounted Gift Trusts could benefit you, then please speak with your financial advisor or contact one of our Financial Planning Consultants who will be delighted to discuss this further with you.

The information contained within this article is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases and reliefs from taxation may be subject to change. The value of your investments can go down as well as up, so you could get back less than you invested. The Financial Conduct Authority does not regulate tax planning.

DisclaimersCrowe Financial Planning UK Limited is authorised and regulated by the Financial Conduct Authority (‘FCA’) to provide independent financial advice. The information set out on this page is for information purposes only and is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. It does not constitute advice to undertake a particular transaction. Appropriate professional advice should be taken on specific issues before any course of action is pursued. Any advice provided by a Crowe Consultant will follow only after consideration of all aspects of our internal advice guidance. Past performance is not a guide to future performance, nor a reliable indicator of future results or performance. The value of investments, and the income or capital entitlement which may derive from them, if any, may go down as well as up and is not guaranteed; therefore, investors may not get back the amount originally invested. The Financial Conduct Authority does not regulate Trusts, Tax or Estate Planning.

Please be aware that by clicking onto any links to third party websites you will be leaving the Crowe Financial Planning website. Please note that Crowe Financial Planning is not responsible for the accuracy of the information contained within the linked sites. |

Related insights