Value Added Tax (VAT)

TAX

Value Added Tax (VAT) to be implemented from April 2021

About VAT

On 12 October 2020, His Majesty Sultan Haitham Bin Tariq bin Taimur issued Royal Decree No. 121/2020 to introduce the Value Added Tax (VAT) law in Oman at the rate of 5%. VAT is likely to be implemented from April 2021. Following the introduction of VAT in the KSA, the UAE and Bahrain, Oman will be the fourth GCC country to implement VAT in the region as per the Unified GCC VAT Framework agreement. The VAT Law will set out the general principles for the application of VAT in Oman. The VAT Executive Regulations will provide more detail on specific areas of the Law and are expected to be published by December 2020.

Exemption to register for VAT

The Oman VAT has exempted the following supplies from VAT in accordance with the conditions and controls determined in the regulations:

1. Financial services

2. Health care services and associated goods and services

3. Education services and associated goods and services

4. Undeveloped lands (bare lands)

5. Resale of residential properties

6. Local passenger transport

7. Renting real estate for residential purposes

8. Imported goods that are exempt or zero-rated in Oman

9. Imported goods for diplomats, consular bodies and international organisations etc

10. Imported good for armed forces and international security forces

11. Import of personal luggage and household appliances by a citizen/foreigner

12. Necessities of non-profit associations

13. Returned goods

Zero-rate

The VAT law has stipulated applying zero rates to the followings supplies as determined under conditions, limitations and situation determined in the regulations:

1. Supply of foodstuffs to be determined by decision of the Chairman

2. Medicines and medical equipment

3. Investment in gold, silver and platinum

4. International and intra-GCC transportation and related services

5. Sea, air and land transportation for commercial purpose

6. Supply of rescue aircrafts, boats and auxiliary ships

7. Supply of crude oil and its oil derivatives and natural gas

8. Exports of goods and services

9. Supply of goods and services to a custom duty suspension situation

10. Re-exporting for goods temporarily imported for repairs and refurbishment

The law reveals significant VAT changes to be done for the business segment across the country. Although regulation is expected in coming months, businesses should consider immediate steps on how to prepare and assess the impact of VAT on their business activities in Oman.

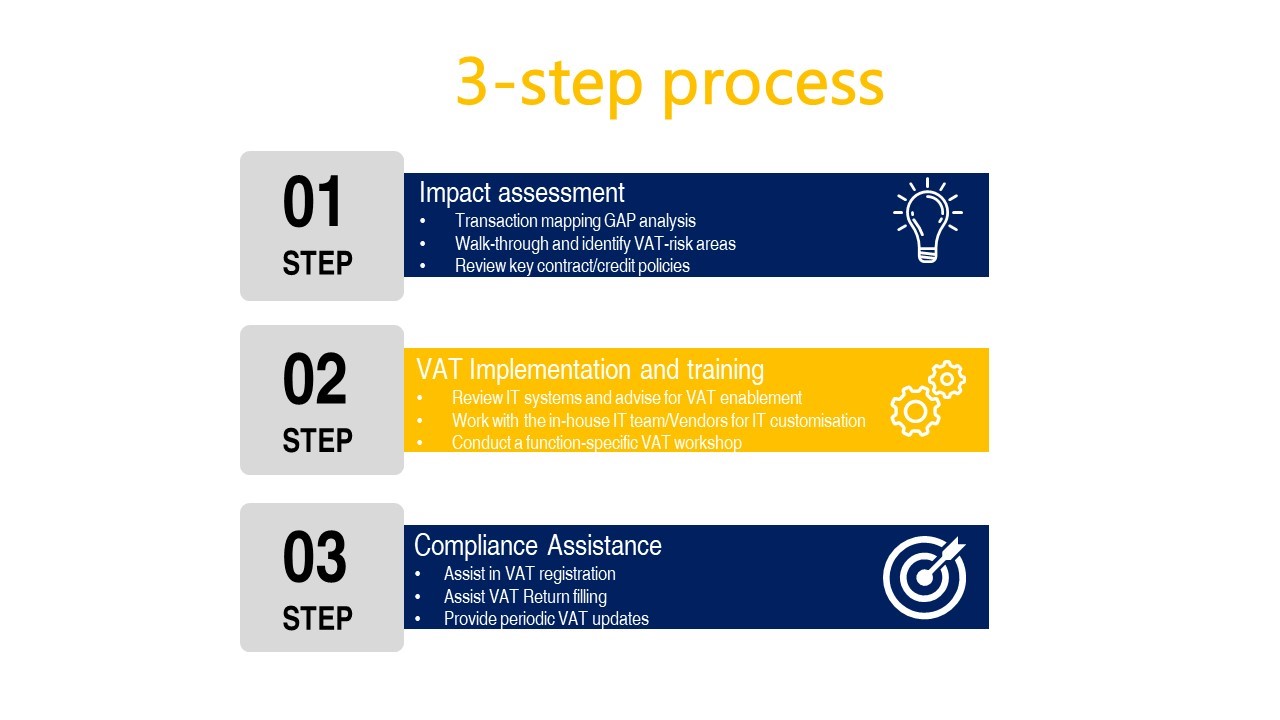

Crowe methodology to implement VAT

The 3-phase process

Phase 1: Impact assessment

- Perform detailed analysis of end to end business transaction flows (GAP analysis)

- Perform walkthrough of the sales/accounts receivable cycle and purchases/accounts payable cycle and identify VAT-risk areas

- Mapping transaction for VAT enablement (tax mapping)

- Review contracts and identify the VAT impact

- Provide report on VAT compliance needs

Phase 2: VAT Implementation and training

- Review existing IT systems and assess their suitability for VAT enablement

- Review system design and monitor the implementation of the recommended change to IT systems

- Work with the in-house IT team/Vendors to finalize and identify the customizations /configurations necessary to be made to IT system to ensure that system meets Oman VAT law requirements

- Review credit policies and advise on cash flow management and inventory management related areas

- Conduct a function-specific VAT workshop to personnel in preparation to meet the VAT compliance obligations

Phase 3: Compliance Assistance

- Assist in VAT registration

- Guidance on first VAT Return filling and related documentation

- Provide periodic VAT updates

We serve as one-point solutions for VAT advisor services for corporates in Oman. We keep providing updates as more and more information becomes available, together with details of the VAT Law on regular intervals.

VAT - Frequently asked Question

Ans 1. VAT is an indirect tax charged on nearly all goods and services that are bought and sold in the Sultanate, including goods and services imported into the Sultanate. Certain goods and services may be zero-rated or exempt.

VAT is a tax on consumption that is paid and collected at every stage of the supply chain; from a manufacturer’s purchase of raw materials to a retailer’s sale of an end-product to a consumer.

VAT is not an ultimate cost for businesses, in general terms. Businesses will collect and account for the tax on the supplies they make; businesses will also pay VAT on the purchases they make. VAT adopts an offsetting mechanism such that the amount of VAT to be remitted to the Tax Authorities is the difference between the output tax (VAT charged and collected on sales) and the input tax paid (VAT paid on purchases).

Ans 2. Most likely registrations will begin in January 2021 and it is expected to be done in phased manner.

Ans 3. VAT registration falls into two categories: mandatory registration and voluntary registration. If a taxable person exceeds the annual mandatory registration threshold of RO 38,500, it is obligated to register; if it exceeds a voluntary registration threshold of RO 19,250, it has the option to register.

Ans 4. Refund situation arises when the output tax to be paid on supplies is less than the input tax to be claimed on the purchase invoices. As per the Oman VAT law, the taxable person has the right to receive refund or carry it over and deduct it from tax dues in any subsequent tax periods.

As per the practice in the neighbouring countries, the refund mechanism is still not effective and refunds a getting carried forward and adjusted in the subsequent returns.

Ans 5. Reverse charge is a mechanism under which VAT is required to be paid for the goods or services by the recipient instead of the supplier when the supplier is not a resident in the Sultanate where the supply takes place. When the reverse charge is applied, the recipient of the goods or services makes the declaration of both their purchase (input VAT) and the supplier’s sale (output VAT) in their VAT return. In this way the two entries cancel each other from a cash payment perspective in the same return.

Ans 6. Import VAT will be payable in addition to any customs duty due on movements of goods into the Sultanate. However, if the importer of record is VAT registered, it is likely that there will be a reverse-charge mechanism available in the Oman to allow the importer to ‘pay’ and ‘recover’ the import VAT at the same time, mitigating any cash flow impact.

Ans 7. If goods are imported by a taxable person from outside the GCC and then goods are then moved to another GCC member state, VAT will be payable at the first point of import. This VAT will be recoverable only in the destination country, however.

Ans 8. The GCC Agreement foresees that financial services performed by banks and certain financial institutions shall be VAT exempt. Oman VAT has exempted certain financial services and regulation are awaited to give more details on it. It is expected in Oman that fee-based financial services will be taxed but margin-based products are likely to be exempt. However, the rules could be different and further guidance will need to be provided at a later stage in that respect, indicating the products and services that could potentially benefit from a VAT exemption.

Ans 9. It is expected that insurance may well be taxable, with the possible exception of life insurance. Oman VAT has exempted certain financial services and regulation are awaited to give more details on it.

Ans 10. In cases where GCC states have not yet introduced VAT locally, it is expected that these states will be treated as third countries - for the purpose of the rules on intra-GCC trade - until they have implemented a domestic VAT system.