- Americas

- Asia Pacific

- Europe

- Middle East and Africa

The Voluntary Disclosure and Amnesty Programme (“VA”) provides an opportunity for taxpayers to voluntarily disclose their indirect tax liabilities and any indirect tax obligations that may not have been fulfilled.

VA is an opportunity offered by the Royal Malaysian Customs Department (“RMCD”) to allow previously non-compliant taxpayers to make good under specified terms. By participating in the VA, taxpayers can facilitate indirect tax compliance in a timely and cost-effective manner, and avoid the costly and contentious audits, litigation and proceedings.

VA is available for tax liabilities derived from the following:

- Customs Act 1967,

- Sales Tax Act 1972 and 2018,

- Service Tax Act 1975 and 2018,

- Excise Act 1976,

- Goods and Services Tax Act 2014,

- Tourism Tax Act 2017, and

- Departure Levy Act 2019.

One of the interesting benefits of VA is the remission of penalty/surcharge. Considering the highest penalty/surcharge to be imposed on the indirect tax incompliance, taxpayers can enjoy a significant potential tax savings by participating in the VA.

VA is divided into two phases. The tax savings depends on which phase the taxpayers complete their VA submission and tax liability payments remittance to the RMCD.

|

|

Phase 1 |

Phase 2 |

|

Period of VA programme |

1 January 2022 to (6 months) |

1 July 2022 to (3 months) |

|

Remission of penalty |

100% |

50% |

|

Remission of indirect tax |

Up to 30% |

Up to 15% |

Categories of taxpayers eligible to participate in VA:

- Persons who are registered / not registered / liable to be registered under existing indirect tax laws.

- Persons who are acquiring imported taxable services.

- Persons who are having a duty / tax facility or exemption.

- Persons who have paid duty / tax on vehicles / importers of vehicles who hold approved permits.

- Local importers / exporters / manufacturers / licensed manufacturing warehouses / licensed warehouses.

- Importers of goods who are connected to Multinational Enterprises (“MNEs”).

- Persons who are earmarked / undergoing an audit / audited before the start of VA Programme for the coverage period on or before 31 October 2021.

Categories of taxpayers NOT eligible to participate in VA:

- Persons who are undergoing or have completed investigations conducted by the Enforcement Division of the RMCD or who have obtained a decision from the court.

- Persons who have been approved for duty / tax / levy remission by the Ministry of Finance.

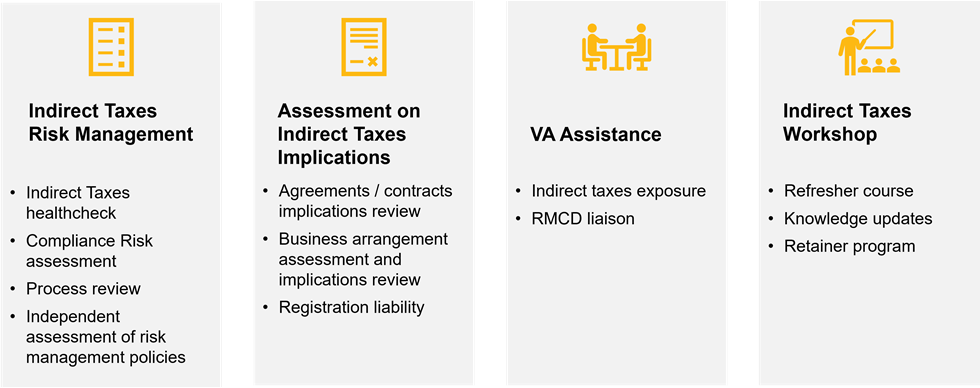

How We Can Assist You

What is your company's Indirect Tax risk level? Find out now.