- Americas

- Asia Pacific

- Europe

- Middle East and Africa

Service Tax on Digital Services

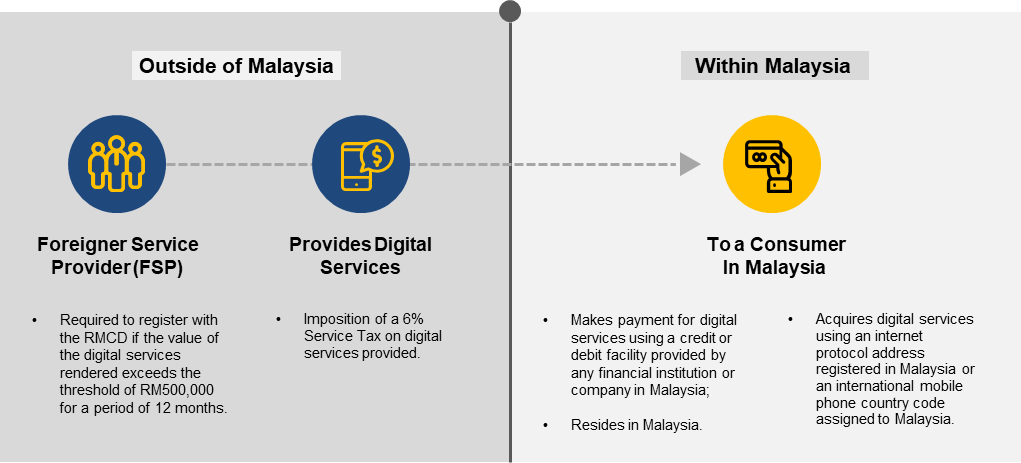

In Malaysia, the scope of Service Tax has been extended to include any digital services provided by Foreign Service Providers to any consumer in Malaysia. This is with effect from 1 January 2020. If the value of the digital services rendered exceeds the threshold of RM500,000 for a period of 12 months, the Foreign Service Providers are required to register with the Royal Malaysian Customs Department (RMCD).

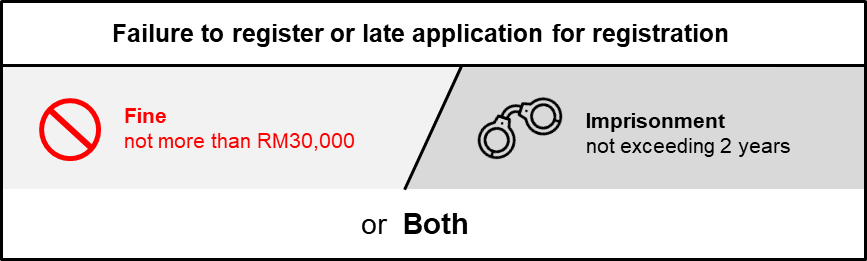

Failure to register or any late application for registration may result in a fine not exceeding RM30,000 or to imprisonment of a term not exceeding two (2) years or to both.

Failure to register or any late application for registration may result in a fine not exceeding RM30,000 or to imprisonment of a term not exceeding two (2) years or to both.

If you have any questions on how this SToDS may affect your business, Crowe Malaysia is here to help. Our experienced tax professionals will be happy to bring clarity and shed light on your tax concerns.

Frequently Asked Questions

- The number of digital based services offered by businesses to consumers has significantly increased in recent past years. At present, around 95% of businesses worldwide benefit from high speed internet connection (OECD, 2018).

- Reduction of the tax base of countries around the world due to Base Erosion Profit Shifting (“BEPS”) has worsened due to digitalisation trends. These trends have also resulted in an unlevelled playing field between offline and online businesses.

- To counter this BEPS, initiatives by the Organisation for Economic Cooperation and Development (“OECD”) (e.g. BEPS Action Plans) have been introduced to redevelop global tax systems as current tax rules are no longer “fit-for-purpose” to tax the digital economy.

- The BEPS Action 1: Addressing the Tax Challenges of the Digital Economy was issued in 2015, to propose recommendations for global tax administrators to tax digital businesses (e.g. through consumption tax systems). Since then, many developments have taken place. As a result, Malaysia is implementing the Service Tax on digital services in 2020.

Every Foreign Registered Person (FRP) will be assigned to a taxable period for which he is required to account for SToDS. The taxable period shall be for a period of three (3) months ending on the last day of any month of any calendar year under subsection 56H(1) Service Tax Act 2018 for the purpose of DST-02 return submission.

- Any person either a business or an who is outside of Malaysia and provides digital services directly; or

- Any person either a business or an individual who is outside of Malaysia and who sells digital services on behalf of any service provider through his online platform. Online platform operators who make transactions for provision of digital services on behalf of any service provider shall be regarded as FSP. FSPs are considered as making transactions on behalf of any service provider if any of the following conditions are met:

a) The online platform operator authorises/ sets the terms and conditions of the underlying transactions;

b) The online platform operator has a direct or indirect involvement in the payment processing;

c) The online platform operator has a direct or indirect involvement in the delivery of the digital service;

d) The online platform operator provides customer support service in relation to the provision of digital services; or

e) The invoice or any other document provided to the consumer identifies the supply as made by the online platform operator.

A consumer in Malaysia is any person who fulfills any two of the following:

- Makes payment for digital services using credit or debit facilities provided by any financial institution or company in Malaysia;

- Acquires digital services using an internet protocol address registered in Malaysia or an international mobile phone country code assigned to Malaysia; or

- Resides in Malaysia.

- Software, application & video games;

- Music, e-books and films;

- Advertisements and online platforms;

- Search engines and social networks;

- Database and hosting;

- Internet Based Telecommunications;

- Online training;

- Online newspapers, online journals and periodicals; and

- Provision of digital content and payment processing services.