Malaysia Short Term Economic Recovery Plan 2020

On 5 June 2020, the Malaysian Government unveiled the Short-Term Economic Recovery Plan (STERP) valued at RM35 billion. This STERP is in addition to the three (3) Economic Stimulus Packages totaling RM260 billion announced earlier.

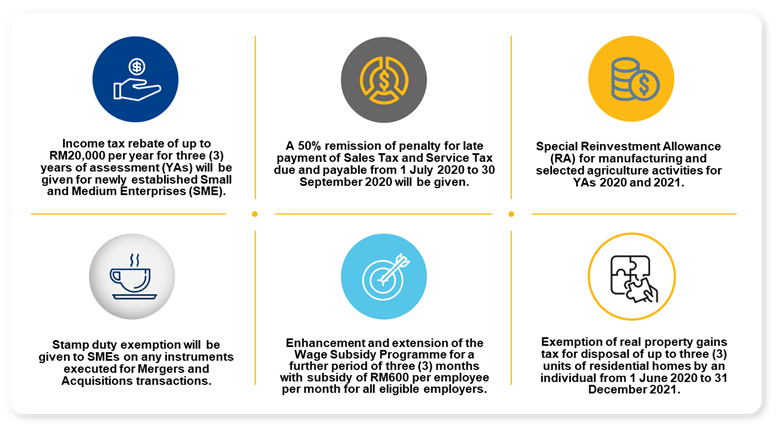

The STERP has 40 initiatives focusing on the following three (3) key thrusts:

- Empower People;

- Propel Businesses; and

- Stimulate the Economy.

Malaysia is now at the Recovery phase of the COVID-19 pandemic with most economic sectors reopened albeit in a controlled manner.

It is timely that the Government introduced this STERP to assist the country’s economy to recover. It is hoped that all the proposals and allocations in the STERP will be implemented soonest possible to help all parties to get back to the “new normal” life.

- Extension of the period and expansion of the scope of COVID-19 related expenses allowed for tax deduction or capital allowance claim.

- The period for claiming special tax deduction of up to RM300,000 for costs of renovation and refurbishment is extended to 31 December 2021.

- 100% Investment Tax Allowance (ITA) for existing companies relocating their overseas manufacturing facilities into Malaysia.

- The period for claiming special deduction on rental discounts given by landlords of private business premises to SMEs is extended to 30 September 2020.

- Further tax deduction for employers implementing Flexible Work Arrangements or who made enhancements to their existing Flexible Work Arrangements.

- 0% tax rate for a period of up to fifteen (15) years for new capital investments in the manufacturing sectors.

- The period for claiming Accelerated Capital Allowance for machinery and equipment including Information and Communication Technology equipment is extended to 31 December 2021.

- Deferment of monthly tax instalments for businesses in the tourism industry will be extended for an additional period of three (3) months to 31 December 2020.

- RM700 million grants and loans will be provided to SMEs and mid-tier companies to digitalise operations and trade channels.

- Up to RM400 million is allocated to provide financial relief for agriculture and food players affected by COVID-19 and the Movement Control Order.

- Bumiputera Relief Financing – PUNB and MARA will provide financing of RM200 million and RM300 million respectively as dedicated financial assistance to Bumiputera entrepreneurs.

- A matching grant of up to RM50 million will be given to gig economy platforms which make contributions for their workers under PERKESO employment injury scheme and EPF i-Saraan contribution.

- PENJANA SME Financing – The banking sector will allocate RM2 billion funding to assist SMEs with a cap of RM500,000 per SME.

- PENJANA Tourism Financing – Up to RM1 billion facility will be made available to finance transformation initiatives by SMEs in the tourism sector.

- PENJANA Micro financing – An allocation of RM400 million will be provided to micro enterprises with a cap of RM50,000 per enterprise where RM50 million is earmarked for women entrepreneurs.

- A matching grant totaling RM10 million through Malaysian Global Innovation and Creativity Centre will be given to social enterprises which are able to crowd source contributions and donations to undertake social projects.

- An allocation of RM25 million will be provided to MDEC for Global Online Workforce (GLOW) programme.

- An investment fund of up to RM1.2 billion will be established to support digitalisation of Malaysian businesses by channeling funding from international investors into the local venture capital space.

- Up to RM70 million will be provided for the “Shop Malaysia Online” campaign to encourage online consumer consumption through e-commerce vouchers.

- An allocation of RM250 million is provided to support the arts, culture, entertainment and event industries to adapt to the new normal.

- Eligible micro enterprises and SMEs will be onboarded to shift towards business digitalisation through a co-funded programme with MDEC and e-commerce platforms.

- Additional allocation of RM50 million will be given to MIDA to undertake marketing and promotional activities.

- Continuation of the National “Buy Malaysia” campaign to encourage the consumption of local products and services through compulsory local products tagging and identification and creation of dedicated Malaysian product channels on major digital platforms.

- Cash incentive of RM600 per month up to a period of six (6) months will be given to businesses providing apprenticeships to school leavers and graduates.

- One-off grant of up to RM5,000 will be provided to registered childcare centres to comply with new healthcare Standard Operating Procedures.

- Cash incentive of between RM800 to RM1,000 per month up to a period of six (6) months will be given to businesses for hiring unemployed workers.

- 100% export duty exemption for the commodity industry i.e. crude palm oil, crude palm kernel oil and refined bleached deodorized palm kernel oil.

- Special individual income tax relief of up to RM2,500 will be given for the purchase of mobile phone, notebook and tablet.

- Tax relief on childcare services expenses will be increased from RM2,000 to RM3,000 for YAs 2020 and 2021.

- Individual income tax exemption of up to RM5,000 will be given to employees who receive a mobile phone, notebook or tablet from their employer.

- Reintroduction of Home Ownership Campaign with stamp duty exemption on the instruments of transfer and loan agreement for the purchase of residential homes.

- The period for Service Tax exemption on accommodation and related services is extended to 30 June 2021.

- The period for claiming income tax relief of RM1,000 incurred on domestic travelling expenses is extended to 31 December 2021.

- Exemption of Tourism Tax will be given to foreign tourists staying at any accommodation premises in Malaysia until 30 June 2021.

- Full exemption of Sales Tax for purchase of locally assembled passenger cars and 50% exemption of Sales Tax for purchase of imported passenger cars.

- One-off cash assistance of RM300 will be given to OKUs and single mothers.

- An unlimited monthly travel pass (My30 Public Transport Subsidy) costing RM30 per month will be introduced for all Malaysian citizens from 15 June 2020 until the end of December 2020.

- An allocation of RM2 billion will be dedicated for reskilling and upskilling programmes for Youth and Unemployed Workers.

- Free internet connectivity of 1Gb per day will be given to all users from 8am to 6pm daily from mid-June 2020 until end of December 2020 to browse educational websites and use of video conferencing applications.

- E-vouchers of RM800 per household for mobile childcare services will be given to working parents.

- Training allowance of RM4,000 will be given to individuals who are retrenched but not covered under the Employment Insurance System.

- The existing allocation for the PEKA B40 Programme is doubled to a total of RM100 million to support the healthcare needs of low-income groups.

- Provision by e-wallet providers of RM50 worth of e-wallet credits and RM50 worth of vouchers, cashback and discounts to all Malaysians aged 18 and above and earning less than RM100,000 annually.

- Approval for Manufacturing license for non-sensitive industries will be issued within two (2) working days.

- An online one-stop business advisory platform (MyAssist MSME One Stop shop) will be set up to provide guidance and facilitate the recovery process for micro enterprises and SMEs.

- Cash flow aid will be provided by SME Bank for G2 and G3 contractors that have been awarded small government projects under the previous Economic Stimulus Packages.

- Sukuk Prihatin worth RM500 million will be issued to facilitate the Rakyat’s participation in supporting post-recovery economic measures.

- Government Linked Companies and large corporations are encouraged to accelerate their vendors’ payment terms.

- An innovation sandbox will be developed to pilot new technology solutions and provide relaxation of regulations to test new technology solutions (e.g. drone delivery, autonomous vehicles).

- Acceleration of the digitalisation of government services to reduce face-to-face transactions (i.e. stamp assessments & duties, unclaimed monies, online interviews for Government scholarships, etc.)

- Establishment of Project Acceleration & Coordination Unit (PACU) at MIDA to accelerate the implementation and coordination of approved investment projects.

To read more, click here for details.

Other Economic Stimulus Packages and Insights

COVID-19 Impact and Response