Crowe Chat Vol.11/2020

Accounting & Audit

Accounting is not as exact as you think. In many instances, estimation of a judgmental nature is involved. As a result, the International Auditing and Assurance Standards Board (IAASB) has issued ISA 540 as guidance to accountants and auditors alike. ISA 540 deals with the auditor’s responsibilities relating to accounting estimates, including fair value accounting estimates, and related disclosures in an audit of financial statements.

The IAASB published the revised ISA 540 in 2018 and this revised standard is effective for audits of financial statements for periods beginning on or after 15 December 2019. This ISA 540 (Revised), Auditing Accounting Estimates and Related Disclosures, is enhanced to better address the public interest issues associated with accounting estimates.

Key Enhancements

The revised ISA 540 establishes more robust requirements and appropriately detailed guidance to foster audit quality by driving auditors to perform appropriate procedures relating to accounting estimates. The key enhancements are:

a) Objective-based work effort directed to methods, assumptions and data

b) The importance of auditor’s decisions about controls and separate assessment of inherent risk and control risk

c) Enhanced evaluation requirements to determine if related disclosures are reasonable

d) Enhanced risk assessment procedures including the concept of spectrum of inherent risk and focus on management bias in risk assessment

e) “Stand-back” requirement and evaluation of external information sources

f) Enhanced requirement when communicating with those charged with governance

Overall Implications

Accounting estimates are increasingly common in financial statements and by its nature, caused an audit to be not easy. The changes in financial reporting such as changes in accounting for expected credit losses and revised IFRS standards dealing with revenue recognition, leases and insurance contracts, increase the awareness of accounting estimates to the users of financial statements.

Auditors need to review the estimates prepared by the management and challenge the basis of conclusions wherever necessary to determine if the accounting estimate used is reasonable. On the other hand, preparers need to prepare the basis of their accounting estimates in more detail and to substantiate these details with documentation and justifications.

Details of ISA 540

At a Glance

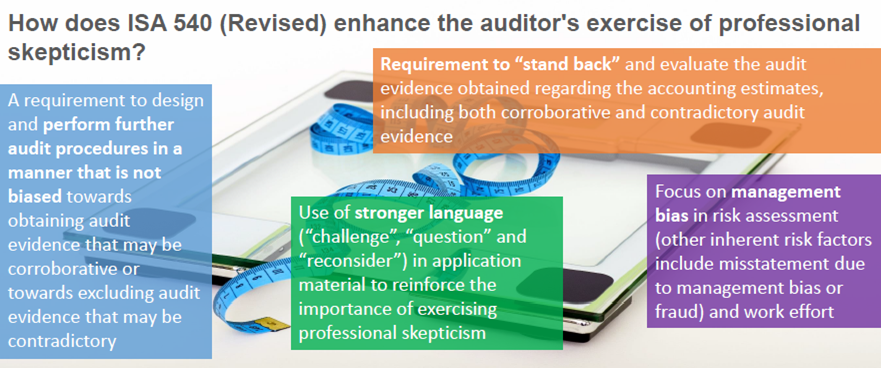

Overall, the revised ISA 540 is enhanced to address the audit quality for accounting estimates by fostering a more independent and skeptical mindset in auditors. The diagram shown at the right pinpoints the areas where auditors should appropriately exercise the professional skepticism.

Effective Date

The ISA 540 (Revised) is effective for audits of financial statements for periods beginning on or after 15 December 2019.