PR 2/2020 and PR 3/2020 – Tax Treatment of Stock in Trade Part I – Valuation of Stock and Part II – Withdrawal of Stock

Introduction

Stock in trade is anything a business acquires, produces or manufactures, for the purpose of manufacturing, selling at a profit or exchanging. It is important for stock in trade of a business to be valued correctly at the end of a financial period to enable the profits and income tax payable of the business to be ascertained accurately.

Previous PR

PR4/2006 - Valuation of Stock In Trade and Work In Progress Part I was issued on 31 May 2006.

New PR

The Inland Revenue Board of Malaysia (IRBM) issued the following PRs on 3 June 2020 to provide guidance on the valuation and withdrawal of stock in trade:

- PR2/2020 - Tax Treatment of Stock in Trade Part I - Valuation of Stock

- PR3/2020 - Tax Treatment of Stock in Trade Part II - Withdrawal of Stock

Details of new PR

PR2/2020 - Tax Treatment of Stock in Trade Part I - Valuation of Stock Subsection 35(3) of the Income Tax Act 1967 (ITA) addresses the basis of valuation of stock in trade which is acceptable for income tax purposes as follows:

- stock is valued either by using the market value or the cost of acquiring the stock; and

- stock consisting of immovable properties, stocks, shares or marketable securities is valued at the lower of its cost price or market value.

PR4/2020 - Tax Treatment of Any Sum Received and a Debt Owing that Arises in Respect of Services to be Rendered

Introduction

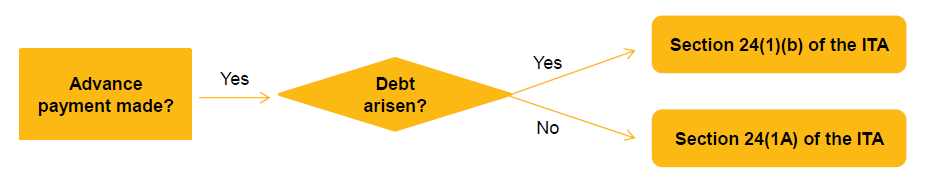

Prior to the year of assessment (YA) 2016, paragraph 24(1)(b) of the ITA only dealt with debts arising in respect of any services rendered which were brought to tax in the YA the debt arises. With effect from YA 2016, an amendment was made to paragraph 24(1)(b) of the ITA to also bring to tax debts arising in respect of any services to be rendered in the YA the debt arises. In YA 2016, a new subsection 24(1A) of the ITA was introduced to tax any advance payments for services in the year of receipt, notwithstanding that the services have yet to be rendered and there is no debt owing.

New PR

The IRBM issued the following PR4/2020 - Tax Treatment of Any Sum Received and a Debt Owing that Arises in Respect of Services to be Rendered on 16 June 2020 to explain the application of paragraph 24(1)(b) of the ITA and subsection 24(1A) of the ITA.

Details of new PR

The new PR highlights the following points in respect of the new provisions:

- Tax treatment effective from YA 2016

- By virtue of paragraph 24(1)(b) of the ITA, a debt owing would arise when there is a contractual obligation to pay or a liability to pay exists.

- The application of paragraph 24(1)(b) of the ITA would have to be considered first before applying subsection 24(1A) of the ITA.

- Transitional tax treatment for advance payments received prior to YA 2016

- The advance payments were received in respect of services that will be rendered subsequent to YA 2016.

- The advance payments received will continue to be taxed when the services are rendered.

- Tax treatment in respect of a refund of an advanced payment

- If a person refunds any sum of money received in respect of services that have yet to be rendered, a tax deduction can be claimed in the YA when the refund is made.

- Services that are Not Subject to Paragraph 24(1)(b) and Subsection 24(1A) of the ITA

- Services that are governed by separate Income Tax Rules – i.e. construction contract or property development.

- Pursuant to Subsection 24(8) of the ITA, Section 24 of the ITA shall not apply to income under Section 4A of the ITA.

- Refundable deposits – i.e. security deposit and refundable deposit, but does not include deposits that are forfeited.

Guidelines - Stamp Duty on the Instruments of Transfer for Unlisted Shares

Introduction

Stamp duty is chargeable on instruments of transfer and not on transactions. The sale of shares in a Malaysian incorporated company will be subject to stamp duty at the rate of RM3 for every RM1,000 i.e. 0.3%.

Previous Guidelines

Guidelines On the Stamping Of Share Transfer Instruments For Shares That Are Not Quoted On The Kuala Lumpur Stock Exchange (Guidelines 2001) was issued in the year 2001.

New Guidelines

The IRBM released the Guidelines On the Stamping Of Share Transfer Instruments For Shares That Are Not Quoted On The Kuala Lumpur Stock Exchange (Guidelines 2020) on 23 June 2020. Guidelines 2019 dated 6 November 2019 was also released on the same day but it was superseded by Guidelines 2020.