Tax Awareness for Employers in Malaysia

What will be the IRBM’s next course of action in reforming the tax system to address tax leakages, reduce the existing tax gap and explore new sources of revenue to increase tax collections? Will the IRBM place more emphasis on employers’ audits?

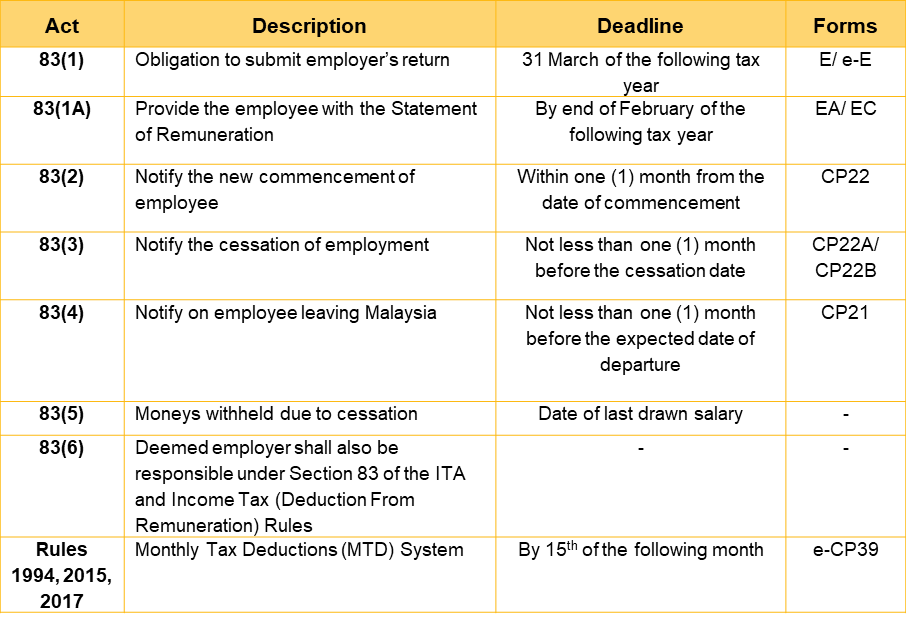

Employers should get ready and be prepared for an audit before it is too late. Having an in-depth understanding of the tax obligations of an employer in Malaysia is important due to the increasingly stringent tax laws and tax audits carried out by the IRBM. Employers’ tax obligations in Malaysia are clearly spelled out under Section 83 of the ITA and Income Tax (Deduction From Remuneration) Rules 1994, 2015 and 2017. A brief summary is as follows:-

Most employers are aware of the annual and monthly submissions that are required to be submitted by them to the IRBM and employees, i.e. Forms E, EA and MTD. However, some employers may face difficulties in executing the IRBM’s requirements in accordance with the relevant legislation due to various practical issues. Continue reading...