Introduction

Business success comes to those who know how to make good use of opportunities. When opportunities knock, hard work and talent create the conditions that allow businesses to flourish. Getting listed on the stock exchange, for example, is one of the opportunities that can steer a business towards growth, wealth and ultimately, further success.

However, not all listed companies succeed. Businesses who know how to capitalize on their advantageous position can use their listing status to undertake strategies that will enhance their competitive position in the market. Indirectly, the successful company is one who knows how to harness the power of the Stock Exchange to get ahead of competitors.

In this publication, we are honored to share our knowledge on how you can seize available opportunities on hand to grow big and prosperous by harnessing the power of the stock exchange.

If you are contemplating strategies on how you can list your company on the stock exchange, raise capital or undertake other corporate exercises in order to grow your business, please feel free to talk to us. We will be glad to help you create the conditions for your business’ success and seize all the available opportunities that come with listing your company.

Like the quote says “If opportunity doesn't knock, build a door.” We are here to help you build the door that will open up new avenues for growth.

Gaining a competitive edge by listing on the stock exchange

The idea of capitalizing on the stock exchange is not new today – we have come across many success stories of companies that have benefited commercially from offering their shares to the public via the stock exchange. What sets a successful company apart from the rest is its ability to harness the power of the Stock Exchange to gain the competitive edge over their competitors.

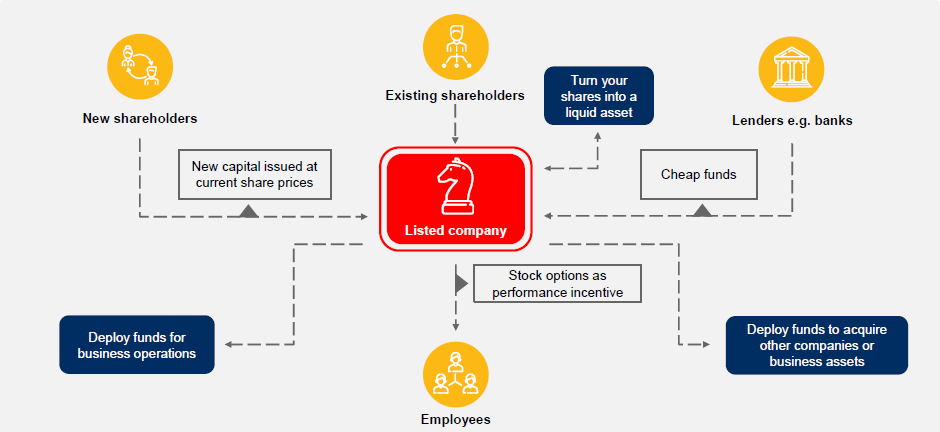

Some of the strategies one can employ to gain an advantageous position by listing on the stock exchange are as follows:-

- Illiquid asset to liquid asset

Use the listing status to convert an illiquid asset i.e private company shares, to a liquid asset i.e. listed company shares

- Incentive for staff

Use share options as an incentive for key staff to drive corporate performance

- Raise funds more efficiently

Raise funds more efficiently via loans or shares than your competitors for your own business operations

- Waive personal guarantees

Raise loan capital without having to pledge the shareholders’ personal assets or provide personal guarantees, thereby providing freedom in raising capital

- Long term investment

Treat the listing as an investment in a long term asset which has value even if the listed company status is disposed of in future

- Undertake acquisitions

Use funds or capital raised to acquire other companies or use your company shares as currency to acquire companies

a. Using your advantageous position to raise funds effectively

Example 1: Raising loans and capital as a PLC versus a non-PLC

Capital is the fuel for expanding business operations or making acquisitions. Ease of access to plentiful capital supply is the dream of every businessman. His capacity to use capital is only constrained by his imagination and business acumen. However, capital is often limited. Capital especially does not come easy because lenders and shareholders are concerned with risk, return and repayment. A listed company may then be a partial answer because it is more transparent, has more corporate governance and more accountability.

Cheap capital comes from a few possibilities – loans, bonds and convertibles.

- Getting cheap loans from the bank if you are a very trustworthy customer

Your trustworthiness to the lender is higher if your company is large, stable, profitable and has a good track record of success. This leads to good credit scoring and reduced interest rates that will gain you a competitive edge against your competitors.

- Raising funds through share capital

Funds can be raised if future shareholders are prepared to pay a good price to buy the shares issued by your company. You can issue your shares at market price and the proceeds will flow into the company which can then be used to buy business assets (property, plant or equipment or intangible assets such as intellectual property) or for working capital (i.e to finance inventory, trade receivables. etc).

You can also use shares as a currency and capital to acquire other companies for your expansion.

- Rights Issue

One of the ways to raise capital is via a rights issue that is offered to all shareholders. The rights issue price can be based on prevailing market price of shares which therefore can garner more proceeds for the listed company. If the major shareholder does not have the funds to finance the rights issue, he can pledge the shares to a bank for a loan. The shares can be used as collateral. On the other hand, if his shares are unlisted, banks will not provide the financing because unlisted company shares are not acceptable as collateral.

- Special placement of shares to special investors

Another way of raising funds is to place out shares to new investors. These investors can include strategic investors who can add value to the company via opening of new markets, providing special knowledge, connections, etc. This special placement can be done if the listed company shares are especially attractive.

|

As an example, on 3 February 2020, TFP Solutions Berhad (“TFP”) (listed on the ACE Market of Bursa Malaysia) had announced their proposed private placement of up to 62 million new ordinary shares. Based on TFP’s circular on 10 July 2020, this exercise was expected to raise gross proceeds of up to RM4.9 million which were mainly channeled towards working capital for their financial technology mobile product development. TFP’s shareholders approved this exercise on 4 August 2020. |

b. Raising funds via loans

Relatively cheap funds can be obtained from banks and other lenders.

- Loans from banks

Banks are more amenable to lending to listed companies due to their transparency, better accountability and greater perceived creditworthiness. As listed entities, banks generally do not require the personal guarantees of directors unlike private companies. They often perceive the risk of lending to listed companies to be lower and as a result, improve the listed companies’ credit scoring and reduce the interest cost. These are helpful measures for the listed entities to raise more loans and assist directors to shield their private assets from the creditors of the listed entity.

- Issuing of bonds

Bonds are a good form of long term capital that can be used to fund long term projects. Bond interest rates can be reasonable and are attractive to bondholders who do not have any option other than placing their funds with banks which provide low fixed deposit interest rates. To expand the market for bonds, bonds can be listed. Listed bonds will interest institutional investors who may want the reasonable interest rates, easy disposal of the bonds, good creditworthiness of the borrowers etc. Lately, perpetual bonds without a fixed date of repayment have been popular as a form of even longer term capital.

- Other instruments attached to sharesAdditionally, a rights issue comprising of an issuance of amongst others, shares and/or loan stocks, and warrants, offer companies the option to raise funds via its existing shareholders by allowing them to purchase the company’s shares and/or loans sometimes at a discount to the prevailing market price. Shareholders gain the upside from the difference in price paid for the rights shares and the higher (theoretically) market price for the shares.

|

As an example, on 27 December 2018, Malayan Flour Mills Berhad (“MFM”) undertook renounceable rights issues involving the issuance of redeemable convertible unsecured loan stocks (“RCULS”), and new (rights) shares, attached with bonus shares and warrants. A total of RM275 million was raised upon completion of this exercise on 28 January 2019 which was mainly channeled towards capital expenditure and repaying revolving credit facilities. The warrants were issued free on the basis of one (1) free warrant for every two (2) RCULS subscribed, and one (1) free warrant for every four (4) rights shares subscribed. |

c. Deployment of your capital as currency for undertaking acquisitions

Many large companies have grown through acquisitions. Acquisitions provide the following advantages:

- New products which the acquirer does not have. This strategy therefore expands the product range of the enlarged company.

- Acquisition of greater talent by the acquirer from the acquiree company.

- Wider markets for the acquirer through a combination of new customer relationships, enlarged sales teams and market specialisations.

- A company that grows well and is profitable will command a higher PE multiple and therefore a higher share price. This virtuous cycle allows a company to grow even further by making use of their higher share price to undertake more acquisitions.

|

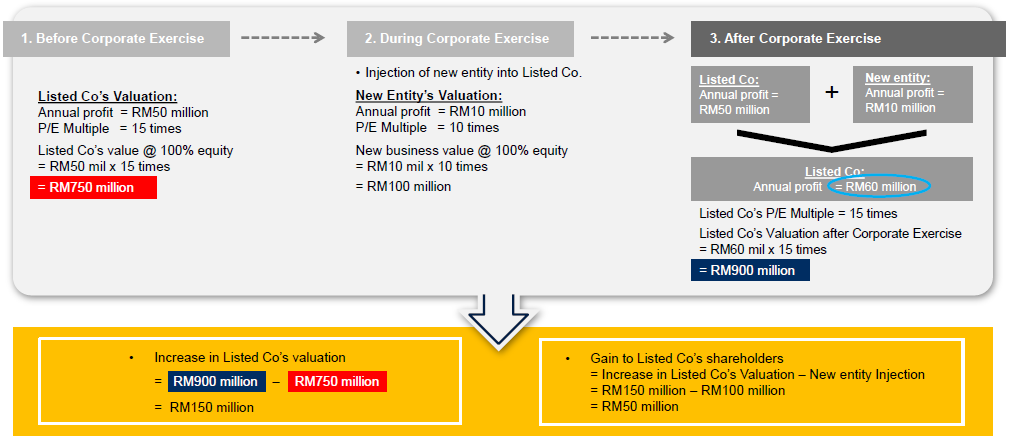

For example, a company has a PE of 10. Due to its policy of growing partly by acquisitions, the market valued the shares favourably at a PE of 15. It made profit of RM50 mil and therefore, the market cap was RM750 mil (PE of 15 x RM50 mil). It then acquired more companies. One of the companies acquired for cash was valued at a PE of 10. The profit of this acquired company was RM10 mil and the valuation was RM100 mil (PE 10 x RM10 mil profit). After the company was acquired, the group now has profit of RM60mil (RM50 mil + RM10 mil). If the PE is 15, the market cap is RM900 mil (15 x RM60 mil). The increased market cap is RM150 mil whereas the acquisition cost is only RM100. The shareholders of the listed company therefore benefited by RM50 mil (RM150 mil – RM100 mil). |

It goes without saying that all acquisitions have to be integrated within the overall organization and their synergies maximized to enhance the value of the overall group. For example, if a listed company acquires a company, the listed company has to help the acquired company to improve the management, recruit new senior executives, introduce more aggressive marketing, invest into better products, provide an incentive scheme for executives, and help the company to open new markets. This improved strategy will enable the acquired company to grow, be more profitable and more valuable to the acquirer.

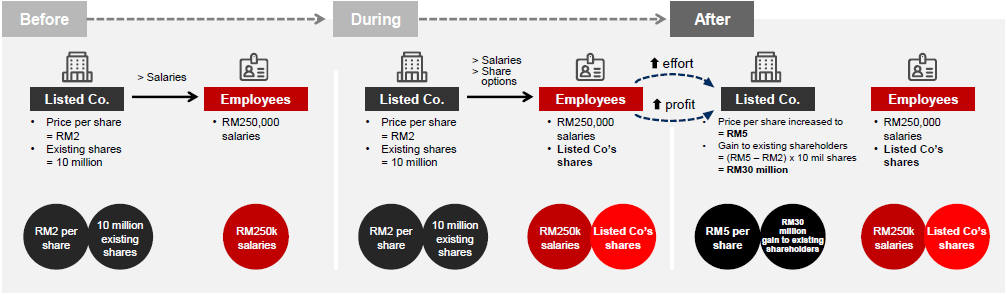

d.Deploying your shares as a monetary incentive for attracting and retaining talent

It is often said that men follow men. Men do not follow companies. Men especially follow good leaders who they trust that will bring them to a new level of success. Good leaders in turn know how to introduce good incentives to attract and retain good men. Good men need good incentives to attain their personal goals. They need to know the potential of the company and how they can work to realize their potential and the potential of their employers. To this end, stock options can be issued to key executives as an incentive whereby the options will vest on certain conditions eg if the share price reaches a certain price. In order to achieve the agreed price, the executive needs to work hard to drive performance within the company and help to grow the profits. If all the executives are aligned in their goal of growing the profits, the company will succeed. This collective alignment is a powerful force in the company. Stock options can therefore be used to incentivize key executives.

An executive is issued with 100,000 share options. His current remuneration package is RM250,000 a year. The option will be vested with the executive when the shares reach a price of RM5. The present share price is RM2. When the share price reaches RM5, this executive will receive a gain of RM300,000 [100,000 x (RM5 - RM2)] which is 120% of his remuneration package. This extra gain will be a good incentive to the executive. On the other hand, although the existing shareholders of the company have lost out a bit due to the dilution of their shares, the dilution is minimal in relation to the extra profits which can be distributed to them as dividends or in relation to the enhanced share price which the shareholder can enjoy through greater wealth as a result of the higher share price. It is interesting to note that this option of incentivizing employees is not available to non-listed companies. Listed companies thus has a distinct advantage over private companies in this respect.

Illustration: Stock options issued to employees

e. A listing is an investment in a long term asset

- A listing brings many advantages and perhaps, some disadvantages. The advantages can enhance the business success of the company. However, some companies may not be so fortunate and due to one reason or another, may not be so profitable. In the event that they have to exit from the business, the listed entity still has good value partly because of its listing status.

- If a company decides not to continue with its business, it can dispose of its business and later, sell off its listing status. As an example, the listed company sells off its business for say RM20 mil. The RM20 mil will be distributed to the shareholders as dividends or as proceeds from a capital reduction exercise. In addition, the listing status can be sold to new shareholders at an agreed price. As the mechanics for the disposal is quite complicated, it will not be elaborated here. However, if the listing status can be disposed for RM10 mil, the shareholders of the listed company will get to enjoy the additional proceeds of RM10 mil.

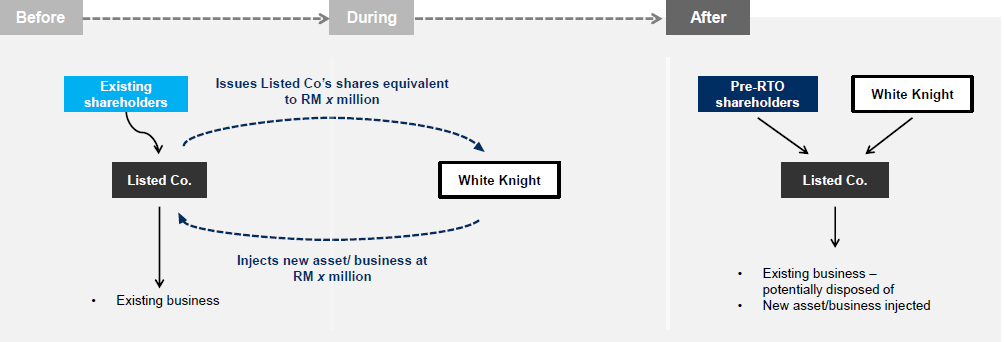

- Using the same concept, companies that have terminated their business can still sell their listing status via a Reverse Takeover (RTO) to new incoming shareholders known as a “White Knight”. In such a case, the new shareholders will bring in a new business into the company and get shares in exchange. However, the existing shareholders will remain and their residual share in the listed entity will enable them to enjoy some value from their otherwise “lost” investment.

Illustration: Reverse Takeover (RTO)