COVID-19: Crowe Tax Planning Handbook For Businesses

The COVID-19 virus was first detected in China in late 2019. Since then, the lethal virus has spread throughout the world. As at 1 April 2020, there were over 850,000 positive cases and 40,000 deaths, with countries such as the United States, Italy and Spain being the new epicenters for the disease. What is clear to economists, industry observers and business practitioners alike is that this pandemic is here to stay for the time being, and businesses must rise to the occasion to adjust to the new normal.

Back home, the COVID-19 virus was first detected in Malaysia in January 2020 and has claimed dozens of lives and infected more than 3,000 people to-date. Many lives and businesses have been directly and indirectly affected by the COVID-19 outbreak. The worst affected sectors are those in the tourism industry as most businesses in this industry suffer a severe drop in revenue due to lesser tourists coming into Malaysia.

On 1 April 2020, the Malaysian government imposed further restrictions on its population to curb the spread of the disease, enhancing the existing Movement Control Order (MCO) that was first implemented on 18 March 2020. From an economic standpoint, the government has taken both proactive and reactive measures to contain the economic fallout arising from the COVID-19 pandemic.

Malaysia announced the first Economic Stimulus Package (ESP1) valued at RM20 billion on 27 February 2020 to ease the financial burden of the people and certain categories of businesses. This was followed by the Prihatin Economic Stimulus Package (ESP2), valued at RM 250 billion on 27 March 2020. An Additional Prihatin SME Economic Stimulus Package (ESP3) valued at RM10 billion and tailored specifically for the micro, small and medium enterprises was announced on 6 April 2020. Whilst the government continues to look at economic policies to help keep the economy afloat, businesses must start taking decisive action in all areas to avoid any other unwanted risks from crystallising.

In this regard, our team of experts have examined the possible repercussions of COVID-19 to businesses on the financial statements (i.e. income, expenses, assets, liabilities) and other issues as well as measures implemented by the government and possible tax planning points that businesses can adopt to ameliorate these difficulties. The guidance provided in this handbook would help to alleviate the tax burdens being faced by businesses to date, as they seek to contain the economic damage that this crisis has brought about.

Overview of Handbook

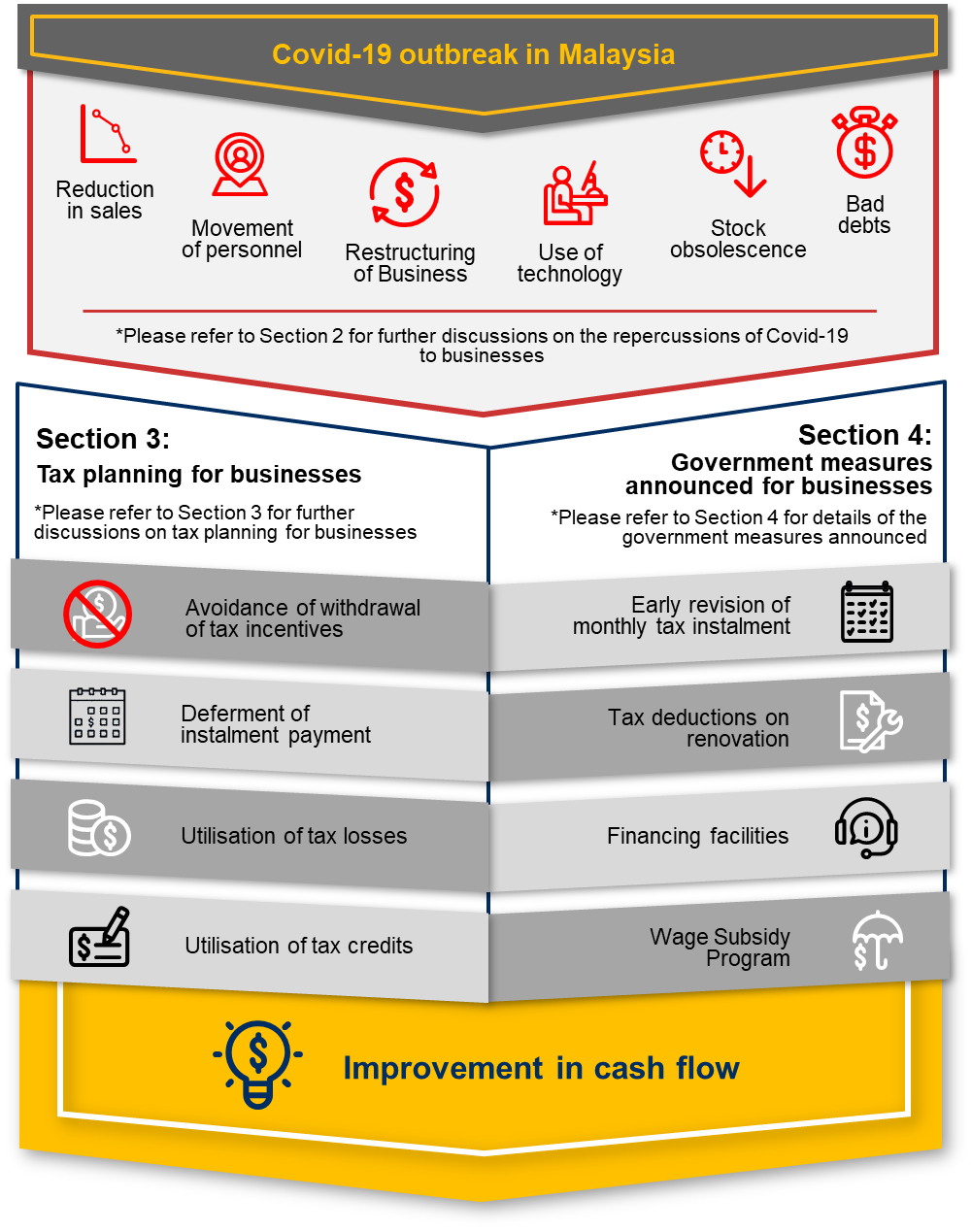

We have produced this handbook with the aim of evaluating the possible impact of COVID-19 to businesses in Malaysia and the tax effect therefrom. Further, we have also discussed on the possible tax planning and Government measures that businesses could leverage on to improve the business cash flow during this period. A broad overview of this handbook is as follows:

To continue reading, click button below for more further details:

Download our exclusive handbook

COVID-19: Crowe Tax Planning Handbook For Businesses infographicEconomic Stimulus Packages

COVID-19 Impact and Response