Listing of a subsidiary and its impact to the holding company

This situation is less common and will only apply to a group which intends to list one of its subsidiaries. In this situation, it is important to understand the effects of the subsidiary’s IPO on the financial position and results of the group as it can be material. It is important especially if the holding company itself is listed or if the group has loan or other covenants.

There are two common scenarios when a group lists its subsidiary.

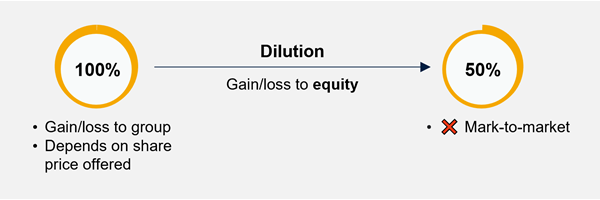

Scenario 1: Where the group retains control over the subsidiary

For example, the group still holds more than 50% shares in the subsidiary.

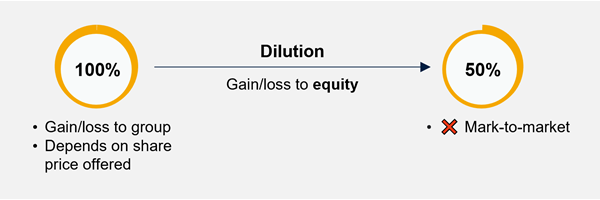

In this scenario, the dilution of the group’s interest in the subsidiary will result in a dilution gain (it can result in a dilution loss but this is very unlikely). This dilution gain will be taken up directly in equity and does not affect the Group’s results.

The remaining investment in the 51% subsidiary will continue to be accounted for in the Group’s financial statements based on existing policy.

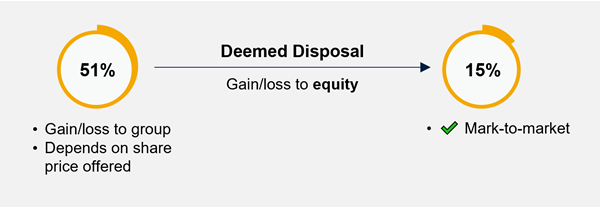

Scenario 2: Where the group cedes control of the subsidiary

For example, the Group retains only 15% equity interest in the former subsidiary.

In this scenario, the effect of the dilution is treated very differently from the first scenario. The dilution gain will be reflected in the profit and loss account of the group.

Hence, if the dilution is significant, which is normally the case, the Group will show a significant increase in its profit in the year the IPO takes place.

In addition, the remaining 15% investment in the former subsidiary will be classified as investments in quoted shares and are required to be marked to market. The changes in the market value are taken to the profit or loss account or other comprehensive income depending on the Group’s accounting policies. This can cause volatility in the results of the group.