Albania

Andorra

Armenia

Austria

Azerbaijan

Belgium

Bulgaria

Croatia

Cyprus

Czech Republic

Denmark

Estonia

Finland

France

Georgia

Germany

Greece

Hungary

Ireland

Italy

Kazakhstan

Kosovo

Latvia

Lithuania

Luxembourg

Malta

Moldova

Netherlands

Norway

Poland

Portugal

Romania

Serbia

Slovakia

Slovenia

Spain

Sweden

Switzerland

Tajikistan

Turkey

Ukraine

United Kingdom

Uzbekistan

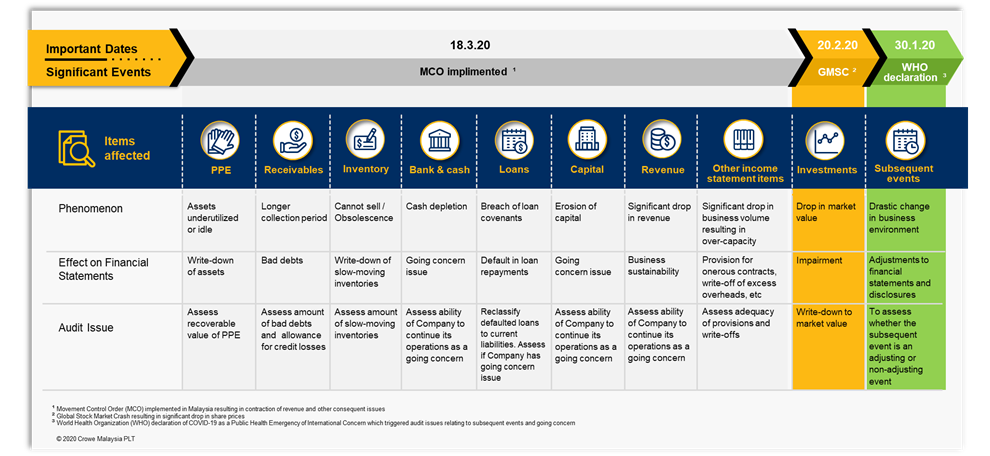

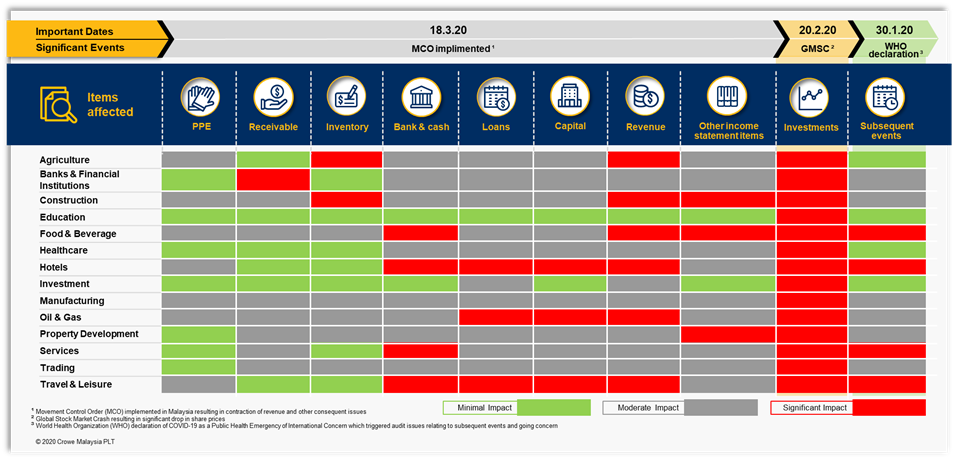

Accounting and Audit Implications of COVID-19

Overview

The recent COVID-19 pandemic that led to the stock market crash and country-wide lockdown in Malaysia has impacted the preparation of financial statements in significant ways. What are these implications? For clarity and easy reading, we have tabulated the important dates involved as well as their impact on the various items in financial statements.

The important dates that impacted financial statements due to the COVID-19 pandemic are as follows:

- 30 Jan 2019

World Health Organization (WHO) declaration of COVID-19 as a Public Health Emergency of International Concern which triggered audit issues relating to subsequent events and going concern.

- 20 Feb 2020

Global Stock Market Crash resulting in significant drop in share prices.

- 18 Mar 2020

Movement Control Order (MCO) implemented in Malaysia resulting in contraction of revenue and other consequent issues.

Commentary

The COVID-19 pandemic will affect financial statements in many significant ways. We detail below these issues and the procedures that auditors need to undertake to assess their veracity:

Impairment of non-financial assets e.g. buildings and equipment

To identify indications of impairment, changes in key drivers and assumptions used in estimating the recoverable amounts of the productive assets.

Provision for onerous contracts

A provision is required when unavoidable costs of meeting the obligations exceed the benefits expected to be received under the contract.

Foreign exchange transactions

To consider the effects of significant fluctuations in foreign exchange rates on the operations of the Company and the effectiveness of hedge accounting.

Inventories

To identify changes in net realisable values due to the decrease in selling prices or due to obsolescence.

Going concern

Material uncertainties may cast significant doubt on the ability of the Company to continue as a going concern.

Government support

To determine the appropriate accounting treatment of government support e.g. Economic Stimulus Package is a government grant that should be accounted for under MFRS 120 ‘Accounting for Government Grants and Disclosure of Government Assistance’.

Fixed production overheads

A higher amount of unallocated fixed overheads has to be expensed off due to abnormal production capacity / low production volume.

Disclosures in financial statements

More comprehensive disclosure is required of significant accounting judgments, estimates and assumptions used in preparing the financial statements that could result in material adjustments to the carrying amount of assets and liabilities.

Events after the reporting date

To carefully evaluate whether information on COVID-19 that becomes available after the reporting date is an adjusting or non-adjusting event for accounting purposes. Financial statements have to be updated if the event is a significant adjusting event; otherwise, a disclosure is required.

Lease contracts

To identity and account for any lease rent concessions.

Impact on auditor’s report

To evaluate whether the impact of COVID-19 is a Key Audit Matter. Depending on resolution of accounting and auditing matters due to COVID-19, possibilities exist as to whether it is necessary for the issuance of a modified opinion or inclusion of a separate section under ‘Material Uncertainty Related to Going Concern (MUGC)’ in the audit report.

Revenue contracts

Material uncertainties may cast significant doubt on the ability of the Company to continue as a going concern.

Receivables

Greater judgment is needed in assessing the expected credit loss.

Fair value of unquoted equity instruments

To update key drivers and assumptions used in the valuation techniques to reflect current market conditions at the reporting date.

Breach of loan covenants

To consider how a breach of loan covenant may affect the timing of repayment of the defaulted loan (e.g. the loan becomes repayable on demand) and how it affects the classification of the related liabilities at the reporting date. This also affects the assessment of the company’s ability to continue to operate as a going concern.

Accounting and Audit Implications of COVID-19

For clarity and easy reading, we have tabulated the important dates involved as well as their impact on the various items in financial statements.

Stay Up-to-date with Our Newsletter

The important tax updates, articles and other exciting news that you don't want to miss.