Hotel, Tourism and Leisure

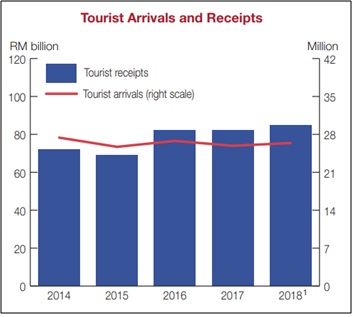

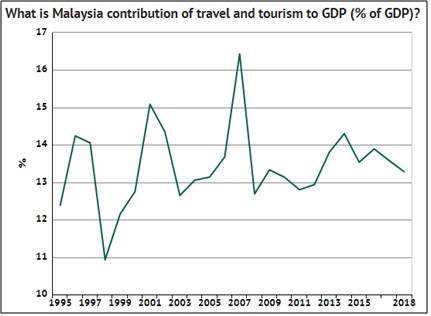

The hotel, tourism and leisure industry is one of the leading service industries and is a significant source of economic growth in Malaysia’s economy. Tourist arrivals in Malaysia were at 25.8 million in 2018, with the industry contributing 13.3% to the country’s GDP in 2018.

Source: Ministry of Finance Malaysia: Economic Outlook 2019 Chapter 3 Macroeconomic Outlook

Source : World Travel and Tourism Council

Tourist attractions in Malaysia include Aquaria KLCC, Petronas Twin Towers and Genting Highlands. Indoor theme parks in Malaysia include Kidzania Kuala Lumpur and Berjaya Times Square, Malaysia’s largest indoor theme park. There are also a number of theme parks in Johor Bahru, Malaysia such as Legoland Malaysia, Puteri Harbour Family Theme Park (Little Red Cube) and Angry Birds Activity Park.

To cater to these tourism projects, many local and foreign owned hotels were built. These hotels can have local owners, but the hotel operating company may be a foreign company. For example, Intercontinental Hotel Group which is a British multinational company currently has five hotels operating under three brands in Malaysia, namely InterContinental, Holiday Inn and Holiday Inn Express. One of the largest premium local brands in the hospitality industry is Lexis Hotels and Resorts (Lexis Hotel Group).

Complexities of the industry from accountancy and tax angles

The hotel industry is characterised by high capital expenditure for the hotel building and labour intensiveness in operating the hotel. Challenges are often faced by hotel owners in finding sufficient guests to achieve a high occupancy rate and at a favourable average daily rate (ADR). Hotels hence need to be operated efficiently whilst being successful to attract a large stream of guests. To achieve this, hotels owners would usually engage a foreign hotel operator to provide the sales network and branding. In return, the hotel operators will receive royalties and service fees based on gross revenue and net revenue. Often these fees, if paid to overseas hotel operators, and other payments to overseas service providers such as Google, will attract Malaysian withholding tax. From 1 January 2019, hotel owners have to account for Service Tax on imported taxable services. As hotels are critical to the tourism industry in Malaysia, the Malaysian government has been offering generous tax incentives for developers of hotels and tourism projects.

How can we help?

In addition to performing a statutory audit, we are able to assist companies in this sector to adopt the correct accounting policies that are appropriate to their circumstances. These policies include those relating to recognition of income, treatment of fees received in advance, deferred taxation due to temporary differences, etc. In particular, revenue recognition for hotels which sell memberships or “products” with multiple performance obligations may be complex. The large capex often seen in most hotels also requires special attention.

Hotel groups with operations in many parts of Malaysia and overseas will find that our network of 13 branches in Malaysia and 250 Crowe firms throughout the world can greatly facilitate group audits.

For more details of our audit services, please click here

From the tax angle, we can assist to plan and apply for tax incentives. This involves understanding the type of tax incentives that a hotel company is eligible for and how best to strategise in order to successfully apply for the tax incentive. In this regard, we have extensive experience with outstanding results for our clients. We can also maximize the claim of capital allowances for the capital expenditure incurred which may at times require careful planning. Group relief may also be used to reduce taxes. In the areas of tax compliance including preparation of tax computations and complying with all other tax rules, we have a large team of tax professionals who are able to offer a broad range of specialised services to serve our clients. These services include maximising the claims of operating expenses, planning for submission of tax estimates to the tax authorities, advising on withholding taxes, resolving grey tax issues, dealing with the tax authorities, etc. Sales Tax does not feature much in the hotel industry but hotel services are generally subject to Service Tax which is an area that our Indirect Tax division is able to advise on.

Companies in the hotel sector, being property-based companies, may encounter Real Property Gains Tax and stamp duty on their property transactions. We have extensive experience in advising on these taxes.

For more details of our tax services, please click here

We have a wide variety of specialised consulting services that can assist your corporate growth and enhance your corporate health. You can find more details in the following links:

We are especially well placed to assist companies in the hotel, travel and leisure market due to the relationship with our affiliate firm, Horwath HTL who are the acknowledged advisory experts in the hotel, travel and leisure industry. Together with Horwath HTL, we are able to offer a good breadth of knowledge and experience in the HTL industry ranging from hotel feasibility studies to hotel internal audits and listing on the Bursa Malaysia.

We are also experienced with transformation plans to assist companies to transform and adapt to the digital economy, restructure to new models of business, exploit opportunities in a changing economy, harness the capabilities of talent and assist in all aspects of change management.