Revised Conceptual Framework for Financial Reporting

The International Accounting Standards Board has issued the revised conceptual framework for financial reporting in March 2018. The revised conceptual framework is applicable for annual periods beginning on or after 1 January 2020.

The conceptual framework sets out:

-

the objective of financial reportingthe qualitative characteristics of useful financial information

-

a description of the reporting entity and its boundary

-

definitions of an asset, a liability, equity, income and expenses

-

criteria for including assets and liabilities in financial statements (recognition) and guidance on when to remove them (derecognition)

-

measurement bases and guidance on when to use them

-

concepts and guidance on presentation and disclosure

The revised conceptual framework introduces new concepts on measurement, presentation and disclosure, derecognition and has updated the definition of assets and liability, and derecognition criteria for assets and liabilities in financial statements. The revised framework also introduces clarification on prudence, stewardship, measurement uncertainty and substance over form.

The concept on measurement describes the factors to be considered when selecting a measurement bases on historical cost and current value. The factors to consider when selecting a measurement basis are relevant and faithful representation.

Presentation and disclosure concept include guidance on including income and expenses in profit or loss and other comprehensive income. The revised conceptual framework describes how information should be presented and disclosed in the financial statements.

The concepts on derecognition specifies guidance on derecognition of assets and liabilities to faithfully represent both assets and liabilities.

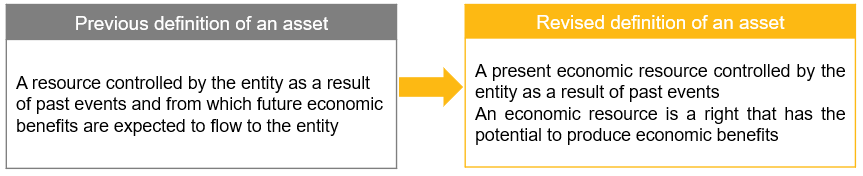

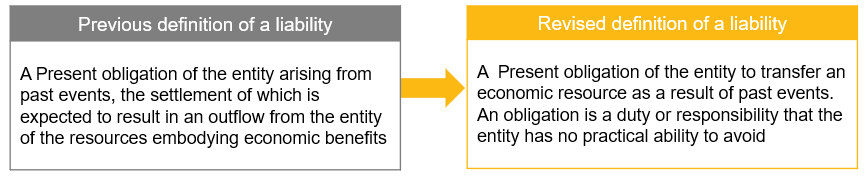

The revised framework has updated the definition of the assets and liabilities reflecting the concepts in the new standards developed by IASB.

The main changes to definition of asset clarifies that an asset is not an inflow of economic benefits rather it is the economic resources controlled by the entity. The flow of economic benefits to the entity need to not be certain or even likely.

A liability is an obligation to transfer economic resource not an ultimate flow of economic resource, and entity should not have practical ability to avoid transfer of the resources, which includes responsibilities that arise from the entity customary practices, published policies or specific statements.

The revised conceptual framework includes fundamental changes to the concepts and need to be looked in interpretation of the accounting standards.