Frequently asked questions and answers about the ROU asset

Q: What does an ROU asset mean in accounting?

A: While most of the focus of ASC 842 revolves around the fact that lessees are reporting a lease liability representing the future lease payments, many stakeholders have asked, “What is an ROU asset, and how is it accounted for?” The ROU asset represents the lessee’s right to control the use of the underlying lease asset for a period of time. Under U.S. GAAP, the ROU asset is considered a long-lived asset that is accounted for following Topic 842’s initial and subsequent measurement guidance. Lessees also must evaluate the ROU asset for impairment in accordance with Topic 360, “Property, Plant, and Equipment,” which broadly applies to other long-lived assets.

Q: How is the ROU asset initially measured?

A: The ROU asset’s initial measurement is based on the initial measurement of the lease liability, plus any lease payments made to the lessor at or before lease commencement, less any lease incentives received, plus any initial direct costs incurred by the lessee.

Q: How is the ROU asset measured upon initial adoption of Topic 842?

A: The answer depends on how the lease is classified and whether the package of transition practical expedients is elected. Most entities are expected to elect to use the package of transition practical expedients, in which case an entity’s classification of its existing leases is not reassessed. Entities that elect to apply the package of transition practical expedients should initially measure the ROU asset as follows:

|

|

| Finance lease |

Recognize an ROU asset equal to the carrying amount of the capital lease asset immediately before transition. |

| Operating lease |

Initially measure the ROU asset equal to the initial measurement of the lease liability, adjusted in this way:

- Add the balance of any existing prepaid rent

- Add the unamortized balance of initial direct costs

- Subtract the balance of any existing accrued rent

- Subtract the balance of any lease incentives

- Subtract impairment of the ROU asset

- Subtract the carrying amount of any liability recognized in accordance with Topic 420 on exit or disposal cost obligations for the lease

|

The transition adjustment, in most cases, is largely a balance sheet gross-up. Entities with significant balances of lease incentives, deferred rent, and/or obligations under Topic 420, “Exit or Disposal Cost Obligations,” at the transition date should keep in mind that these balances are, in most cases, merely reclassified on the balance sheet in establishing the initial ROU asset. That is, in most cases, the balances are not derecognized or adjusted through a cumulative effect adjustment to equity.

Q: Can the ROU asset exceed the fair value of the underlying asset?

A: Yes, unlike the old lease guidance for capital leases, Topic 842 does not prohibit this scenario. However, entities in this position should assess the accuracy of their lease measurement assumptions, such as the discount rate, identification of lease and nonlease components (if applicable), and allocation of contract consideration between the lease and nonlease components (if applicable).

Q: How is the ROU asset subsequently measured?

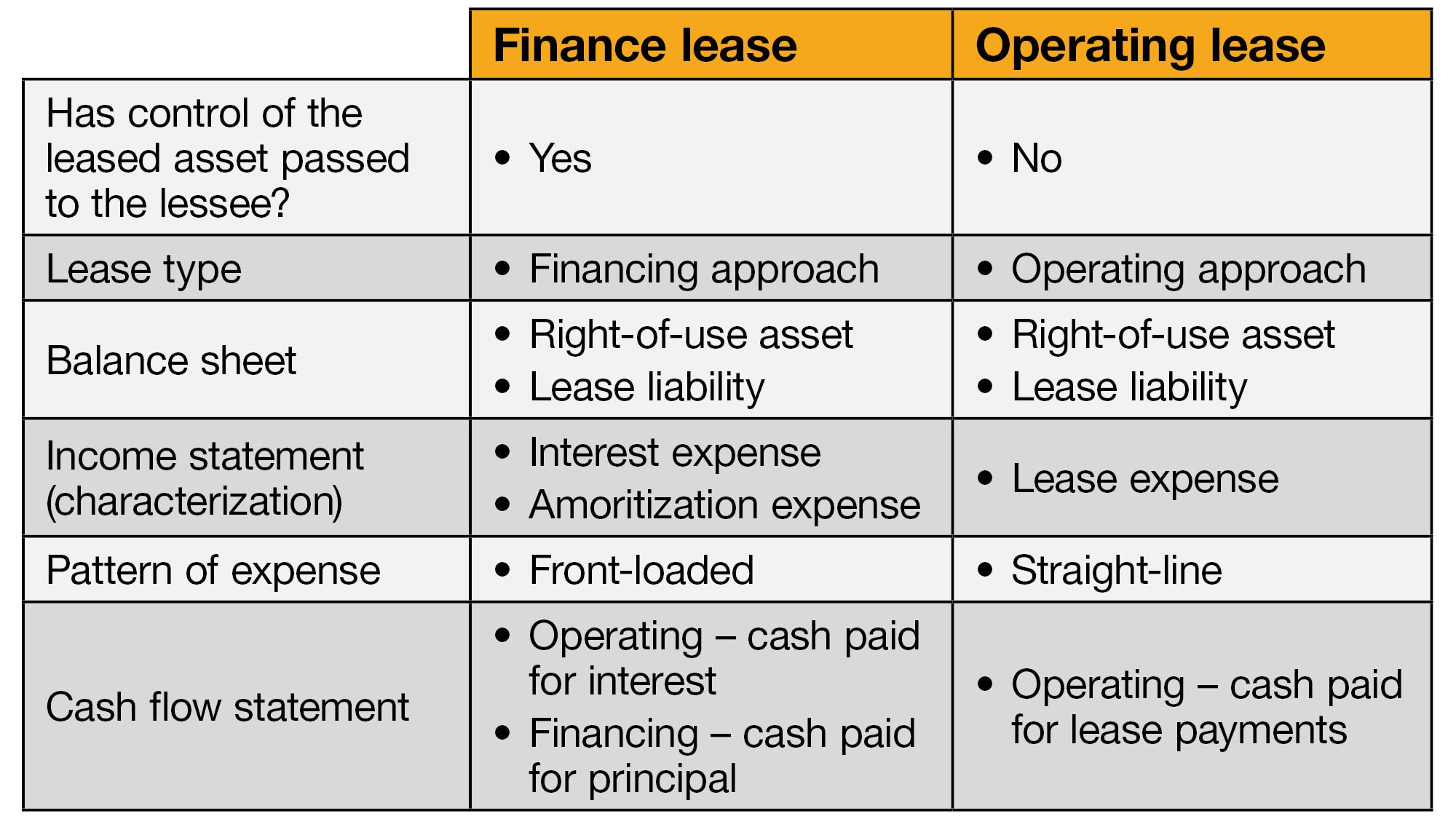

A: The answer depends on whether the lease is classified as a finance lease or an operating lease, as follows:

|

|

|

| Finance lease |

The ROU asset is amortized on a straight-line basis (unless another systematic basis is more representative of the asset’s pattern of use) over the lease term. If the lease transfers ownership of the underlying asset, the ROU asset is amortized to the end of the underlying asset’s useful life. |

| Operating lease |

Unless an impairment or modification has occurred, the ROU asset is subsequently measured in a similar manner as its initial measurement. That is, the ROU asset is, in many cases, subsequently measured based on the recalculated lease liability balance, adjusted for the effect of differences between lease payments and straight-line lease cost. Mechanically, the ROU asset is adjusted each reporting period by a “plug” to achieve the operating lease’s straight-line lease cost. Unless an impairment occurs, the operating lease ROU asset is not amortized on a straight-line basis. |

Q: How is the ROU asset of an operating lease subsequently measured after an impairment?

A: After an impairment, the ROU asset reverts to being amortized over the remaining lease term on a straight-line basis.

Q: How are lease incentives subsequently accounted for?

A: As previously described, the subsequent measurement of an operating lease’s ROU asset is largely a “plug” for the difference between the lease’s straight-line lease cost and the change in the lease liability (that is, the accretion of the liability based on the discount rate less lease payments made during the period). Consequently, lease incentives that were recognized upon initial measurement of the ROU asset subsequently are adjusted through the adjustment to the ROU asset.

Topic 842 is silent regarding how to account for contingently receivable lease incentives that are expected to be received after the lease commencement date (for example, a buildout allowance provided by the lessor after the lessee incurs buildout costs). More than one acceptable approach exists to account for lease incentives that are neither paid nor payable at lease commencement; however, the approach depends on the facts and circumstances of the lease incentive’s terms and conditions. Entities should evaluate the terms and conditions of significant lease incentives and discuss their approach with individuals responsible for accounting policy decisions and governance, as well as with their accounting advisers or independent accountants, as applicable.

Q: What are some other examples of when the ROU asset might be subsequently adjusted?

A: Besides applying the subsequent measurement guidance previously described and evaluating the asset for potential impairment in accordance with Topic 360, entities need to consider the impact to the ROU asset when the following events or conditions take place:

- A modification is made that does not grant the lessee an additional ROU asset at a market rate, including a partial termination of the lease. Topic 842 introduces a more robust framework to account for lease modifications than prior GAAP.

- The lease is fully terminated before the expiration of the lease term.

- A remeasurement triggering event occurs, as outlined in the following table: