.png?h=330&hash=8F6632A21721CEFD52E101A9CFD59384)

For a multinational enterprise, transfer pricing can be both a burden and an opportunity. A burden as several documents are required to be presented and in order. It also presents an opportunity, because well-planned transfer pricing can actually prevent double or unnecessary taxation and fines.

What is Transfer Pricing?

Transfer pricing is basically nothing more than determining the internal pricing of intra-group transactions (sale of goods or services). Internal pricing at multinational companies has large effects on how much income tax is due in a jurisdiction. This is why tax authorities are very concerned about transfer pricing and why the number of laws regarding transfer pricing have been increasing over the years.

Not playing by the rules of tax authorities may lead to fines, additional assessments or profit adjustments.

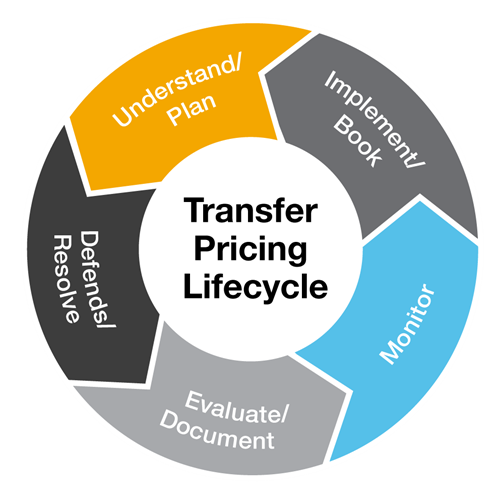

The transfer pricing lifecycle below shows the steps required to be in compliance and efficiently address the regulatory burden:

How we can help

When dealing with complex intercompany transactions, turn to the highly trained Crowe transfer pricing team of tax professionals and economists. We can provide insights into the intricacies of transfer pricing analysis to help you get a clear picture of your options. Crowe can also help you develop best practices for comprehensive tax due diligence, resolving transfer pricing inquiries, and interacting within each country of operation.

Global transfer pricing services

Global Transfer Pricing Services from Crowe offer economic consulting services in connection with tax issues arising from transactions among controlled parties. As part of our service offering, we seek to determine whether the pricing of intercompany transactions is consistent with the arm’s length standard.