For many small and micro businesses facing into an uncertain future after the pandemic, wondering what is their next move, SCARP may be the rescue option they need.

A Small Company Administrative Rescue Process (SCARP) is a formal restructuring option for SMEs that enables a company to restructure its balance sheet and write off a proportion of its debts. A SCARP provides a low-cost alternative to examinership as it is designed to be quicker and involves less court oversight.

The SCARP process is aimed at companies that meet two of the following three criteria:

- Fewer than 50 employees

- Turnover of less than or equal to €15m per annum

- A balance sheet total not exceeding €7.5m

These companies must be unable or likely to be unable to pay debts and have not used the examinership process (or SCARP) in the previous five years.

Among the key attractions of the process is its relative simplicity and straightforward nature.

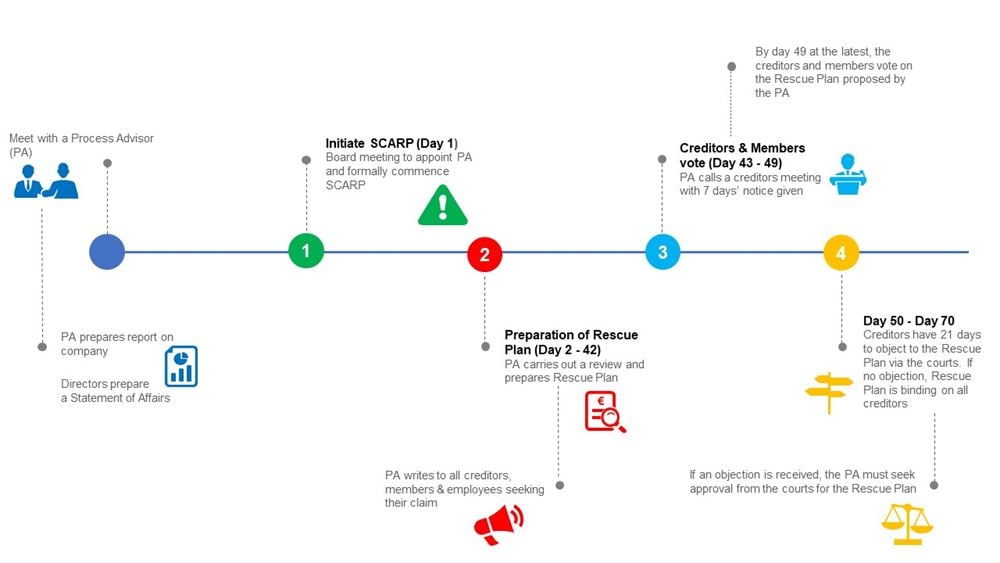

Overview of the process

Key stages of the SCARP process

Prepare a Statement of Affairs

Having identified the need to enter the process, the directors of the company will prepare a Statement of Affairs in a prescribed form which is a listing of assets and liabilities.

Process Advisor appointment and report

In order to enter the process, the company will engage an Insolvency Practitioner to act as a Process Advisor (PA).

The PA will then issue a report on whether the company has a reasonable prospect of survival and whether a SCARP is appropriate.

Board meeting

In order to formally commence the SCARP, the directors of the company will call a board meeting within seven days of receiving the PA’s report. At the board meeting, the directors will pass a resolution to commence the process. On passing the resolution the SCARP process will formally commence. This is day 1 of the process.

Process Advisor engagement with creditors

The PA will write to all known creditors enclosing a copy of the Statement of Affairs and the Process Advisor’s report.

Creditors will also receive a Proof of Debt form which needs to be returned to the PA within 14 days. Excludable creditors (state creditors such as the Revenue Commissioners and the Department of Social Protection) have the ability to ‘opt-out’ of the process. They must provide the specific grounds for opting out of the process such as failure to comply with tax requirements, being party to an ongoing audit or an appeal relating to a tax requirement.

During this 14-day period, creditors are given a chance to provide input to the PA and to disclose any facts they consider material to the process.

Process Advisor’s Rescue Plan

Having carried out a review of the company’s affairs and consulted with the directors, creditors and shareholders, the PA will prepare a Rescue Plan. The Rescue Plan can allow for the write-down of the company’s debts provided that it is fair and equitable and does not unfairly prejudice any creditor, i.e. each creditor must be provided with a better outcome than in a liquidation.

Creditors meeting to approve Rescue Plan

Once the Rescue Plan has been formulated, the PA must call a meeting of members and each class of creditor within 42 days of his/her appointment. Creditors are invited to vote (having been provided with seven days’ notice) on the plan by day 49.

The Rescue Plan will be approved by 60% in number, representing a majority in value of at least one class of impaired creditors at the creditors' meetings. If there are no objections to the rescue plan within 21 days, then it becomes binding on the company, its members, and its creditors.

Court applications

SCARP is designed to avoid oversight of the court and, as set out above, it is possible to conclude the process without court applications. In certain circumstances however, applications will need to be made to the courts, as follows:

- Making an application for a stay on receivership or provisional liquidation appointments. The company must be able to demonstrate to the court that it has a reasonable prospect of survival.

- Seeking a stay on proceedings that were live at the date of commencement of the SCARP.

- Making an application to repudiate a lease. Such an application will only need to be made if the landlord contests the repudiation, otherwise, the repudiation will be approved when the rescue plan is filed with the court. In order to repudiate a lease, the PA must:

- Notify the landlord of intention to repudiate.

- Consideration must be given to any proposals / modifications put forward by the landlord.

- Notify the landlord of intention to include a provision repudiating the lease in the rescue plan and inform them of their right to participate at the meeting or file an objection.

- If agreement cannot be reached, an application must be made to the court to repudiate the lease.

- A creditor objects to the Rescue Plan

- The creditor must set out the grounds for its objection. The grounds for objection must state that the Rescue Plan is unfairly prejudicial, inequitable or was put forward for an improper purpose.

- Where a creditor files a notice of objection the burden of proof is on the PA to demonstrate that the Rescue Plan is fair and equitable and so ensures that the Rescue Plan cannot fail by simply lodging an objection.

- If the objection is upheld, the Rescue Plan must be modified otherwise it will fail.

- If the objection is dismissed the Rescue Plan comes into effect immediately.

The SCARP process is a very attractive and low-cost mechanism which allows companies with a viable business stream to be restructured and survive. It is designed with preferential creditors in mind and so could be the solution to deal with Revenue arrears, rates arrears and redundancy/staff reorganisations. It recognises that businesses have been damaged by the pandemic, that the business environment has changed and that there is the need for businesses to become leaner with balance sheets cleansed of unaffordable historical debts so that these businesses can again thrive in a post-COVID-19 world.

Please contact a member of our restructuring and insolvency team if you wish to confidentially discuss the above or any other restructuring requirements and receive a no-obligation consultation.