The SME liquidity challenge: successfully navigating the options

In order to support businesses during this crisis, the Irish Government has introduced a range of policy initiatives. The initial support packages, announced on 9 March, amounted to €3.1bn. While the bulk of this was in the form of much-needed unemployment benefit and wage support, a number of new liquidity supports were introduced including the €200m SBCI COVID-19 Working Capital Loan Scheme and the extensions of the SBCI Credit Guarantee Scheme and SBCI Future Growth Scheme.

On 2 May, the Government announced a further package of measures to support businesses. From a liquidity perspective this included a new €2bn SBCI Credit Guarantee Scheme to support lending to SME for terms ranging from three months to six years. While this is a very welcome development for SMEs, it will not be available until the new government is formed and the relevant legislation passed. A new €2bn ISIF Pandemic Stabilisation and Recovery Fund targeting investment in medium to large enterprises was also announced.

There has been some comment in the media about the relatively low take-up of the existing SBCI COVID-19 Working Capital Loan Scheme. A recent article reported that SMEs have borrowed just €33m of the €200m fund in its first six weeks. While over 2,000 businesses have sought approval from SBCI, less than 200 loans were approved at that six-week mark.

Meeting the liquidity challenge

Crowe has been actively working with SME clients on funding solutions to meet short-term liquidity requirements. The process is not without its challenges, but we have had positive outcomes. A starting point is to make a realistic assessment of the funding needs of the business and the ability to support future repayments. With this information, we can quickly assess the most suitable funding options for the business and help navigate the credit process.

SBCI Working Capital Loan Scheme

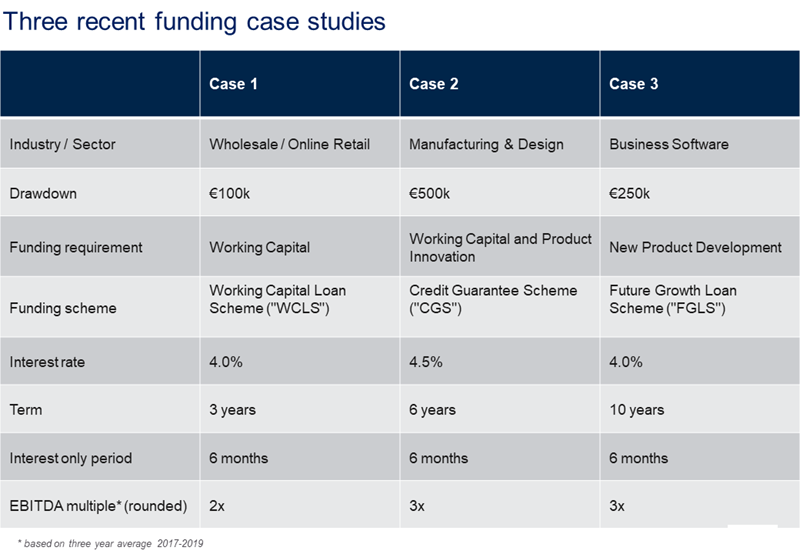

We recently secured funding of €100k for a business in the wholesale / on-line retail sector. The business was experiencing working capital difficulties due to a short-term collapse in wholesale sales. While it expected revenues to pick up within the next six months as restrictions ease, this is dependant on meeting existing supply terms and replenishing stock. The most suitable funding product in this case was the SBCI Working Capital Loan Scheme as it provided immediate liquidity to support a short-term funding requirement.

SBCI Credit Guarantee Scheme

For another client we were able to secure €500k under the SBCI-backed Credit Guarantee Scheme. The business was operating in the manufacturing and design sector. Funding was needed for short-term working capital needs and to support future product development. The key selling point of the Credit Guarantee Scheme in this instance was the ability to term out repayments over a six-year period. This is in contrast to the three-year repayment period under the Working Capital Loan Scheme. This afforded the business with the cash flow capacity to invest in its product and support a positive growth trajectory in the medium term.

SBCI Future Growth Loan Scheme

We have found the SBCI-backed Future Growth Loan Scheme to be useful for businesses who are seeking capital to expand and grow their operations. Loans under this scheme have an 8-10 year repayment horizon and provide funding on an unsecured basis up to €500k. We note that there is limited lending capacity with the banks for this scheme at present. The funding line is expected to be replenished in the coming months.

How we can help

As the economy starts to open up, many more businesses are likely to need a fresh injection of funds. The process of securing a new loan can be daunting and stressful for business owners. It is more complex for those without existing lending relationships or with limited collateral. The application process can be time consuming and distract from the day-to-day focus on managing the business. For these reasons it is critical to have an experienced advisor who understands and can assess the range of options available to guide you through the process and secure the optimum funding structure for your particular needs.For further information on how we can help successfully navigate funding options please contact a member of our corporate finance team.