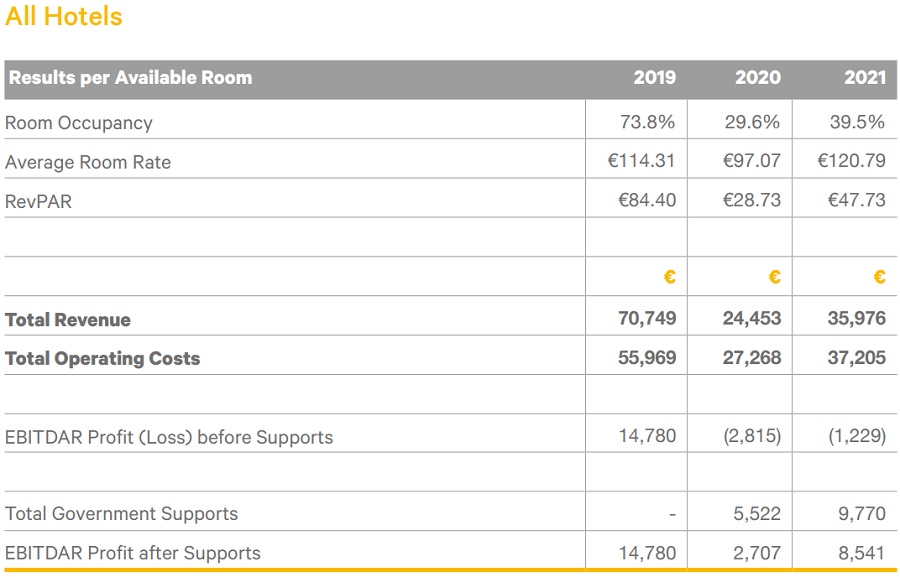

Across 2020 and 2021 the hotel sector in Ireland recorded a massive loss in revenues due to the Government restrictions imposed to curb the spread of COVID-19, including periods of business closure, travel restrictions and social distancing as well as the reduction in worldwide travel.

Revenues fell by 65% in 2020 and 49% in 2021 against 2019 levels.

The extremely low occupancy levels of 29.6% in 2020 and 39.5% in 2021, compared to 73.8% in 2019, further confirm the unprecedented impact that the pandemic had on business levels in comparison to a normal year of trading.

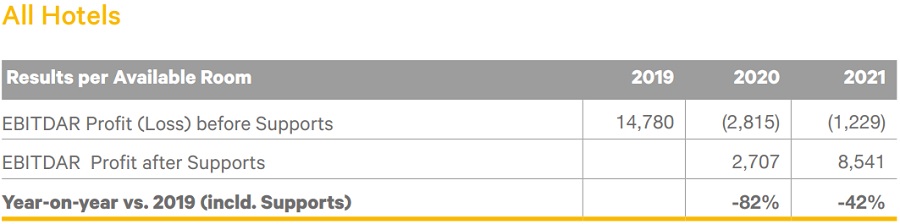

EBITDAR profit

Throughout the pandemic, businesses were forced into periods of closure, which required subsequent periods of ramp-up to reopen, and were generally trading at levels which were loss-making. The above was only sustainable through the provision of supports from the Government, including a reduction in VAT to 9%, payroll support schemes (TWSS and EWSS), the COVID Response Support Scheme (CRSS) and other grants and cost waivers which set out to underwrite the non-payroll costs of the business for periods when the hotels were impacted by closures, such as the reduction in rates.

The cumulative impact of these supports was to convert the sector from being loss-making to being profitable at EBITDAR level. The level of EBITDAR profits for 2020 were still however down 82% on 2019 levels and 42% in 2021 on 2019 levels.

Cash flow and tax warehousing

EBITDAR profit, even when factoring in the benefit of the Government supports, created cash flow challenges for hotels in meeting their normal business commitments. The results show that 52% of hotels sought a capital moratorium on their bank loans and a further 26% had to increase their bank overdraft or take on new bank debt, including those supported by SBCI. For 18% of hotels the owners were forced to inject personal funds to shore up the business cash flow.

The cash flow pressures and concerns are reflected by the number of hotels that availed of tax warehousing. Over 70% of hotels elected to defer payment of some taxes to retain cash in their business. The deferred taxes are sizeable, and we estimate that hotels that have availed of tax warehousing have built up an average liability equivalent to 45% of their 2019 VAT and payroll taxes. Over four in ten of these hotels which have warehoused taxes expect that repayments will stretch into 2024, and one in six see the liability not being cleared until 2026.

This highlights the solvency issues that could have existed for hotels if their banks did not show flexibility on moratoriums and if the Government had not introduced a tax warehouse scheme that afforded deferral of these obligations to a time when the pandemic restrictions had been lifted and trade could again be undertaken under normal conditions.

COVID-19 supports

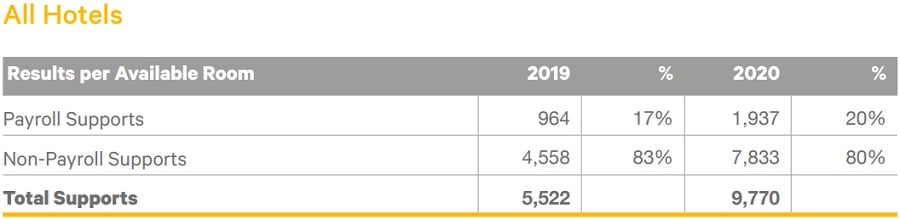

It is interesting to see that operating costs per room were underwritten by significant amounts in 2020 and 2021. It is also interesting to note that the underwrite was higher in 2021 as there was more activity at hotels.

In summary, the total costs for 2020 were €27,268 PAR and the total supports were €5,522 PAR, a 20% underwrite. For 2021 the total costs were €37,205 PAR with total supports of €9,770 PAR, a 26% underwrite.

When asked about the importance of supports it is not surprising that the employee wage supports ranked number one as they accounted for 83% of total supports in 2020 and 80% of total supports in 2021. This highlights the importance of people and the large payroll costs within the hospitality sector.

The second-ranking support was CRSS and other grants.

The VAT reduction featured as third in importance which probably reflects the fact that hotels were operating at much-reduced trading levels and therefore VAT would have been lower than in normal years.

The monetary value of the VAT reduction and the rates waiver are not included within the calculations of Government supports as these did not represent an inflow of monies to the hotel which would have been recorded in their profit and loss accounts. If these were given monetary values, the extent of the full value of Government support mechanisms for the sector would be seen to be even higher.

Pandemic-era challenges

Over 80% of respondents ranked staff recruitment and increasing costs as their greatest challenge faced throughout the pandemic. This is not unsurprising as significant periods of closure within the industry saw hospitality staff lost to other sectors, such as retail, which provided greater certainty in employment. Additionally, many employees returned to their home countries and have not returned to work in the Irish hospitality sector.

Hoteliers see dealing with cost inflationary pressures as a key challenge. While recovering the cost increases through stronger pricing was possible early in the recovery cycle, hoteliers appear concerned that the ongoing cost inflationary pressures might not be absorbed through higher prices and so will lead to some profit erosion.

Conclusion

The COVID-19 pandemic has been the most disruptive event ever experienced by the Irish hotel sector. From March 2020 to March 2022 there were limiters impacting the ability of hotels to trade.

The Government, to ensure the sufficiency of the healthcare system in Ireland and to save lives, introduced a series of operational regulations and travel restrictions that decimated revenues for the hotel sector. In recognition of the impact on the sector of these policies, the Government provided a package of business support measures that aimed to shore up the cash flow position of hotels such that these businesses would remain viable and ready to ramp up when the pandemic restrictions were lifted.

While after two difficult years, the prospect of revenues recovering quickly to 2019 levels has boosted the confidence of hoteliers in the outlook for their sector, the fear factor on both staff costs and general business costs rapidly increasing are well signalled in the general comments provided by hoteliers.

The impact of the 9% VAT rate on rooms and food sales being changed again to 13.5% was noted as a major concern.

The pandemic era once again reminds us that the sector is cyclical, and that hotels need be prepared for downcycles occurring at least once every decade. The experience of the last two years demonstrates the resilience that hoteliers have to survive any crisis. The scale of the Government supports made available reassures hoteliers that the sector’s importance as an employer, as infrastructure for tourism and as a driver of regional economic growth is recognised by Government and when needed, appropriate supports can be made available.

The challenge going forward will be availability and affordability of investment in the hotels as higher costs lead to lower profit levels, energy costs continue at the inflated levels being experienced in 2022 and legacy creditor build-up from the pandemic era needs to be paid down. There are already catch-up expenditures from deferred projects or repairs programmes which had to be cut during the pandemic years as well as the necessary projects to reduce energy consumption.

The main call-out by hoteliers was the retention of the 9% VAT rate over the medium term to allow hotels to recover fully to pre-pandemic profit levels and have the ability to generate earnings that are sufficient to meet the reinvestment requirements that hotels face to reduce their carbon footprint.

To order your copy of the 2022 Hotel Industry Survey please contact Sinead O’Rourke.