Crowe 2020 restaurant and hospitality industry sentiment survey

As a trade partner to the Restaurants Association of Ireland, Crowe has undertaken a COVID-19 impact and outlook sentiment survey for the restaurant and hospitality sector. With this sector facing one of the most challenging years in its history, we wanted to examine how the pandemic is affecting the outlook for the sector and the supports that business owners need to sustain operations through to a recovery. The survey was carried out online between 24 August and 14 September 2020.

The following is an extended version of an article that appeared in the Irish Times on Thursday 8 October.

The survey indicates the indefatigable spirit of operators in the restaurant and hospitality sector. The number of businesses that were able to reopen after three months of closure is remarkable.

This feat was only achieved through a solidarity of purpose supported by the government with the TWSS and rates waiver initiatives, by the banks through easily accessed payment breaks on loans, by landlords allowing rent payment forbearance and by the hard work of business owners to re-establish as lean a business as possible. A number of respondents noted they were working double the hours they normally did to ensure their business survives.

The survey was carried out at a time when most businesses were offering in-house dining under what is referred to as a Level 2 restriction. The imposition of Level 3 will make a difficult situation impossible for many, and without additional supports to help these businesses sustain themselves while closed, many will not be able to achieve a second re-opening.

79% of respondents see their business not returning to 2019 levels until 2022 at the earliest. At best, 2021 will only see a modest let-up in business pressure points, so all of the temporary measures introduced will need to be extended for all of next year if these businesses are to be saved.

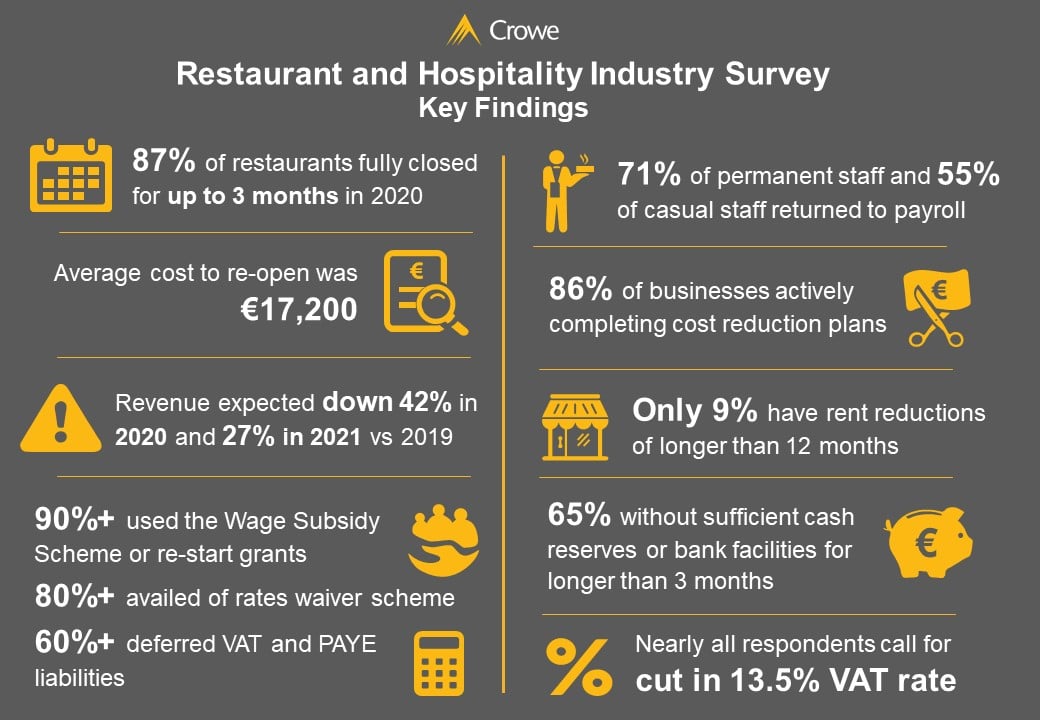

87% of food outlets surveyed said 2020 represents a year where at best they will have only nine months’ trade. While Q4 is traditionally for many restaurants the busiest period, reflecting the Christmas season, this year will be very different. Revenues are expected to be down 41% in Q4 2020 as compared to the previous year, leaving these businesses vulnerable for Q1 2021 as the normal cash buffer of Christmas trading will not have been earned to get them through a traditionally quieter period.

The sector’s outlook of being 27% down in 2021 probably reflects more hope than reality. In 2019, the sector derived 46% of its revenue from international visitors and the ITIC (Irish Tourism Industry Council) expects at least a 60% fall in the value of international tourism next year.

After the last lockdown, the average cost to re-open was €17,200, which for a small business is a very significant sum. Indeed, without the TWSS it is certain that many of the businesses, which have so far managed to bring back 79% of their permanent staff and 55% of their casual staff, would not have been able to sustain a re-opening. The Government recognises that the restaurant and hospitality sector is particularly exposed due to COVID-19 restrictions and the TWSS was a spectacular success in retaining jobs within the sector.

Twice as many respondents were disappointed or very disappointed compared to those satisfied or very satisfied with the July Jobs Stimulus package. A key component of this package was the new EWSS wage support scheme, which is to run until the end of March 2021, but which has reduced subsidy levels for the employer. The respondents’ disappointment may reflect their view that the wage support scheme needs to be extended to the end of 2021, as they will still be trading at only 70% of 2019 levels.

While the extension of wage supports from 31 August 2020, through the introduction of EWSS, provides a lifeline for these hospitality businesses, the level of subsidy is greatly reduced. The change from a weekly payout mechanism to monthly is also going to put a major dent in already stretched cash flows for these businesses.

For example, over the month of September, a business with 10 employees could have faced a reduction of €6,000 in subsidies, as the average claim is reduced from €350 per week to €203 per week. These businesses will also face a delay in the receipt of the contribution for seven weeks as part of the transition from TWSS to EWSS, resulting in a further €14,000 hit to cash flow. The introduction of the EWSS scheme puts a dent of €20,000 in the cash flow for the average business in the month of September compared to August and is completely unfair. It also perhaps shows a lack of understanding as to the financial pressure many of these businesses are under after six months of trading through COVID-19.

There is now a strong argument that the COVID-19 tax warehousing scheme for hospitality businesses be extended until the end of October 2020 from the end of August 2020 to allow businesses to file their September payroll tax return, defer the liability to after November 2021 and be compliant so their first EWSS claim for September is made by Revenue. This could be brought in under new guidance from Revenue. This would provide a much-needed payment break when cash flow is already stretched to breaking point for many businesses. We know from the last recession that it is not the fact that a business is loss making that forces it to close, but the fact that it just cannot pay the next bill.

With 13% of businesses with no cash reserves and 35% with reserves to support their needs for only three months, the support measures to boost cash flow for these businesses, if curtailed before their business volumes lift back to 2019 levels, will see many of these businesses go under.

Over 90% of respondents have benefitted from the restart grant, which would equate to their annual rates bill, but for many would have been well short of the €17,200 average cost to re-open their business.

Over 80% have availed of the local authority rates waiver, which is set to end on 30 September 2020. The extension of this measure for the remainder of the year is the number one ask in terms of preference for ongoing supports, showing the worry business owners have about their short-term survival and the need to keep unaffordable costs out of the business.

Over 60% of respondents have availed of the VAT and payroll taxes deferment, which creates cash flow now but only at the expense of cash flow in the later stages of 2021. It emphasises the mindset of being in survival mode and deferring potential future cash flow challenges.

There is a very high dependence on leased property within the hospitality sector, and landlord concessions will determine whether many businesses will survive or not. The overall picture is that landlords have been slow to agree rent reductions to levels which are affordable by tenants whose revenue will not recover until 2022. The survey identified that just 9% of landlords have agreed reductions for their tenants for a period greater than six months. For the majority of cases where rent reductions have been agreed, the rent has been reduced by between 40% and 60%.

For those who have not been given a rent reduction, 68% say they will not be able to afford their contracted rent, so there may be trouble ahead for landlords who do not engage with tenants. The key message for landlords is that appropriate arrangements that cover all of 2021 are needed and the arrangements should be tailored to the circumstances of the tenant’s trade.

It is therefore important that a mechanism to force some compromise be established so that affordable rent levels for COVID-19-impacted trade can be adjudicated on. In the absence of landlords or tenants accepting the adjudicated rent, then arrangements should be made for the properties to be handed back to the landlords, as the business is unlikely to be viable.

Looking forward to Budget 2021, the big ask of respondents is a cut in the 13.5% VAT rate. Half of respondents would like to have the previous 9% VAT rate reinstated, while the other half would like to see the rate matched to the 5% rate of the UK and Northern Ireland. A major task for the sector will be to build back revenue levels. The value proposition that businesses can make to domestic and international customers will help accelerate their recovery and a cut in the VAT rate will facilitate lower prices and help stimulate demand.

Nearly half of respondents availed of a payment break on their loans. These concessions were generally available on request from banks for a maximum period of six months and so will expire from 31 October 2020 onwards.

Thereafter, it appears that banks will deal with customers on a case-by-case basis and require cash flows and a more detailed submission before agreeing to any additional loan payment breaks. These businesses need to be made aware by their banks of what information needs to be submitted to put in place appropriate arrangements for 2021.

The recent introduction of the SBCI Loan Guarantee Scheme, with term loans of up to five and a half years, will be a welcome source of working capital for businesses to help bridge the gap between now and 2022 when business levels are expected to return to 2019 trading levels.

It is noted that only 25% of respondents had sought additional working capital, which probably reflects a reluctance to borrow in such uncertain times and perhaps a concern that new facilities would not be approved, whereas the SBCI product may be the more suitable and more available loan solution for many businesses.

Download results to Crowe 2020 Restaurant & Hospitality Industry Sentiment Survey.

Crowe’s specialist hotel, tourism and leisure team comprises experienced accountants and hospitality consultants with practical industry expertise that enables us to provide a wide range of tax, liquidity & cash flow management, restructuring & insolvency and accounting services to the sector.

To find out more about the range of specialist hotel, tourism and leisure (HTL) services Crowe offers, visit our HTL sector webpage or contact a member of our HTL team.

Specialist hospitality business advisors

Helping restaurant owners navigate the challenges associated with COVID-19.