The deadline for filing personal and corporate income taxes is here!

In addition, thanks to the change allowing the submission of a power of attorney until the end of the deadline for submission of the return by a tax advisor, you have a chance to fulfil your obligation to the tax administrator in time and without penalty even now.

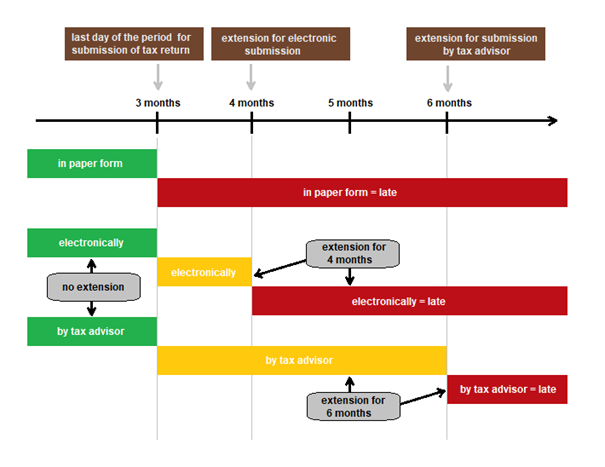

Below you can find a graphical representation of the particular deadlines for the different forms of submission valid as of this year (with the exception of the above mentioned General Pardon):

,

,

Source: Explanatory note to Act No. 283/2020 Coll. (translation to English: Crowe)

Further extension is possible on the basis of an application for an extension of the deadline for submission of a tax return by up to 3 months. If the taxpayer has income from abroad, the possibility of extending the deadline even up to 10 months applies, i.e. until the first November working day. However, such a request needs to be duly justified, as the tax administrator decides on the seriousness of the reasons set out in the request and there is no legal right to an extension. This request must be delivered to the tax administrator no later than the day of the deadline for submission of the tax return. In addition, the acceptance of an application is standardly subject to an administrative fee, but the fees associated with applications submitted between 1 January and 16 August 2021 are waived by a decision of the Minister of Finance.

Therefore, if the need to extend the deadline for any reason concerns you, do not hesitate to contact us. We can help you with the preparation of an application for an extension of the deadline, as well as with the calculation of the tax itself and the submission of your tax return to the appropriate tax office.