As of October 1, 2020, legislation passed in Ontario allowing self-employed real estate agents to incorporate and earn their commission income through a Personal Real Estate Corporation (“PREC”). While a PREC is not considered a professional corporation under the Ontario Business Corporations Act, it still allows real estate professionals many of the same benefits.

Are you wondering if incorporating is the right move for you? Our real estate industry experts share some pros and cons to help you decide whether or not to incorporate your business.

- The PREC must be incorporated or continued under the Ontario Business Corporations Act.

- The PREC will have a single controlling shareholder who must be a real estate broker or salesperson registered with the Real Estate Council of Ontario (“RECO”) (i.e. only the real estate broker or sales person can own voting shares of the PREC, referred to as “equity shares”).

- The controlling shareholder must make all the decisions for the PREC. There should be no written agreement or other arrangement that restricts or transfers powers of the controlling shareholder to manage or supervise management of the business and affairs of the corporation.

- Any non-voting shares (also referred to as “non-equity shares”) must be owned directly or indirectly by family members (spouse, children, parents, trust for minor child) of the controlling shareholder.

- Only one registered real estate professional may own equity shares of the PREC, and thus control the corporation. However, non-equity shares may also be held by another registrant if they are a family member of the equity shareholder.

- Like other professional corporations, a PREC does not limit the professional liability of the controlling shareholder.

- While the services provided by a corporation governed by a regulatory body often restrict the corporation’s activities to practicing the profession, as a PREC is a regular business corporation, there are no restrictions that limit its ability to carry on other income-earning activities, such as passive investing or other entrepreneurial ventures.

- There are no restrictions on naming. The name of the corporation does not need to include “Professional Real Estate Corporation”.

Tax Deferral

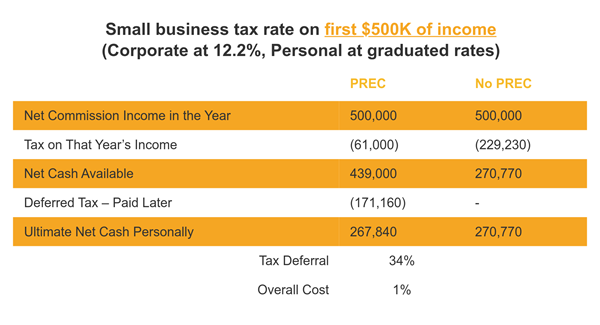

The most appealing benefit of incorporation is the ability to defer tax. For high-income earners who do not need their entire earnings immediately, there is an opportunity to defer personal income, and therefore personal taxes, into the future. Deferring a portion of your current income also allows you to “smooth” your career earnings over your lifetime. Shifting personal taxable income from your peak earning years to your retirement years means that when you eventually have the income paid to you by the PREC, you will be subject to a lower personal marginal tax rate.

If you are going to need all the funds personally, there is no tax deferral and instead a small tax cost. In addition, you would have the annual compliance costs to pay for the company.

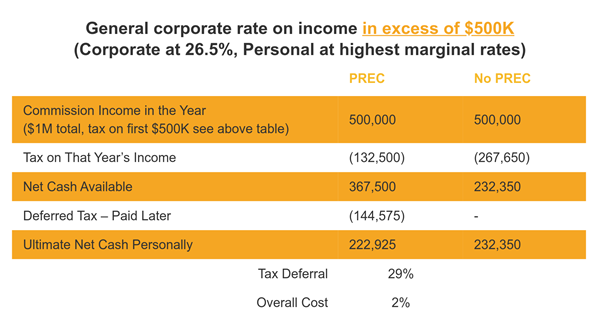

Below are illustrations of how the tax deferral would work on your first $500K and on another $500K above that:

Note: To the extent there is an immediate cash flow need for all the earnings of the PREC, there is no tax deferral.

Lifetime Capital Gains Exemption (LCGE) on Sale of a Business

The Lifetime Capital Gains Exemption (“LCGE”) allows small business owners to shelter the tax on capital gains of up to $883,384 (for the 2020 taxation year) on the sale of the qualified small business corporation shares. Consult with your tax advisor to ensure that you structure your business arrangements and the PREC appropriately to take advantage of the strategic planning opportunities available to you.

Income Splitting

A PREC can provide the opportunity to split business income among family members to lower the combined taxes within your family. Generally, income splitting options available to PRECs include paying family members wages or dividends. Consideration should be made to ensure wages are for “reasonable services performed”. Also, given the limitations imposed in 2018 by Tax Split Income (TOSI), consideration should be made in respect of whether dividends paid to family members will be subject to tax at the highest marginal rate. Even if TOSI may apply on split income now, it may still be worthwhile to consider issuing non-equity shares to your spouse, for example, so that you can split income after you turn 65, when TOSI will no longer apply. Consult with your tax advisor to see what structure makes sense for both now and the future.

The following are some other considerations as to whether a PREC is right for you.

- Incorporation Costs and Regulations: There are costs involved when starting any business including legal and accounting fees. There are also ongoing administration costs for annual corporate minute maintenance, financial statement preparation, and annual filings for: corporate tax returns, sales tax, and payroll (as applicable).

- Extra Paperwork: Corporations must maintain separate books and records as well as prepare PREC contracts to continue your real estate practice under the PREC.

- Reduction to Small Business Deduction: If a corporation earns passive income (i.e. investment income) in excess of $50,000 in its prior year, specific rules will reduce the Small Business Deduction (“SBD”) available to that corporation and, as such, its ability to access the 12.2 per cent corporate tax rate. In Ontario, the combined rate would be 18.2 per cent in this scenario; still offering a PREC a significant deferral when compared with the highest personal rate in Ontario of 53.53 per cent.

- Small Business Deduction and Associated Corporations: If you or your spouse own other businesses, the PREC may not be able to access all (or any) of the lowest corporate tax rate. This could mean that instead of paying 12.2 per cent tax on the first $500,000 of net taxable income in the PREC, the company would be paying 26.5 per cent and the deferral (as shown in the second table above).

Incorporating now will not make sense for all real estate agents. Instead, it may be more fiscally responsible to wait and incorporate in a future year. You need to consider your own family’s personal financial situation. Our professionals at Crowe Soberman LLP can assist in determining if a PREC is right for you, and if it is, we can lessen the administrative burden associated with having a PREC.

This article has been prepared for the general information of our clients. Specific professional advice should be obtained prior to the implementation of any suggestion contained in this article. Please note that this publication should not be considered a substitute for personalized tax advice related to your situation.

Related Posts

Contact Us