Introduced in the 2021 Federal Budget, the new Canada Recovery Hiring Program (CRHP) is designed to provide businesses with a subsidy of up to 50 per cent of the incremental increase in eligible remuneration paid in a qualifying period. The program will begin on June 6, 2021 and will continue for six consecutive four-week periods until November 20, 2021. To maintain consistency with the Canada Emergency Wage Subsidy (CEWS) and the Canada Emergency Rent Subsidy (CERS) programs, the six CRHP periods are identified as Periods 17 through 22.

Unlike the CEWS program, which intends to subsidize an employer’s existing payroll costs during the dire months of the pandemic, the intention of the CRHP is to encourage employers to increase the hours of existing employees, bring back laid-off or furloughed employees, and hire new employees during the economic recovery phase. A business may only apply for either the CEWS or the CRHP for a particular period, so proper planning and analysis may need to be undertaken to ensure that the entity is applying for the program that provides the most benefit in each period.

Entities qualifying for the CRHP include Canadian-controlled private corporations (CCPCs), cooperative corporations and partnerships where no more than 50 per cent of the partnership is held by non-qualifying entities, such as non-CCPCs and corporations exempt from income tax.

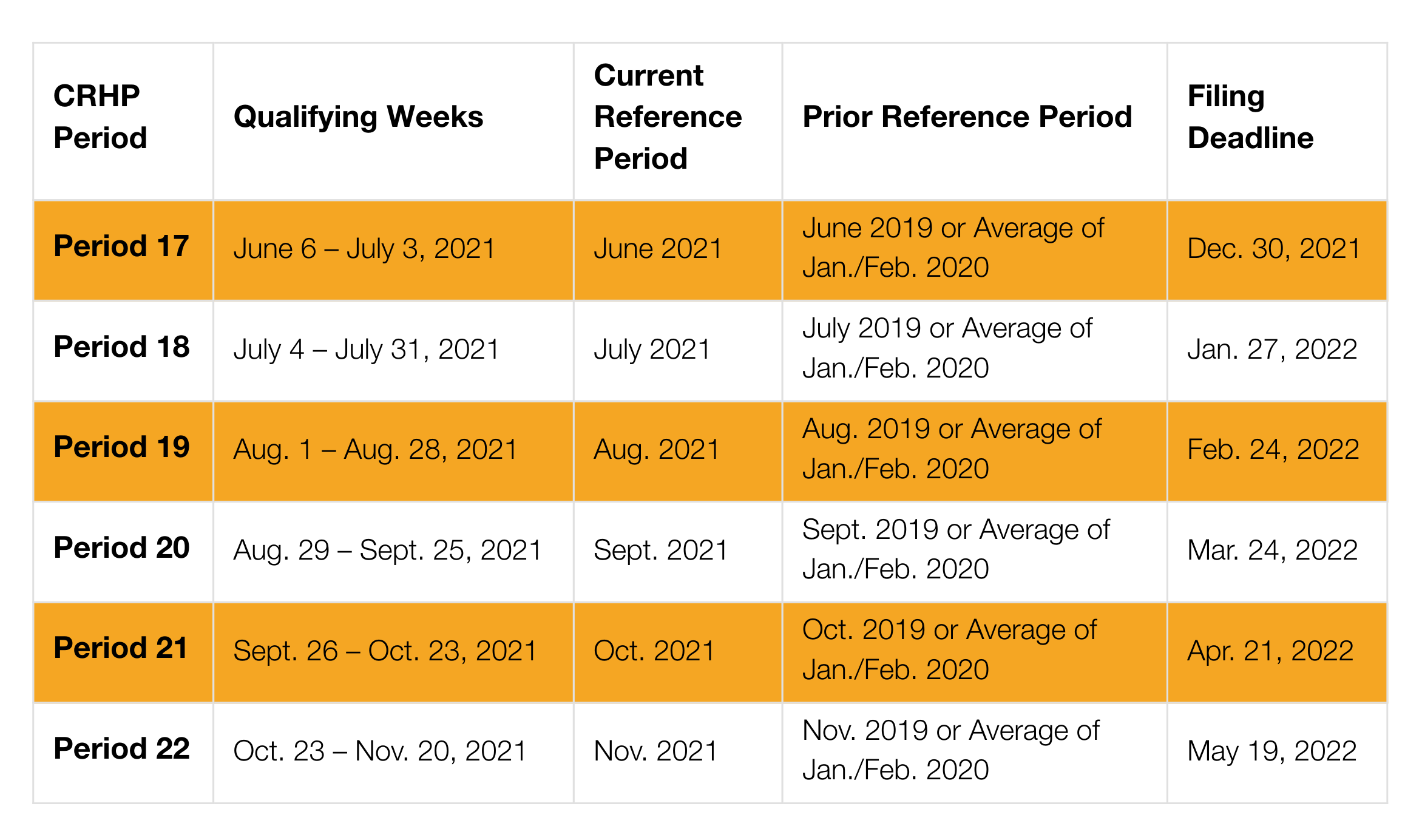

In addition, to qualify, an entity must have experienced a monthly revenue decline. For Periods 18 and onward, eligibility for the CRHP will be restricted to those entities which have experienced a revenue decline of at least 10 per cent. The monthly revenue decline methodology and calculations for the CRHP are the same as under the CEWS and the CERS and must be applied consistently between the three subsidy programs. See Table 1 for details on the reference periods and deadlines for each qualifying period. For purposes of the CRHP, eligible remuneration is the same as for the CEWS. It includes salaries, wages and other remuneration paid for which employers are required to make payroll withholdings. Bonuses and vacation pay (if any) must be allocated to the specific period and generally cannot be claimed in one period as a “lump sum” payment. Eligible remuneration will not include severance pay, stock option benefits, or non-cash taxable benefits such as the use of a corporate vehicle.

Eligible remuneration for the CRHP for an employee in respect of a week is the least of:

- $1,129;

- Eligible remuneration paid to the employee in respect of that week;

- If the employee does not deal at arm’s length with the eligible entity, the baseline remuneration in respect of the eligible employee; and

- If the employee is on leave with pay, nil.

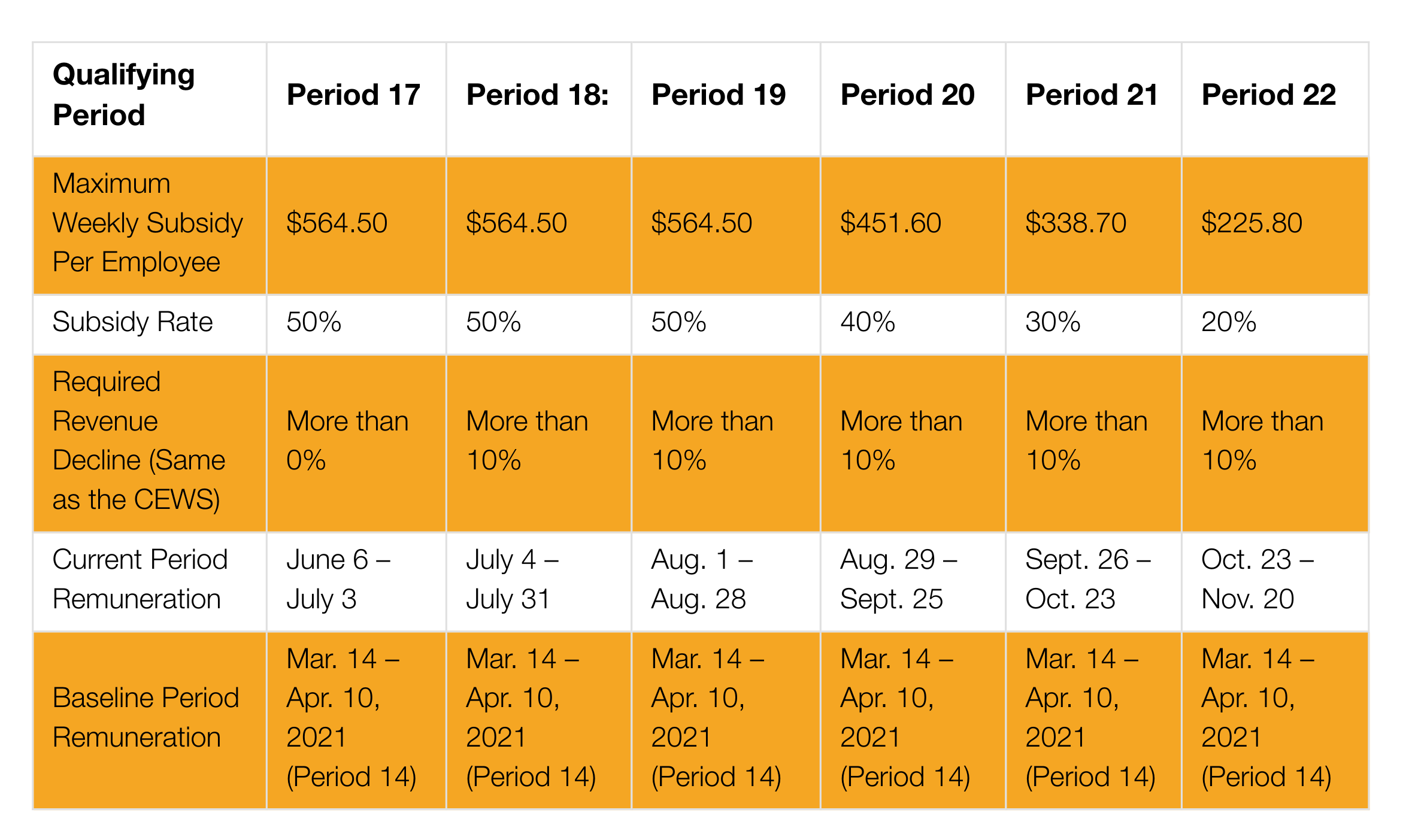

The CRHP subsidy itself is calculated as A x (B – C), where:

- A is the subsidy rate for the qualifying period;

- B is the total current period eligible remuneration; and

- C is the total base period eligible remuneration.

The remuneration baseline period for all CRHP periods is the same, March 14 to April 10, 2021, i.e. Period 14 of the CEWS. See Table 2 for a summary of the applicable periods and rates for the announced CRHP periods.

Table 1: CRHP Reference Periods and Filing Deadlines

Table 2: CRHP Calculation for the Six Periods (Identified as Periods 17 to 22)

Planning Considerations

When determining whether a business should apply for the CEWS or the CRHP, there is no short cut and a full calculation of both subsidies is recommended.

Employers thinking about (re)hiring employees later in the year may consider doing this earlier, as the CRHP is the highest between June 6 to August 28. This may be especially beneficial if there is a (re)training or (re)certification process required for returning employees. During this period, when theoretically the employee is least productive, the costs to (re)train or (re)certify the employee is subsidized at a high rate.

Finally, an employer may wish to consider hiring summer students. The CRHP applies to summer students and the subsidy rate is highest in the summer months. In addition to other credits and programs, such as the Student Work Replacement Program and the Ontario Co-operative Education tax credit, the marginal cost to hire a summer co-op student may be minimal.

Connect with the Author

Kevin Yang, CPA, MAcc

Specialist, Tax

T: 416 963 7215

E: [email protected]

This article has been prepared for the general information of our clients. Please note that this publication should not be considered a substitute for personalized advice related to your situation.