For the purposes of the UHT, residential real estate properties include, but are not limited to, detached houses, semi-detached houses, condominium units, townhouses, duplexes/triplexes, and cottages or cabins.

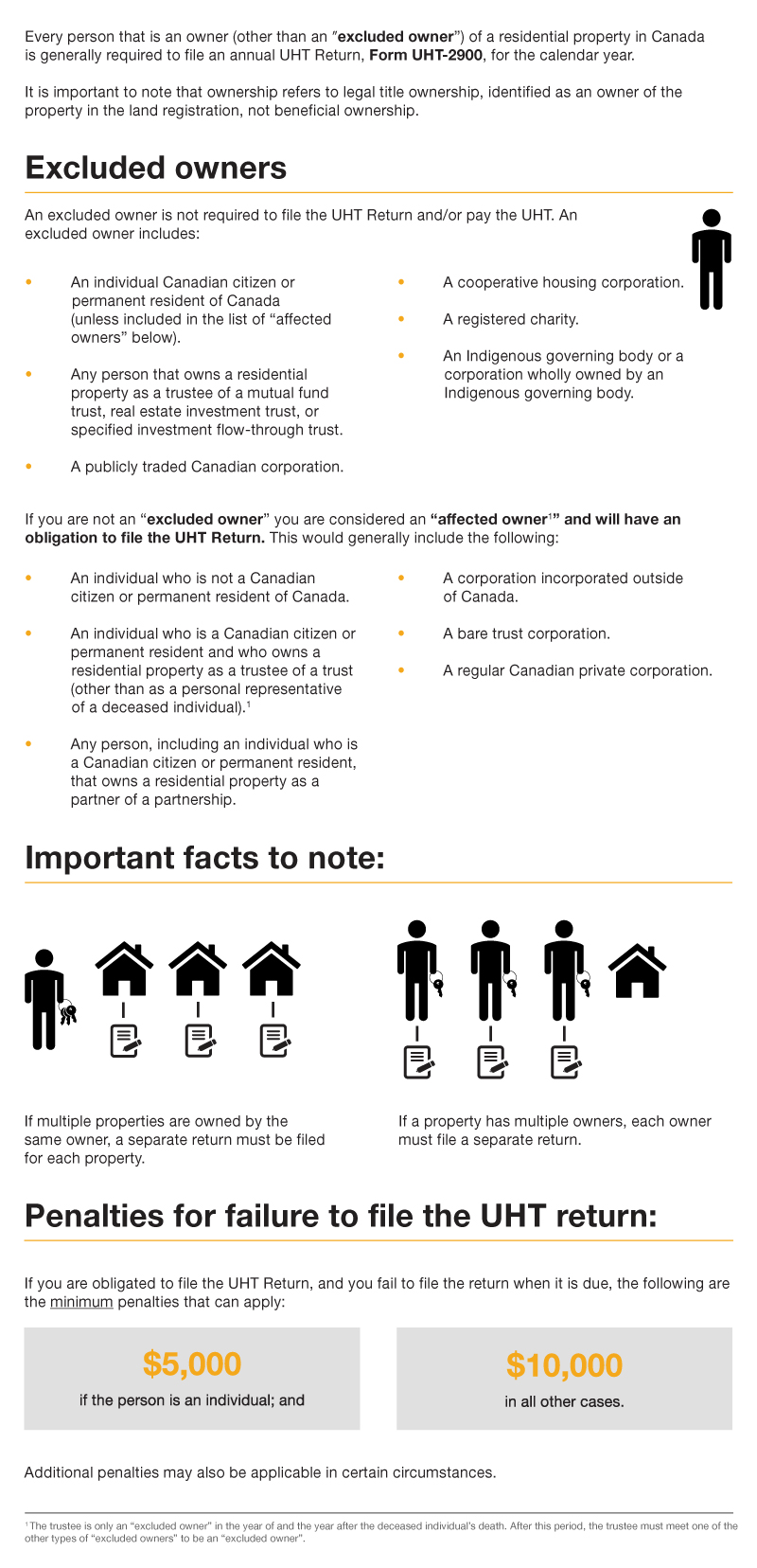

Federal Underused Housing Tax

What real estate owners need to know

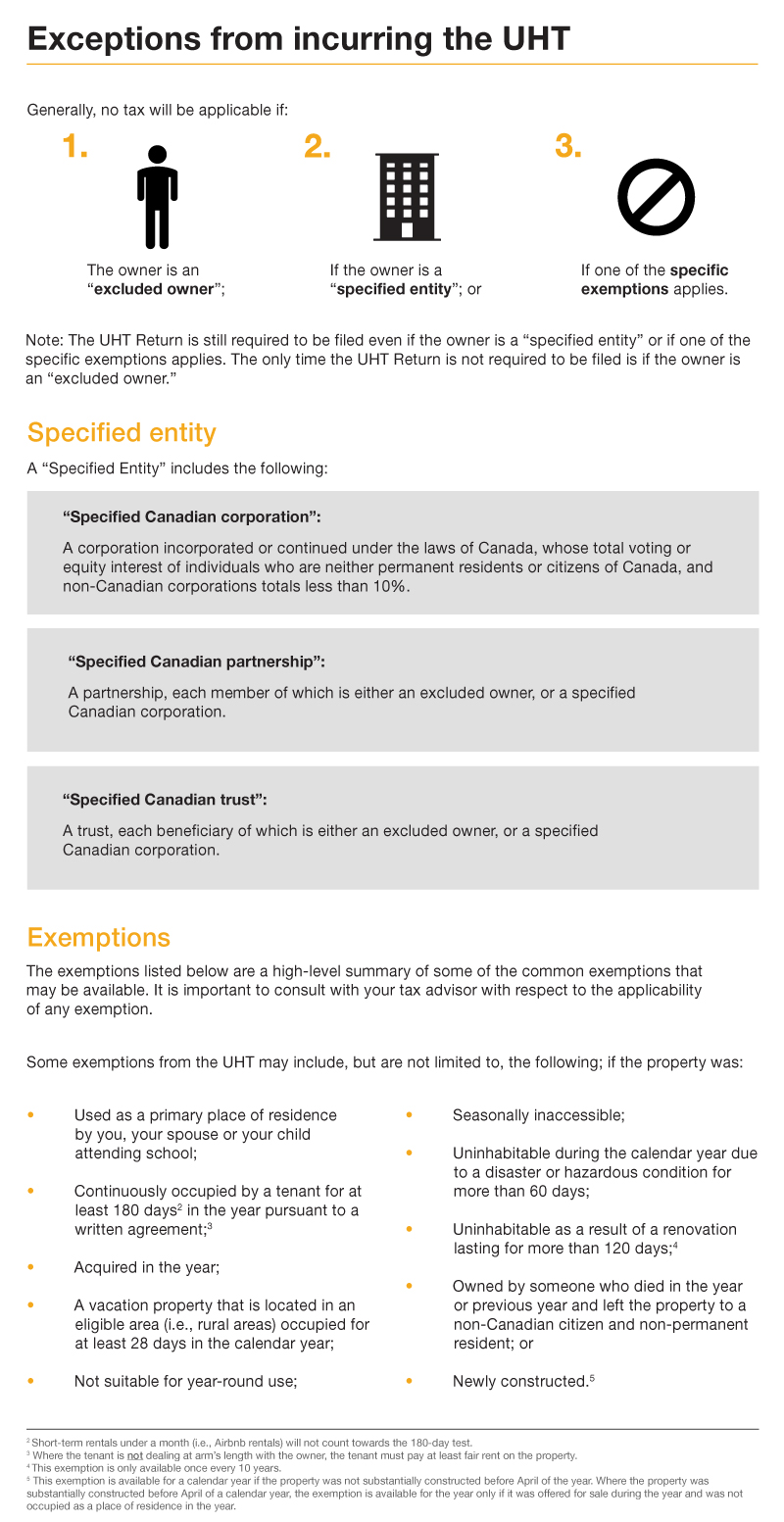

For the purposes of the UHT, residential real estate properties include, but are not limited to, detached houses, semi-detached houses, condominium units, townhouses, duplexes/triplexes, and cottages or cabins.

Provincial and municipal jurisdictions in Canada may also impose taxes on non-residents and foreign ownership of residential real estate property (such as British Columbia’s provincial Speculation and Vacancy tax, Toronto’s municipal Vacant Home Tax, etc.). These are separate from the Federal UHT and can apply on top of the UHT.

It is important for purchasers and owners of Canadian real estate to be wary of these rules, as penalties and fines could be applicable for non-compliant taxpayers. Contact your Crowe Soberman advisor to see how the UHT may impact you.

Download the complete UHT Infographic here.

This infographic has been prepared for the general information of our clients. Please note that this publication should not be considered a substitute for personalized advice related to your situation.

UHT Informational Video

Learn more about UHT and why it matters to you.

Related Insights

Contact Us