Building a retirement nest egg is one of the most important financial endeavors. When we are young, it is easy to feel like we have plenty of time to save towards retirement and we often justify frivolous purchases. However, as we grow older, our ability to contribute to our RRSPs becomes more challenging, as disposable income may be diverted to more immediate priorities such as repaying student loans, furthering our education, paying down a mortgage, childcare expenses, etc. Yet, even for those who do make it a priority to save, investing for retirement is more commonly done as an afterthought—addressed by making a lump-sum RRSP contribution right before the contribution deadline. For some, the cash to fund an RRSP contribution is only available at a certain time of the year, for example, upon receipt of a year-end bonus. However, those who have the funds available to make monthly RRSP contributions but choose to make lump-sum contributions instead are missing out on a simple but powerful way to boost the value of their retirement savings.

The effect of compounding (the process in which an investment’s earnings are reinvested to generate additional earnings over time) is tremendous. It has been shown that those who start investing early in their RRSP will have more at retirement than those that invest later in life and try to catch up by making larger contributions. But does contributing monthly to one’s RRSP versus making a lump-sum contribution at the end of the year really make a difference? The answer, quite simply, is yes.

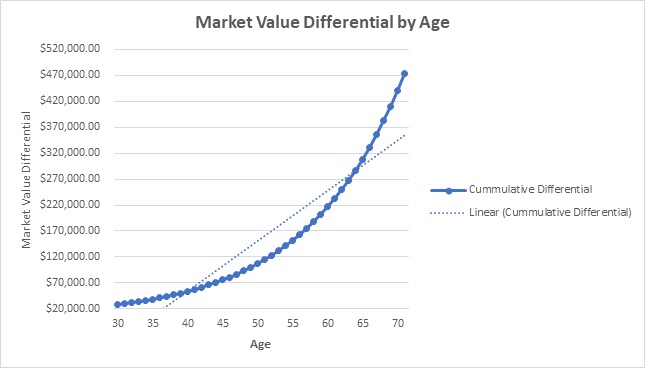

Take two individuals. Molly and Mike are both 30 years old, and both earn enough earned income to generate the maximum RRSP contribution room annually. Molly has bought into the idea of contributing to her RRSP monthly, whereas Mike is a “last-minute” guy and scrambles to make his RRSP contribution just before the deadline every year. Let’s assume that both RRSPs grow at a simple annual rate of 7.5 per cent (Molly’s effective annual rate is 7.2359 per cent), at age 71 when Molly will have $8,712,500 in her RRSP, Mike will only have $8,238,600. While an accumulated difference of $473,900 (5.8 per cent) over 42 years may not seem like a big deal to some, the only difference between Mike and Molly was the timing of when they made their contributions (monthly versus annually).

There are also other benefits to making regular, systematic contributions to an RRSP. First, monthly contributions result in smaller payments, so they pose a lower financial burden, from a cash flow perspective, than a lump-sum contribution. After a few months, Molly doesn’t even notice the automatic withdrawals from her bank account, but every year, Mike finds it challenging to come up with the lump- sum contribution. Second, monthly investors take advantage of dollar-cost-averaging, to avoid the pitfall of buying high and selling low. In other words, by making periodic investment purchases, investors can mitigate the risk of price fluctuations by buying the same investment at different times throughout the year, averaging the overall cost of the investment. This can lead to a higher rate of return and more money available upon retirement.

Now that the 2019 RRSP contribution deadline has passed, consideration should be given to thinking more like Molly and less like Mike for 2020 and future years. It can have a big payoff down the road.

| AGE | CONTRIBUTED EVENLY |

LUMP-SUM CONTRIBUTIONS |

CUMULATIVE DIFFERENTIAL |

|---|---|---|---|

| 30 | $27,537.06 | - | $27,537.06 |

| 35 | $206,462.91 | $168,161.01 | $38,301.91 |

| 40 | $476,235.09 | $422,574.04 | $53,661.05 |

| 45 | $877,425.93 | $801,817.40 | $75,608.53 |

| 50 | $1,468,359.33 | $1,361,352.85 | $107,006.48 |

| 55 | $2,332,849.80 | $2,180,886.58 | $151,963.22 |

| 60 | $3,591,313.28 | $3,374,937.16 | $216,376.12 |

| 65 | $5,416,718.77 | $5,108,007.91 | $308,710.86 |

| 71 | $8,712,502.85 | $8,238,672.77 | $473,830.09 |

The calculation assumes that the maximum RRSP contribution is made and that the RRSP contribution limit grows at a rate of 1.5% per annum. The RRSP contributions generate a 7.5% per annum rate of return and excludes the impact of investment trading costs.

This article has been prepared for the general information of our clients. Specific professional advice should be obtained prior to the implementation of any suggestion contained in this article. Please note that this publication should not be considered a substitute for personalized tax advice related to your particular situation.