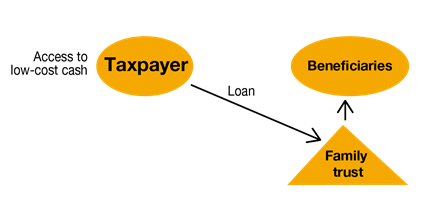

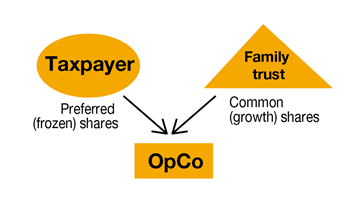

Consideration 2: Corporate “freezes” and intergenerational transfers

You may consider a "freeze" of your share ownership as a technique to transfer future wealth to the next generation. Then, introduce family members as the future growth owners of the business. However, this runs the risk of potentially triggering adverse tax consequences under the Income Tax Act known as “corporate attribution”.

You can structure a corporate freeze in a certain way to limit the application of corporate attribution. Some structures require the corporation to maintain “small business corporation” status or ensure there is a “designated persons” clause in the trust indenture.

Other structures can avoid corporate attribution by having the company pay an annual dividend to the original shareholder based on the prescribed rate of interest. An increase in the prescribed rate means that corporations will now have to pay a larger dividend than they historically needed to.