Who can claim home office expenses?

For 2020 only, employees who worked from home more than 50 per cent of the time over a period of at least four consecutive weeks due to COVID-19 will be able to claim home office expenses.

To avoid the detailed tracking of expenses and the administration caused by employers to certify their employee(s) requirement to work from home, the CRA has introduced a simplified method to claiming home office expenses. The simplified method is a new temporary flat rate of $2 per day for each day worked at home, to a maximum of $400 for the 2020 taxation year. Under this flat rate method, detailed tracking of expenses and an employer signed T2200 or T2200S (discussed in Other Requirements section below) is generally not required. In calculating the workdays, individuals must use the days that they worked full-time or part-time from home, but not days of absence (i.e., vacation days, sick leave, or other days off).

In order to qualify to claim home office expenses under the regular “detailed” method (rather than the temporary flat rate method noted above), you must (1) complete more than 50 per cent of your employment duties from your workspace at home (for a period of at least four consecutive weeks for the 2020 taxation year) or (2) the home office must be used on a regular and continuous basis to meet with clients. Whether using the temporary method or the “detailed method”, if your employer has reimbursed you for all of your home office expenses, you are not eligible to claim home office expenses.

Your employer must agree that you were in fact required to fulfill your employment functions through your home office (this does not need to be part of your employment contract and may be a verbal agreement). Given that many businesses are requiring employees to work remotely, this should not be a difficult position to take for the 2020 taxation year. However, on a go-forward basis you may want to review your employment contract or your organization’s employee manual/work-from-home policy to ensure it is applicable to you.

With COVID-19 and social distancing requirements, face-to-face meetings with clients/customers/patients is much less common. CRA has not yet clarified whether virtual meetings/appointments qualify as “regularly and continual meetings” for the purposes of being eligible to claim home office expenses. Instead, it is more likely you will be able to meet the requirement of spending more than 50 per cent of your working time in your home office. Based on the current tax rules, however, it appears you can only deduct home office expenses if you were required to work from home for more than six months of the calendar year, irrespective of the fact you worked from home more than 50 per cent of the time during the period of, say, five months.

For 2020 only, employees who worked from home more than 50 per cent of the time over a period of at least four consecutive weeks due to COVID-19 will be able to claim home office expenses.

For 2020 only, employees who worked from home more than 50 per cent of the time over a period of at least four consecutive weeks due to COVID-19 will be able to claim home office expenses.

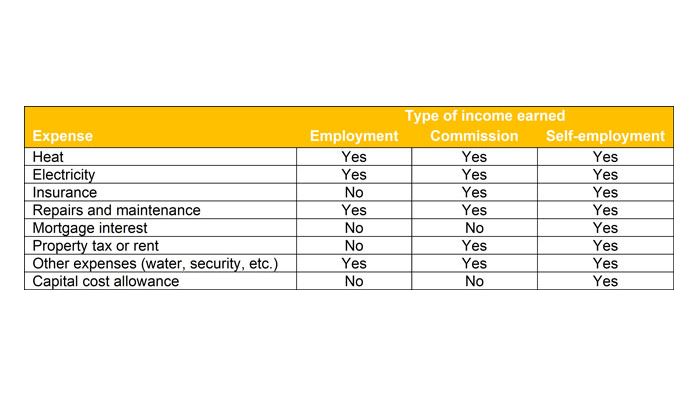

After you’ve calculated the total expenses you are eligible to claim, you need to determine what percentage of those costs relate to your home office. Generally, you must consider both the percentage of time the space is used for work and the proportion of the home that is used for the workspace.

After you’ve calculated the total expenses you are eligible to claim, you need to determine what percentage of those costs relate to your home office. Generally, you must consider both the percentage of time the space is used for work and the proportion of the home that is used for the workspace.

If you are an employee who is eligible to deduct expenses in relation to your home office, you may be able to claim a rebate of the Goods and Services Tax (“GST”) and the Harmonized Sales Tax (“HST”) paid on these expenses based on the portion of the expenses deductible for the year.

If you are an employee who is eligible to deduct expenses in relation to your home office, you may be able to claim a rebate of the Goods and Services Tax (“GST”) and the Harmonized Sales Tax (“HST”) paid on these expenses based on the portion of the expenses deductible for the year.