Making donations to charities, either personally or corporately, will result in tax savings. However, depending on the particular situation, it may make more sense to donate through a corporation in order to truly maximize the tax savings.

What are the benefits of donating personally?

For individuals, eligible donations made provide a non-refundable tax credit, reducing any personal income taxes owing. Unused donations can be carried forward up to a maximum of five years, so if an individual made a donation in 2017 but has no taxes owing, they can claim the donation tax credit to reduce their taxes in a tax year up to 2022. In Ontario, an individual will realize tax savings of $20.50 for every $100 of donations on the first $200 of charitable donations made. For every $100 of donations made in excess of $200, the tax savings can be as high as $50.41.

What are the benefits of donating through a corporation?

For corporations, donations also result in tax savings, albeit in the form of a deduction from income, rather than a credit. Similar to individuals, unused charitable contributions may be carried forward for up to five years. The charitable donation deduction will reduce corporate taxes by $13.50 on the first $100 of donations made when taxable income is less than $500,000 in the corporation and by $26.50 when taxable income is greater than $500,000 in the corporation.

At first glance, it may appear that the benefit of donating personally results in greater tax savings; however, upon closer examination that is not always the case.

So which is better, personally or through a corporation?

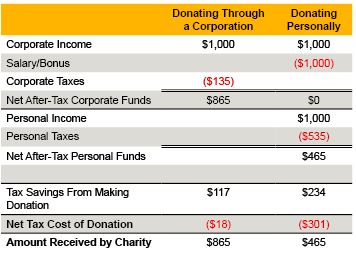

Let’s say you are an individual that falls within the highest personal income tax bracket, you have already made more than $200 of donations personally during the year and you want to make an additional charitable donation. You have $1,000 of pre-tax income in your corporation and are wondering whether it makes sense to donate directly through the corporation or to take the money out of the corporation via additional salary or a bonus. After the corporation pays its corporate tax, it would have $865 available to make the donation. The corporate-made donation would result in corporate tax savings of roughly $117, resulting in a net tax cost of $18 to make the charitable contribution. If, instead, you decided to withdraw the money and make the donation personally, after paying the personal income tax, you would have $465 available to make the donation. After claiming the charitable donation tax credit, the net tax cost of making the donation would be approximately $301 – significantly more than if the donation is made through the corporation. Additionally, the charity would be far better off if the donation was made through the corporation than if it was made personally ($865 received versus $465). See the analysis below:

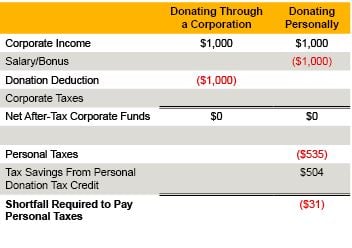

In another example, let’s say that you want to make a $1,000 charitable donation and there is $1,000 in the corporation. In this case, if the donation was made directly from the corporation, the corporation would pay no corporate tax and the charity would receive $1,000. If, instead you pulled the money out of the corporation by way of additional salary or a bonus and then made a $1,000 donation, the donation tax credit would not fully offset the personal income tax owing on the additional salary or bonus and there would be a net shortfall of roughly $31 required to cover the personal income taxes. See the analysis below:

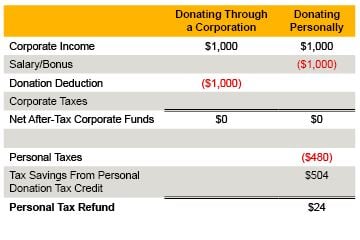

Individuals outside the top marginal personal income tax bracket may get different results. If a person has $150,000 of taxable income, they are slightly better off making the $1,000 donation personally. See the analysis below:

The general rule of thumb is that if an individual expects to have more than $206,000 of taxable income personally in 2018, it makes sense from a tax perspective to make the donation directly through the corporation. If not, then the donation should be made personally. This threshold amount changes every year, so you should check in with your tax advisor annually.

Crowe Soberman LLP has extensive experience in advising clients on their philanthropic endeavours. Please contact us for more information on how to get the most out of your donations.

This article has been prepared for the general information of our clients. Specific professional advice should be obtained prior to the implementation of any suggestion contained in this article. Please note that this publication should not be considered a substitute for personalized tax advice related to your particular situation.