Are you an American working in Canada? You need to consider the major tax consequences that will directly impact you. Here are three major tax implications that Americans working in Canada should know about.

1. You will be taxed differently if you are moving to Canada permanently.

Generally, if you are a “tax resident” of a particular country, you are liable to pay taxes in that country on your worldwide income. It is not uncommon for a globally mobile individual to be considered a “tax resident” of more than one country. If proper advice is not sought, this can result in two countries having the right to tax your worldwide income, or in other words - double taxation. This problem is often mitigated via the appropriate tax treaty between the two countries in question. As a citizen of the United States, you are automatically considered an American “tax resident” under its domestic tax rules, but you can easily be considered a “tax resident” of Canada if your move to Canada for work suggests permanence (such as selling your American home to buy one in Canada, moving your spouse and children with you, etc.). You can also be considered a Canadian “tax resident” if you spend 183 days or more in a calendar year in Canada. Generally, if you are working in Canada for an American employer for a short period of time, you will not be considered a resident of Canada for tax purposes. If you are not a tax resident of Canada, you must only pay personal income taxes in Canada on certain income earned in Canada, or whose source is Canadian.2. Your employer is required to withhold a certain amount from your pay for Canadian tax purposes, but may be able to apply for exemption.

Employers that pays any employee for employment services rendered in Canada have a domestic tax obligation to withhold payroll source deductions on these amounts and remit them to the Canada Revenue Agency (“CRA”). Regardless of whether the employee works in Canada for one day or the entire year, this obligation is required. Given the administrative burden for having to withhold and remit for employees spending little time in Canada, the CRA provides a couple potential tax exemptions from withholding and remitting, under certain circumstances, and if the proper forms are filed on-time with the CRA. One of these forms is called the R102-R: Regulation 102 Waiver Application, which should be completed no less than 30 days in advance of employment services in Canada for each employee. Another exemption form, the RC473: Non-Resident Employer Certification, is a blanket form that can cover all short-term U.S. employees sent to work in Canada by their U.S. employer over a period of two years. This form will only cover employees that are present in Canada for less than 90 days in any 12-month period. In addition, under the Canada-US Social Security Agreement, certain deductions such as Canada Pension Plan premiums and Employment Insurance contributions will not have to be withheld and deducted. This assumes that the employee is subject to social security taxes in the U.S.3. You may have to file a Canadian tax return

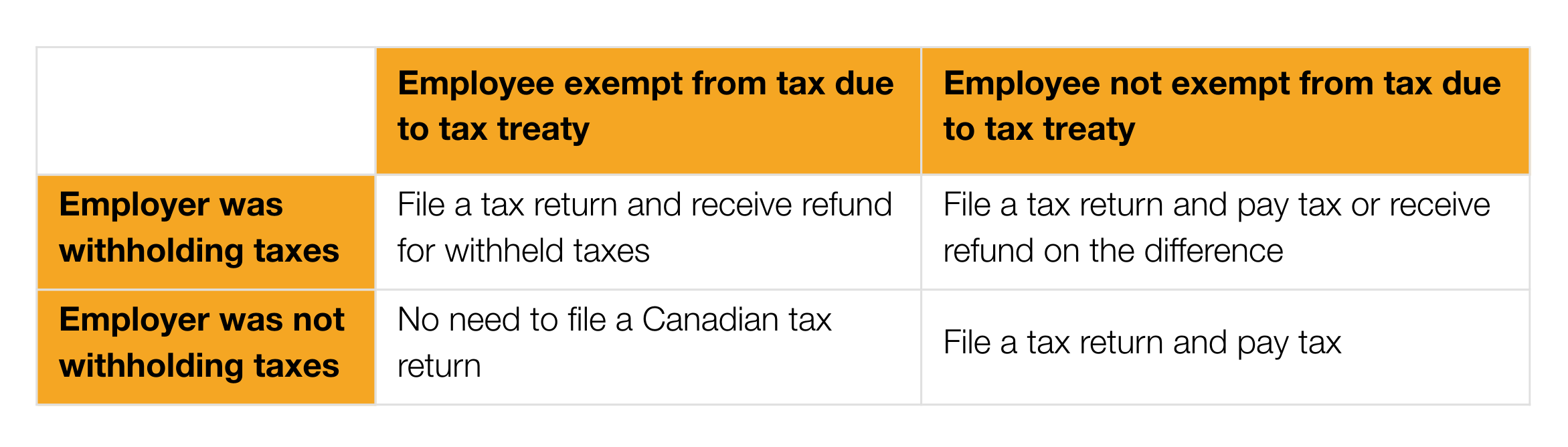

An American employee that is not a Canadian tax resident under Canadian law is required to only pay taxes on certain Canadian income. If your U.S. employer withheld Canadian payroll source deductions from your pay while working in Canada, you may be entitled to a refund of these taxes as per the Canada-U.S tax treaty. You will be eligible for a refund if you earned either less than $10,000 CAD during your employment term in Canada, or if your stay in Canada was less than 183 days in any 12-month period and the amount is not borne by a permanent establishment in Canada. Your Canadian tax obligations can be summarized in the following matrix:

While earning employment income in Canada may expose American employees to income taxation in Canada, most American employees will not be subject to Canadian personal income taxation due to the exemptions in the Canada-US tax treaty. Depending on your specific situation, it can be quite confusing to determine whether you need to file a Canadian income tax return to either pay tax or receive your refund. Contact a Crowe Soberman advisor to help identify your Canadian income tax obligations.

This article has been prepared for the general information of our clients. Specific professional advice should be obtained prior to the implementation of any suggestion contained in this article. Please note that this publication should not be considered a substitute for personalized tax advice related to your particular situation.