On Monday, April 19, 2021, Prime Minister Justin Trudeau and Minister of Finance Chrystia Freeland released Federal Budget 2021: A Recovery Plan for Jobs, Growth and Resilience. The Liberal government’s highly-anticipated budget comes nearly two years after its last publication and includes a comprehensive (and extensive) spending plan.

Canada’s Federal Budget Highlights 2021

A Recovery Plan for Jobs, Growth and Resilience.

COVID-19 Recovery

To strengthen long-term and supportive care, Budget 2021 proposes to provide $3 billion over five years, starting in 2022-23, to Health Canada to support provinces and territories in ensuring standards for long-term care are applied and permanent changes are made.

To strengthen long-term and supportive care, Budget 2021 proposes to provide $3 billion over five years, starting in 2022-23, to Health Canada to support provinces and territories in ensuring standards for long-term care are applied and permanent changes are made. To help seniors living in their homes, Budget 2021 proposes to provide $90 million over three years, starting in 2021-22, to Employment and Social Development Canada to launch the Age Well at Home initiative which supports community-based organizations in providing practical aid that helps low-income and otherwise vulnerable seniors age in place.

The government is also proposing to increase Old Age Security (OAS) for seniors 75 years of age and older, beginning in 2022. Budget 2021 proposes to meet the immediate needs of seniors by providing a one-time payment of $500 in August 2021 to OAS pensioners who will be 75 years of age or older as of June 2022.

Budget 2021 then proposes to introduce legislation to increase regular OAS payments for pensioners 75 years and older by 10 per cent on an ongoing basis as of July 2022. This would increase the benefits for approximately 3.3 million seniors, providing additional benefits of $766 to full pensioners in the first year, and indexed to inflation going forward.

To move forward on establishing national mental health standards, Budget 2021 proposes to provide:

To move forward on establishing national mental health standards, Budget 2021 proposes to provide:

- $45 million over two years, starting in 2021-22, to Health Canada, the Public Health Agency of Canada, and the Canadian Institutes of Health Research, to help develop national mental health service standards, in collaboration with provinces and territories, health organizations, and key stakeholders;

- $100 million over three years, starting in 2021-22, to the Public Health Agency of Canada to support projects for innovative mental health interventions for populations disproportionately impacted by COVID-19, including health care workers, front-line workers, youth, seniors, Indigenous people, and racialized and Black Canadians;

- $50 million over two years, starting in 2021-22, to Health Canada to support a trauma and post-traumatic stress disorder (PTSD) stream of mental health programming for populations at high risk of experiencing COVID-19 trauma and those exposed to various trauma brought about by COVID-19; and

- $62 million, in 2021-22, to Health Canada for the Wellness Together Canada portal so that it can continue to provide Canadians with tools and services to support mental health and well-being.

Budget 2021 proposes to provide a total $2.2 billion over seven years towards growing a vibrant domestic life sciences sector. This support would provide foundational investments to help build Canada’s talent pipeline and research systems, as well as support the growth of Canadian life science firms.

Budget 2021 proposes to provide a total $2.2 billion over seven years towards growing a vibrant domestic life sciences sector. This support would provide foundational investments to help build Canada’s talent pipeline and research systems, as well as support the growth of Canadian life science firms.

To facilitate the safe restart of air travel in a way that limits transmission of COVID-19 and protects travellers, Budget 2021 proposes to provide:

To facilitate the safe restart of air travel in a way that limits transmission of COVID-19 and protects travellers, Budget 2021 proposes to provide:

- $82.5 million in 2021-22 to Transport Canada to support major Canadian airports in making investments in COVID-19 testing infrastructure;

- $105.3 million over five years, starting in 2021-22, with $28.7 million in remaining amortization and $10.2 million per year thereafter to Transport Canada to collaborate with international partners to further advance the Known Traveller Digital Identity pilot project, which will test advanced technologies to facilitate touchless and secure air travel; and

- $271.1 million in 2021-22 to the Canadian Air Transport Security Authority to maintain operations and enhanced screening services at the 89 airports.

- To improve sanitization at screening checkpoints, $6.7 million in 2021-22 to the Canadian Air Transport Security Authority to acquire and operate sanitization equipment.

Budget 2021 proposes to provide $57.6 million in 2021-22 to extend the Mandatory Isolation Support for Temporary Foreign Workers Program to help employers offset costs associated with temporary foreign workers having to fulfill isolation requirements upon entering Canada. Support of up to $1,500 per worker would be provided to employers until June 15, 2021 for costs of the 14-day isolation period. If workers are required to quarantine at a government approved facility (due to a lack of suitable facilities at their employers’ facilities), employers can receive up to $2,000 per worker for costs associated with mandatory isolation requirements.

Budget 2021 proposes to provide $57.6 million in 2021-22 to extend the Mandatory Isolation Support for Temporary Foreign Workers Program to help employers offset costs associated with temporary foreign workers having to fulfill isolation requirements upon entering Canada. Support of up to $1,500 per worker would be provided to employers until June 15, 2021 for costs of the 14-day isolation period. If workers are required to quarantine at a government approved facility (due to a lack of suitable facilities at their employers’ facilities), employers can receive up to $2,000 per worker for costs associated with mandatory isolation requirements. After June 15, 2021, employers would receive $750 per worker until the winddown of the program on August 31, 2021. After August 31, the government intends on phasing-out this program and will consult with employers on the transition to ensure that migrant workers are similarly compensated by their employers through their quarantine period.

Business Stimulus Measures

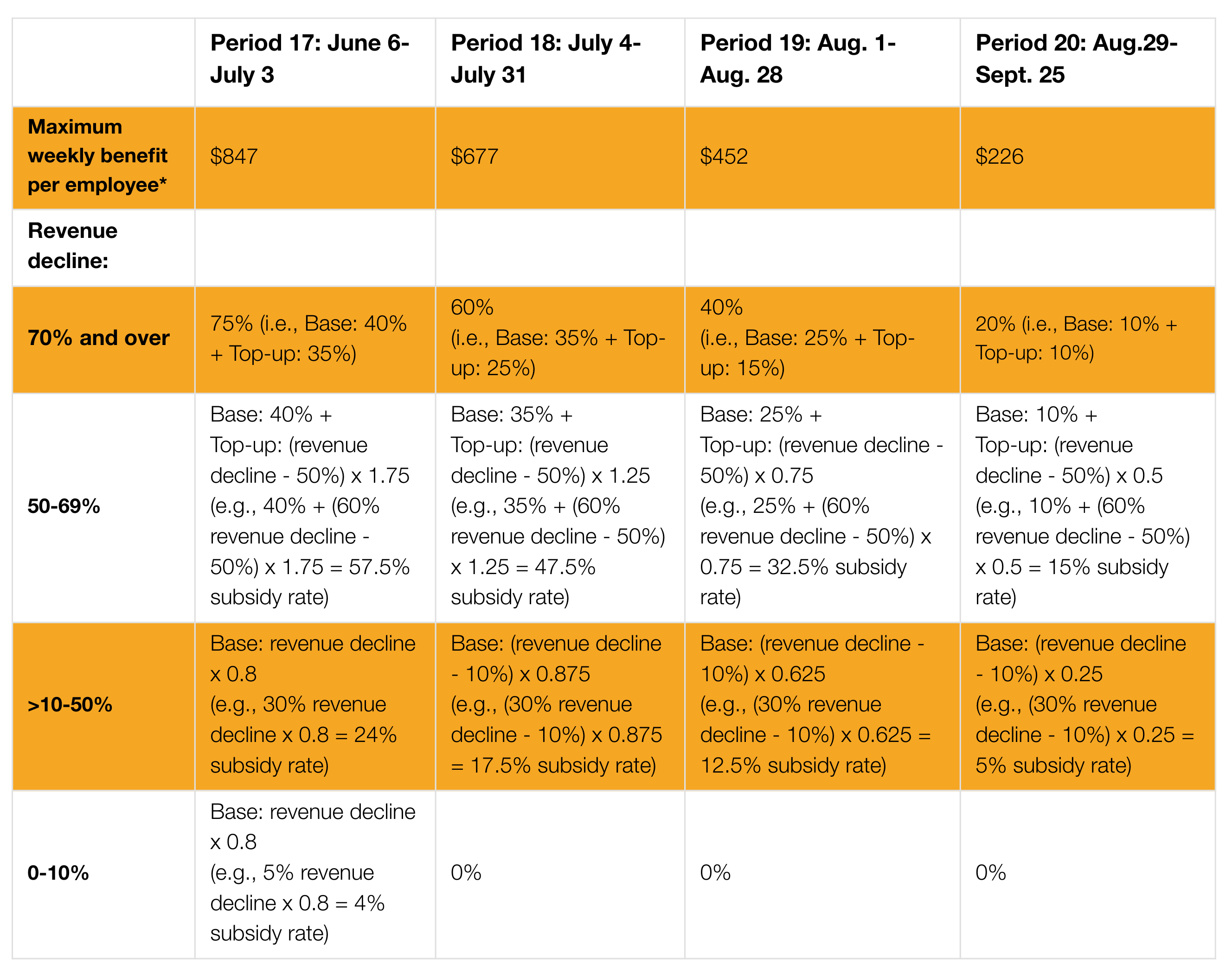

The government introduced the CEWS to prevent further job losses and encourage employers to quickly rehire workers previously laid off as a result of COVID-19. Budget 2021 proposes to extend the CEWS for the period June 6, 2021 to September 25, 2021. The subsidy rates would be gradually phased out starting on July 4, 2021. The proposed CEWS rates are summarized in the table below:

The government introduced the CEWS to prevent further job losses and encourage employers to quickly rehire workers previously laid off as a result of COVID-19. Budget 2021 proposes to extend the CEWS for the period June 6, 2021 to September 25, 2021. The subsidy rates would be gradually phased out starting on July 4, 2021. The proposed CEWS rates are summarized in the table below:

* The maximum weekly benefit per employee is equal to the maximum combined base subsidy and top-up wage subsidy for the qualifying period applied to the amount of eligible remuneration paid to the employee for the qualifying period, on remuneration of up to $1,129 per week.

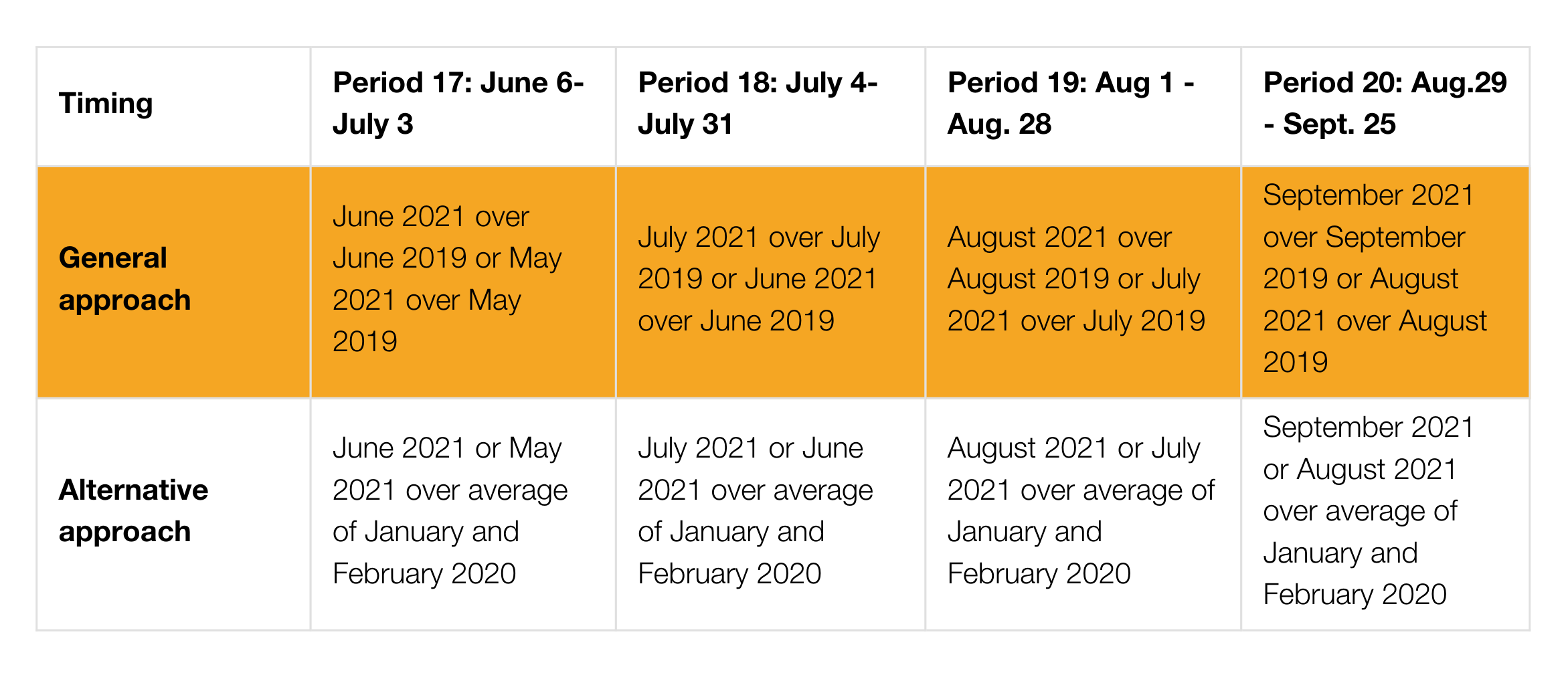

In addition, Budget 2021 proposes the following CEWS reference periods for periods 17 to 20:

Employers that had chosen to use the general approach for prior periods would be required to continue to use that approach for additional periods.

Baseline Remuneration

Budget 2021 proposes to allow an eligible employer to elect to use the following alternative baseline remuneration periods:

- March 1 to June 30, 2019 or July 1 to December 31, 2019, for the qualifying period between June 6, 2021 and July 3, 2021; and

- July 1 to December 31, 2019, for qualifying periods beginning after July 3, 2021.

CEWS Repayment Requirement

Budget 2021 proposes that public companies be required to repay CEWS amounts received for qualifying periods that begin after June 5, 2021 should the aggregate compensation for “specified executives” during the calendar year exceeds the aggregate compensation for specified executives during the 2019 calendar year. The goal with this proposal is to preclude these public companies from using CEWS funds to increase remuneration payments to top executives.

A publicly listed corporation's specified executives will be those individuals that are Named Executive Officers (CEO, CFO, etc.) whose compensation is required to be disclosed under Canadian securities laws in the company’s annual information circular provided to shareholders, or similar executives in the case of a corporation listed in another jurisdiction.

The amount of the CEWS repayment would be equal to the lesser of:

- The total of all CEWS amounts received in respect of active employees for qualifying periods that begin after June 5, 2021; and

- The amount by which the corporation's aggregate specified executives' compensation for 2021 exceeds its aggregate specified executives' compensation for 2019.

Support for Furloughed Employees

To align with benefits under EI, Budget 2021 proposes to adjust the CEWS in respect of furloughed employees for the period June 6, 2021 to August 28, 2021, to the lesser of:

- The amount of eligible remuneration paid in respect of the week; and

- The greater of:

- $500; and

- 55 per cent of pre-crisis remuneration for the employee, up to a maximum subsidy amount of $595.

Currently, the maximum base rent subsidy rate under the CERS is set at 65 per cent through the qualifying period ending on June 5, 2021.

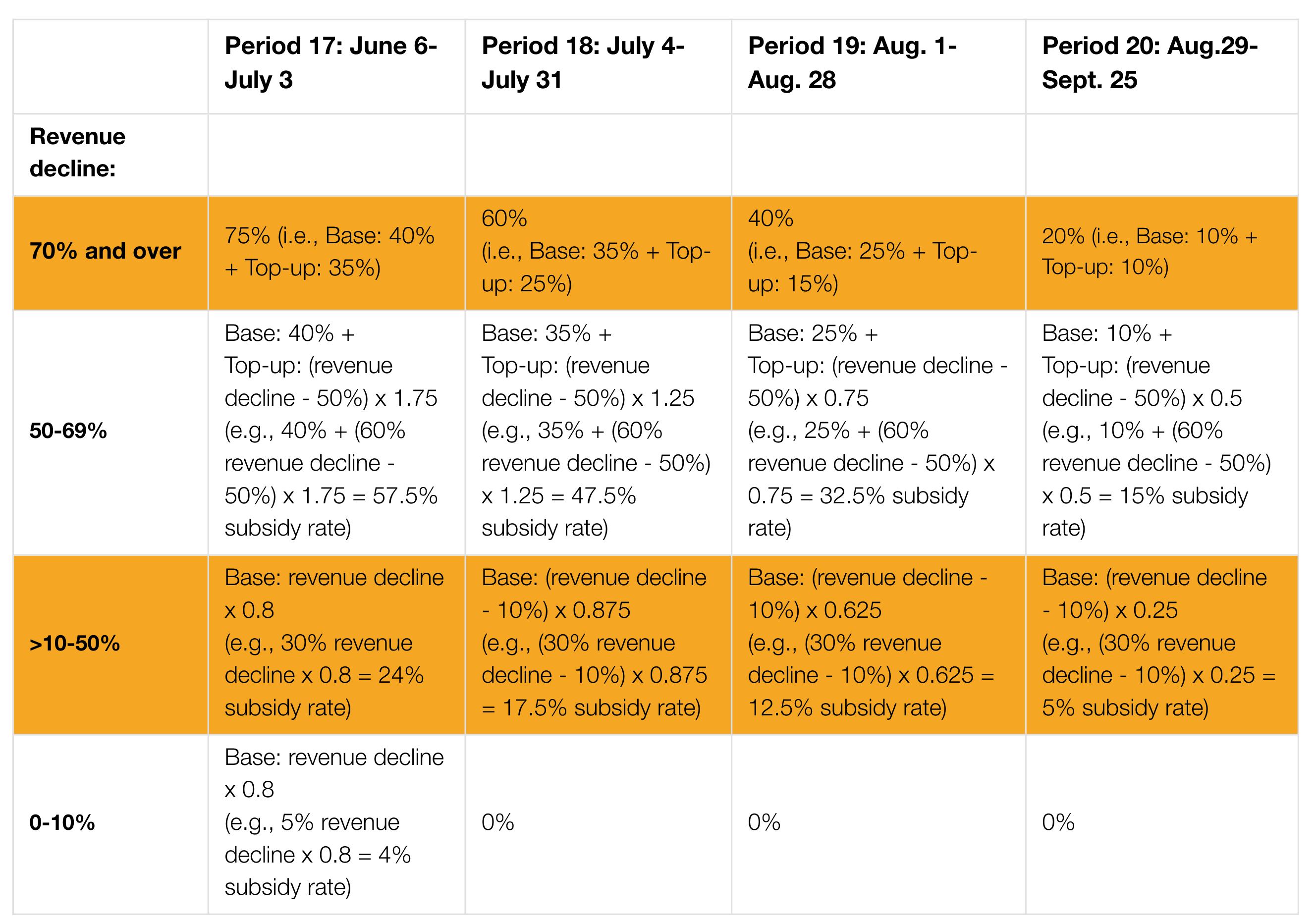

Budget 2021 proposes adopt the base rent subsidy rate structures in the table below for June 6, 2021 to September 25, 2021. The CERS subsidy rates would be gradually phased out starting on July 4, 2021.

* Expenses for each qualifying period are capped at $75,000 per location and are subject to an overall cap of $300,000 that is shared among affiliated entities.

** Period 17 of the Canada Emergency Wage Subsidy would be the tenth period of the Canada Emergency Rent Subsidy. Period identifiers have been aligned for ease of reference.

Lockdown Support

Some business locations had to cease operations or significantly limit their activities as a result of the government mandated lockdowns. In order to qualify for the previously enacted Lockdown Support, an applicant must qualify for the base rent subsidy.

Budget 2021 proposes to extend, for the qualifying periods between June 6, 2021 to September 25, 2021, the current 25-per-cent rate for the Lockdown Support.

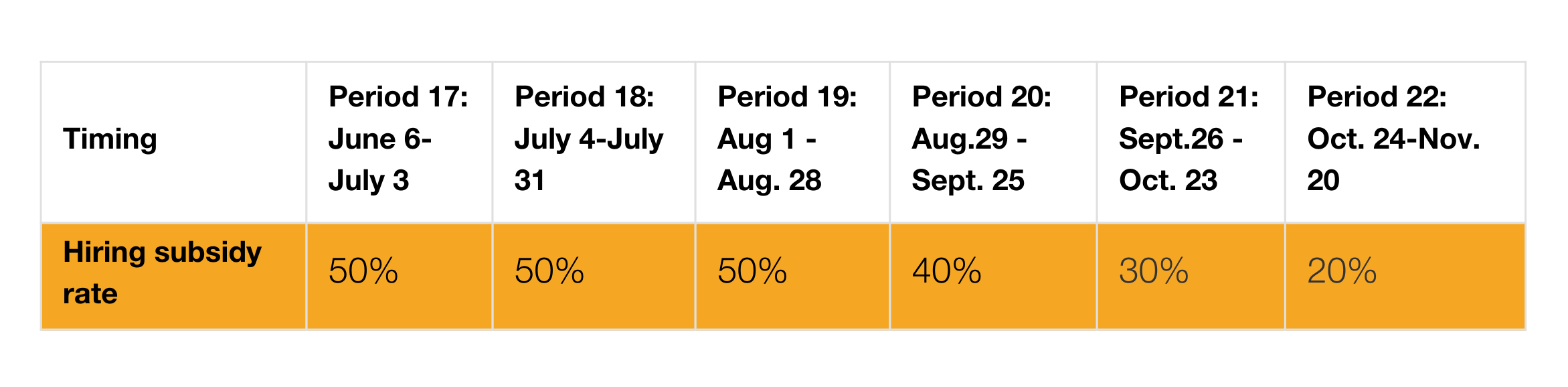

Budget 2021 proposes to introduce the new CRHR to provide eligible employers with a subsidy of up to 50 per cent on the incremental remuneration paid to eligible employees between June 6, 2021 and November 20, 2021. An eligible employer would be permitted to claim either the CRHR subsidy or the CEWS for a particular qualifying period, but not both.

Budget 2021 proposes to introduce the new CRHR to provide eligible employers with a subsidy of up to 50 per cent on the incremental remuneration paid to eligible employees between June 6, 2021 and November 20, 2021. An eligible employer would be permitted to claim either the CRHR subsidy or the CEWS for a particular qualifying period, but not both.

The types of remuneration eligible for the CRHR subsidy are the same as though eligible for the CEWS. Eligible remuneration generally includes salary, wages, and other remuneration for which employers are required to withhold or deduct amounts on account of the employee's income tax obligations. However, it does not include severance pay, or items such as stock option benefits or the personal use of a corporate vehicle.

The amount of remuneration for employees would be based solely on remuneration paid in respect of the qualifying period.

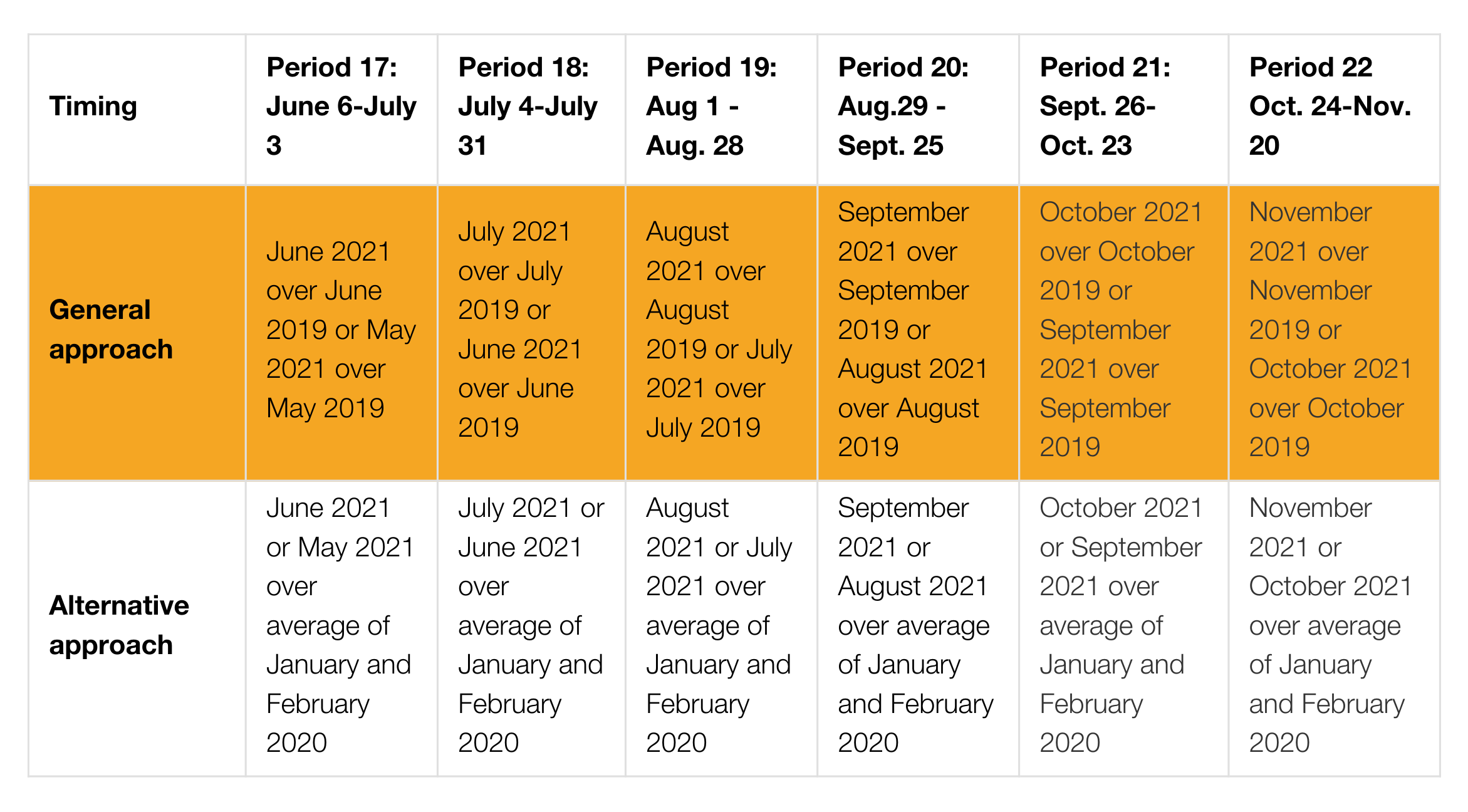

The table below summarizes the dates used to calculate the incremental remuneration:

Incremental remuneration qualifying periods:

CRHR Subsidy Amount

Provided that an eligible employer's decline in revenues exceeds the revenue-decline threshold (see below) for a qualifying period, its CRHR subsidy in that qualifying period would be equal to its incremental remuneration multiplied by the applicable CRHR subsidy rate for that qualifying period, per the chart below.

*Period 17 of the CEWS would be the first period of the CRHR.

Revenue-Decline Threshold

To qualify for a CRHR subsidy in a qualifying period, an eligible employer would have to have experienced a decline in revenues (same measurement as that applied to the CEWS) sufficient to qualify for the CEWS in that qualifying period. For qualifying periods where the CEWS is no longer in effect, an eligible employer would have to have experienced a decline in revenues of more than 10 per cent. As such, an eligible employer's decline in revenues would have to be more than:

- 0 per cent, for the qualifying period between June 6, 2021 and July 3, 2021; and

- 10 per cent, for qualifying periods between July 4, 2021 and November 20, 2021.

Revenue Decline Reference Periods

The revenue decline test would be applied to the CRHR reference periods as follows:

*Period 17 of the Canada Emergency Wage Subsidy would be the first period of the Canada Recovery Hiring Program. Period identifiers have been aligned for ease of reference.

An application for the CRHR subsidy for a qualifying period would be required to be made no later than 180 days after the end of the qualifying period.

Budget 2021 proposes to provide temporary immediate expensing of amounts paid for certain “eligible property” acquired by a Canadian-Controlled Private Corporation (CCPC) on or after Budget Day. Highlights of this immediate expensing proposal are summarized as follows:

Budget 2021 proposes to provide temporary immediate expensing of amounts paid for certain “eligible property” acquired by a Canadian-Controlled Private Corporation (CCPC) on or after Budget Day. Highlights of this immediate expensing proposal are summarized as follows:

- Available in respect of "eligible property" that becomes available for use before January 1, 2024, up to a maximum amount of $1.5 million per taxation year;

- The $1.5 million limit would be shared among associated members of a group of CCPCs;

- The limit would be prorated for taxation years that are shorter than 365 days;

- The half-year rule would be suspended for property for which this measure is used;

- “Eligible property” would be capital property that is subject to the CCA rules, other than property included in CCA classes 1 to 6, 14.1, 17, 47, 49 and 51; and

- The immediate expensing does not alter the overall CCA that can be taken in respect of the eligible property over its life – the larger deduction taken in the first year means that future CCA claims will be lower.

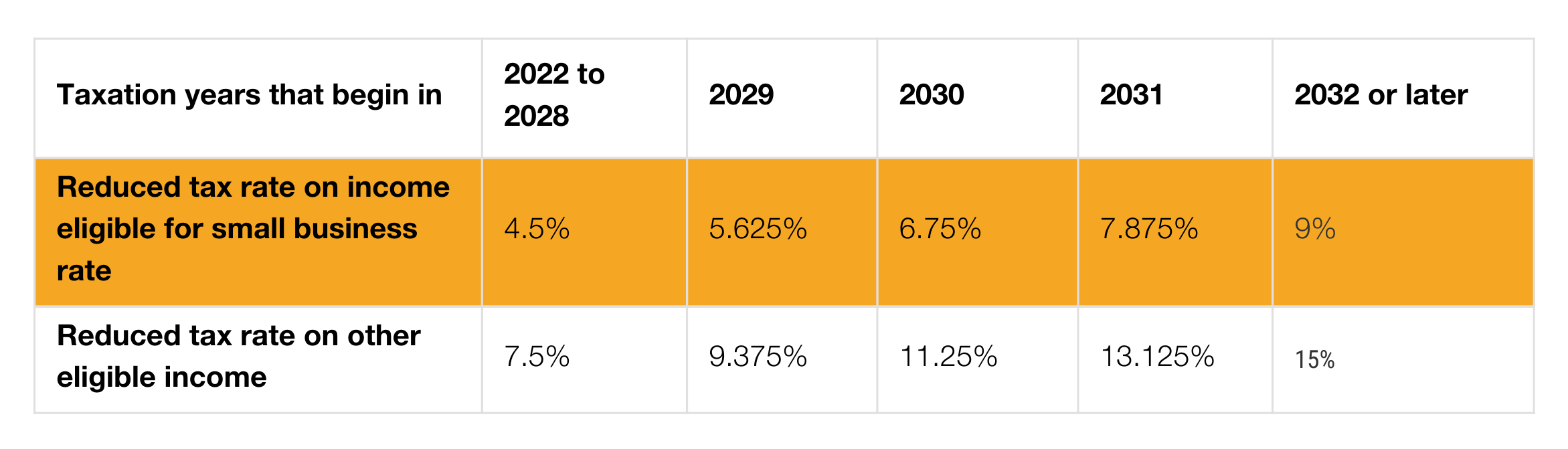

Budget 2021 proposes a temporary measure to reduce corporate income tax rates for qualifying zero-emission technology manufacturers. Specifically, taxpayers would be able to apply reduced tax rates on eligible zero-emission technology manufacturing and processing income of:

- 7.5 per cent, where that income would otherwise be taxed at the 15 per cent general corporate tax rate; and

- 4.5 per cent, where that income would otherwise be taxed at the 9 per cent small business tax rate.

Taxpayers with income subject to both the general and the small business corporate tax rates would be able to choose to have their eligible income taxed at either the reduced rate of 4.5 per cent (I.e., the small business rate) or the general reduced rate of 7.5 per cent. The amount of income taxed at the 4.5 per cent rate plus the amount of income taxed at the small business rate of 9 per cent would not be allowed to exceed the business limit (currently $500,000).

These reduced tax rates would apply to taxation years that begin after 2021 and would be gradually phased out starting in taxation years that begin in 2029, with full phase out after 2031, as per the chart below.

Currently, Classes 43.1 and 43.2 provide for accelerated CCA in respect of investments in specified clean energy generation and energy conservation equipment. Budget 2021 proposes to expand Classes 43.1 and 43.2 to include other clean technology assets and remove fossil-fueled type assets.

Currently, Classes 43.1 and 43.2 provide for accelerated CCA in respect of investments in specified clean energy generation and energy conservation equipment. Budget 2021 proposes to expand Classes 43.1 and 43.2 to include other clean technology assets and remove fossil-fueled type assets.

Budget 2021 proposes to temporarily extend certain timelines by 12 months for the Canadian Film or Video Production Tax Credit (CPTC) and the Film or Video Production Services Tax Credit (PSTC) to recognize that many productions were disrupted by the Covid-19 pandemic.

Budget 2021 proposes to temporarily extend certain timelines by 12 months for the Canadian Film or Video Production Tax Credit (CPTC) and the Film or Video Production Services Tax Credit (PSTC) to recognize that many productions were disrupted by the Covid-19 pandemic. The CPTC provides a 25 per cent refundable tax credit on qualified labour expenditures and is available to productions certified to be Canadian film or video productions.

The PSTC provides a 16 per cent refundable credit on qualified Canadian labour expenditures and is available to foreign films and videos produced in Canada.

Budget 2021 proposes to provide $105 million over three years, starting in 2021-22, for Telefilm Canada to modernize its current suite of programs to provide better access to a diverse range of creators and producers, support green practices, and respond to increasing digitization in the audiovisual industry.

Budget 2021 proposes to provide $105 million over three years, starting in 2021-22, for Telefilm Canada to modernize its current suite of programs to provide better access to a diverse range of creators and producers, support green practices, and respond to increasing digitization in the audiovisual industry. To provide opportunities for equity deserving creators to build skills and experience, and to support greater diversity in top-tier productions, Budget 2021 also proposes to provide $60 million over three years, starting in 2021-22, to the Canada Media Fund to increase support for productions led by people from equity deserving groups working in the Canadian audiovisual industry.

Budget 2021 proposes to enhance the current reporting requirements in respect of certain transactions undertaken by taxpayers that are considered “avoidance transactions” as defined under the general anti-avoidance rule (GAAR).

Budget 2021 proposes to require that uncertain tax treatments be reported to the CRA by corporate taxpayers. This disclosure would be similar to that which is required under generally accepted accounting principles (GAAP).

Budget 2021 proposes to require that uncertain tax treatments be reported to the CRA by corporate taxpayers. This disclosure would be similar to that which is required under generally accepted accounting principles (GAAP).

A reporting corporation would generally be required to report an uncertain tax treatment in respect of a taxation year where the following conditions are met:

- The corporation is required to file a Canadian return of income for the taxation year.

- The corporation has at least $50 million in assets at the end of the financial year that coincides with the taxation year (or the last financial year that ends before the end of the taxation year).

- The corporation, or a related corporation, has audited financial statements prepared in accordance with IFRS or other country-specific GAAP relevant for domestic public companies (e.g., U.S. GAAP).

- Uncertainty in respect of the corporation's Canadian income tax for the taxation year is reflected in those audited financial statements.

There are significant penalties (of up to $100,000) for non-compliance, including the statute of limitations period on that particular taxation year not being invoked until disclosure requirements are complied with.

Budget 2021 proposes to curtail tax planning that involves a transfer of assets from a taxpayer to non-arm's length persons for less than fair market value consideration, the purpose of which is to avoid paying their tax debts. Significant penalties (up to $100,000) apply to promoters or planners involved in the implementation of these transactions.

Budget 2021 proposes to curtail tax planning that involves a transfer of assets from a taxpayer to non-arm's length persons for less than fair market value consideration, the purpose of which is to avoid paying their tax debts. Significant penalties (up to $100,000) apply to promoters or planners involved in the implementation of these transactions.

In response to multilateral efforts to address the base erosion and profit sharing (BEPS), Budget 2021 proposes to build on the OECD and the G20 BEPS Action Plan (BEPS Action Plan). BEPS refers to international tax planning arrangements used by multinational enterprises to reduce taxes by exploiting the interaction between domestic and international tax rules – for example, through shifting profits earned in Canada to other jurisdictions.

In response to multilateral efforts to address the base erosion and profit sharing (BEPS), Budget 2021 proposes to build on the OECD and the G20 BEPS Action Plan (BEPS Action Plan). BEPS refers to international tax planning arrangements used by multinational enterprises to reduce taxes by exploiting the interaction between domestic and international tax rules – for example, through shifting profits earned in Canada to other jurisdictions.

Interest Deductibility Limits

Budget 2021 proposes to introduce an earnings-stripping rule consistent with the recommendations in the BEPS Action Plan. The new rule would limit the amount of net interest expense that a corporation may deduct in computing its taxable income to no more than a fixed ratio of "tax EBITDA", which is that corporation's taxable income before taking into account interest expense, interest income and income tax, and deductions for depreciation and amortization, as determined for tax purposes.

Starting in 2023, the government proposes that the amount of interest that certain businesses can deduct be limited to 40 per cent of their earnings in the first year of the measure and 30 per cent thereafter. Relief will be provided for small businesses and for other situations that do not represent significant tax base erosion risks. The government expects to release draft legislation this summer and will seek stakeholder input on the new rules.

- Deduction/non-inclusion mismatches: These arise where a country allows a deduction in respect of a cross-border payment, the receipt of which is not included within a reasonable period of time in ordinary income in the other country. For these purposes, "ordinary income" generally means income that is subject to income tax at the recipient's full tax rate and does not benefit from any exemption, exclusion, deduction, credit or comparable tax relief.

- Double deduction mismatches: These arise where a tax deduction is available in two or more countries in respect of a single economic expense.

The 2021 Budget proposes amendments to the new measures announced in the Fall Economic Statement 2020 that would come into force on July 1, 2021 as follows:

The 2021 Budget proposes amendments to the new measures announced in the Fall Economic Statement 2020 that would come into force on July 1, 2021 as follows:

- Safe Harbour Rules: Under the earlier proposals, platform operators would be required to collect and remit the GST/HST on the supplies they facilitate by third parties that are not registered for GST/HST purposes. Budget 2021 proposes new rules that would limit the liability of a platform operator for failure to collect and remit tax as a result of having relied in good faith on information provided by a third-party supplier.

- Eligible Deductions: Budget 2021 proposes to clarify that suppliers registered for the GST/HST under the new GST/HST regime for non-resident vendors are eligible to deduct amounts for bad debts and certain provincial HST point-of-sale rebates to purchasers (e.g., in respect of audio books) from the tax that they are required to remit.

- Threshold Amount Determination: Under the proposed new GST/HST regime, a non-resident vendor or distribution platform operator with sales to consumers in Canada that exceed, or are expected to exceed, $30,000 over a 12-month period is required to register for the GST/HST under the new regime and charge the GST/HST on their sales. Budget 2021 proposes to exclude zero-rated sales from those sales.

- Platform Operator Information Return: Budget 2021 proposes to provide the Minister of National Revenue the authority to register a person that the Minister believes should be registered under the new regime.

Businesses must obtain and retain certain information in order to support their ITC claims. The required information is contained in documents provided by their suppliers, such as invoices or receipts. The information requirements for these documents are graduated, with progressively more information required when the amount paid or payable in respect of a supply equals or exceeds thresholds of $30 or $150. Budget 2021 proposes to increase the current ITC information thresholds to $100 (from $30) and $500 (from $150).

Businesses must obtain and retain certain information in order to support their ITC claims. The required information is contained in documents provided by their suppliers, such as invoices or receipts. The information requirements for these documents are graduated, with progressively more information required when the amount paid or payable in respect of a supply equals or exceeds thresholds of $30 or $150. Budget 2021 proposes to increase the current ITC information thresholds to $100 (from $30) and $500 (from $150).

In addition, under the ITC information rules, either the supplier or an intermediary (i.e., a person that causes or facilitates the making of a supply on behalf of the supplier) must provide its business name and, depending on the amount paid or payable in respect of the supply, its GST/HST registration number, on the supporting documents. Budget 2021 proposes to allow billing agents (that do not cause or facilitate the making of a supply on behalf of the supplier) to be treated as intermediaries for purposes of the ITC information rules.

These measures would come into force on the day after Budget Day.

The GST New Housing Rebate entitles homebuyers to recover a percentage of the GST (or the federal component of the HST) as well the Ontario component of the HST paid on the purchase of a new home subject to price thresholds. Under the current rules, if two or more unrelated individuals buy a new home together, all of those individuals must meet this condition – otherwise none of them will be eligible for the Rebate. Budget 2021 proposes to make the Rebate available as long as the new home is acquired for use as the primary place of residence of any one of the purchasers or a relation of any one of the purchasers. This measure would apply to a supply made under an agreement of purchase and sale entered into after Budget Day.

The GST New Housing Rebate entitles homebuyers to recover a percentage of the GST (or the federal component of the HST) as well the Ontario component of the HST paid on the purchase of a new home subject to price thresholds. Under the current rules, if two or more unrelated individuals buy a new home together, all of those individuals must meet this condition – otherwise none of them will be eligible for the Rebate. Budget 2021 proposes to make the Rebate available as long as the new home is acquired for use as the primary place of residence of any one of the purchasers or a relation of any one of the purchasers. This measure would apply to a supply made under an agreement of purchase and sale entered into after Budget Day.

The 2021 Budget also announced other sales tax measures relating to the following:

The 2021 Budget also announced other sales tax measures relating to the following:

- New measures relating to the rebate of excise tax for goods purchased by provinces.

- Increase to excise duty on tobacco.

- A new excise duty on vaping products.

- A new luxury tax on the retail sale of new luxury cars and personal aircraft priced over $100,000, and boats priced over $250,000, effective as of January 1, 2022.

The Government of Canada is announcing its intention to introduce legislation that will establish a federal minimum wage of $15 per hour, rising with inflation, with provisions to ensure that where provincial or territorial minimum wages are higher, that wage will prevail.

The Government of Canada is announcing its intention to introduce legislation that will establish a federal minimum wage of $15 per hour, rising with inflation, with provisions to ensure that where provincial or territorial minimum wages are higher, that wage will prevail.

Entrepreneurs, especially those from equity deserving groups such as racialized Canadians, young people, LGBTQ2+ people, and more, face barriers to starting and growing a business. Budget 2021 proposes to provide:

Entrepreneurs, especially those from equity deserving groups such as racialized Canadians, young people, LGBTQ2+ people, and more, face barriers to starting and growing a business. Budget 2021 proposes to provide:

- Up to $101.4 million over five years, starting in 2021-22, to Innovation, Science and Economic Development Canada for the Small Business and Entrepreneurship Development Program;

- Affordable financing, increase data, and strengthen capacity within the entrepreneurship ecosystem, Budget 2021 proposes to provide up to $146.9 million over four years, starting in 2021-22, to strengthen the Women Entrepreneurship Strategy. Women entrepreneurs would have greater access to financing, mentorship, and training. Funding would also further support the Women Entrepreneurship Ecosystem Fund and the Women Entrepreneurship Knowledge Hub; and

- Up to an additional $51.7 million over four years, starting in 2021-22, to Innovation, Science and Economic Development Canada and the regional development agencies for Canada’s first-ever Black Entrepreneurship Program.

- $42 million over three years, starting in 2021-22, to expand the Aboriginal Entrepreneurship Program.

To fuel the recovery, jobs, and growth, the government is launching the Canada Digital Adoption Program, to help small and medium-sized businesses expand their online customer base, access digital support and take advantage of e-commerce opportunities.

To fuel the recovery, jobs, and growth, the government is launching the Canada Digital Adoption Program, to help small and medium-sized businesses expand their online customer base, access digital support and take advantage of e-commerce opportunities.

Budget 2021 proposes to provide $1.4 billion over four years, starting in 2021-22, to Innovation, Science and Economic Development Canada, to:

- Work with organizations across Canada to provide access to skills, training, and advisory services for all businesses accessing this program.

- Provide microgrants to smaller, main street businesses to support costs associated with technology adoption.

Budget 2021 also proposes to provide $2.6 billion on a cash basis over four years, starting in 2021-22, to the Business Development Bank of Canada to help small and medium-sized businesses finance technology adoption.

To make sure small business and independent entrepreneurs can access the capital they need to recover, innovate, and grow in the long-term, Budget 2021 proposes to improve the Canada Small Business Financing Program through amendments to the Canada Small Business Financing Act and its regulations. These proposed amendments include:

To make sure small business and independent entrepreneurs can access the capital they need to recover, innovate, and grow in the long-term, Budget 2021 proposes to improve the Canada Small Business Financing Program through amendments to the Canada Small Business Financing Act and its regulations. These proposed amendments include:

- Expanding loan class eligibility to include lending against intellectual property and start-up assets and expenses.

- Increasing the maximum loan amount from $350,000 to $500,000 and extending the loan coverage period from 10 to 15 years for equipment and leasehold improvements.

- Expanding borrower eligibility to include non-profit and charitable social enterprises.

- Introducing a new line of credit product to help with liquidity and cover short-term working capital needs.

To remove internal trade barriers, Budget 2021 proposes to allocate $21 million over three years, starting in 2021-22, to:

To remove internal trade barriers, Budget 2021 proposes to allocate $21 million over three years, starting in 2021-22, to:

- Work with provincial and territorial partners to enhance the capacity of the Internal Trade Secretariat that supports the Canadian Free Trade Agreement in order to accelerate the reduction of trade barriers within Canada;

- Advance work with willing partners towards creating a repository of open and accessible pan-Canadian internal trade data to identify barriers, including licensing and professional certification requirements; and

- Pursue internal trade objectives through new or renewed discretionary federal transfers to provinces and territories.

The government will also engage with key stakeholders to work towards lowering the cost of doing business by reducing credit card transaction fees (interchange fees) and ensure that small businesses benefit from pricing that is similar to large businesses.

The impact of COVID-19 on workers and businesses in tourism, arts, and culture has been severe. Recognizing the impact that COVID-19 has had on these industries, Budget 2021 proposes to:

The impact of COVID-19 on workers and businesses in tourism, arts, and culture has been severe. Recognizing the impact that COVID-19 has had on these industries, Budget 2021 proposes to:

- Establish a $500 million Tourism Relief Fund, administered by the regional development agencies. The Fund will support investments by local tourism businesses in adapting their products and services to public health measures and other investments that will help them recover from the pandemic and position themselves for future growth;

- Invest $200 million through the regional development agencies to support major festivals;

- Invest $200 million through Canadian Heritage to support local festivals, community cultural events, outdoor theatre performances, heritage celebrations, local museums, amateur sport events, and more;

- Provide $100 million to Destination Canada for marketing campaigns to help Canadians and other visitors discover and explore the country;

- Provide $80 million over two years, starting in 2021-22, to Canadian Heritage to remove barriers to participation in sports programming and to help community organizations kick-start local organized sports that are accessible to all; and

- Provide $300 million over two years, starting in 2021-22, to Canadian Heritage to establish a Recovery Fund for Heritage, Arts, Culture, Heritage and Sport Sectors.

Budget 2021 proposes an additional $304.1 million over five years, starting in 2021–22, to allow the Canada Revenue Agency (CRA) to fund new initiatives and extend existing programs, including:

Budget 2021 proposes an additional $304.1 million over five years, starting in 2021–22, to allow the Canada Revenue Agency (CRA) to fund new initiatives and extend existing programs, including:

- Increasing GST/HST audits of large businesses where risk assessment models have found the greatest risk of non-compliance;

- Modernizing the CRA’s risk assessment process to prevent unwarranted and fraudulent GST/HST refund and rebate claims at the outset, and improve the ability to issue refunds for compliant businesses as quickly as possible; and

- Enhancing capacity to identify tax evasion involving trusts and provide better service to executors and trustees.

Budget 2021 proposes to implement a Digital Services Tax at a rate of three per cent on revenue from digital services that rely on data and content contributions from Canadian users. The tax would apply to large businesses with gross revenue of 750 million euros or more. It would apply as of January 1, 2022, until an acceptable multilateral approach comes into effect.

Budget 2021 proposes to implement a Digital Services Tax at a rate of three per cent on revenue from digital services that rely on data and content contributions from Canadian users. The tax would apply to large businesses with gross revenue of 750 million euros or more. It would apply as of January 1, 2022, until an acceptable multilateral approach comes into effect.

Climate Action and Green Measures

Through Budget 2021, the government proposes to provide $4.4 billion to the Canada Mortgage and Housing Corporation (CMHC) to help homeowners complete home retrofits through interest-free loans worth up to $40,000. The program is planned to be available by summer 2021 with support for up to 200,000 households.

Through Budget 2021, the government proposes to provide $4.4 billion to the Canada Mortgage and Housing Corporation (CMHC) to help homeowners complete home retrofits through interest-free loans worth up to $40,000. The program is planned to be available by summer 2021 with support for up to 200,000 households.

The Net Zero Accelerator was launched in December of 2020 with the goal of building and securing Canada’s clean industrial advantage. Budget 2021 proposes to provide a further $5 billion over seven years to the Accelerator supporting good jobs and projects that will reduce domestic greenhouse gas emissions across the Canadian economy.

The Net Zero Accelerator was launched in December of 2020 with the goal of building and securing Canada’s clean industrial advantage. Budget 2021 proposes to provide a further $5 billion over seven years to the Accelerator supporting good jobs and projects that will reduce domestic greenhouse gas emissions across the Canadian economy.  Canada is a leader in Carbon capture, utilization, and storage (CCUS), an important tool for reducing emissions in high emitting sectors, with domestic projects that currently capture four megatonnes of carbon every year. Through Budget 2021, the government proposes to introduce an investment tax credit for capital invested in CCUS projects, beginning in 2022, with the goal of reducing emissions by at least 15 megatonnes of CO2 annually. Budget 2021 also proposes to provide $319 million over seven years, starting in 2021-22, with $1.5 million in remaining amortization, to Natural Resources Canada to support research and development that would improve the commercial viability of carbon capture, utilization, and storage technologies.

Canada is a leader in Carbon capture, utilization, and storage (CCUS), an important tool for reducing emissions in high emitting sectors, with domestic projects that currently capture four megatonnes of carbon every year. Through Budget 2021, the government proposes to introduce an investment tax credit for capital invested in CCUS projects, beginning in 2022, with the goal of reducing emissions by at least 15 megatonnes of CO2 annually. Budget 2021 also proposes to provide $319 million over seven years, starting in 2021-22, with $1.5 million in remaining amortization, to Natural Resources Canada to support research and development that would improve the commercial viability of carbon capture, utilization, and storage technologies.

Social Measures

The Disability Tax Credit (DTC) is a non-refundable tax credit that helps individuals with disabilities or individuals supporting them to reduce personal tax. For 2021, the value of the credit is $1,299. To be eligible for the DTC, an individual must incur disability related costs and have a certificate confirming that they have a severe and prolonged impairment in physical or mental functions.

The Disability Tax Credit (DTC) is a non-refundable tax credit that helps individuals with disabilities or individuals supporting them to reduce personal tax. For 2021, the value of the credit is $1,299. To be eligible for the DTC, an individual must incur disability related costs and have a certificate confirming that they have a severe and prolonged impairment in physical or mental functions. Budget 2021 proposes to expand access to the DTC by expanding the eligibility criteria of mental functions necessary for everyday life, as well as expanding on rules regarding life-sustaining therapy. The proposed changes would apply to 2021 and subsequent taxation years.

The Canada Workers Benefit (CWB) is a non-taxable refundable credit that supplements the earnings of low- and modest-income workers. The benefit is calculated based on 26 cents for every dollar of working income earned in excess of $3,000 up to $1,395 for single individuals (without dependants) or $2,403 for families (couples and single parents).

The Canada Workers Benefit (CWB) is a non-taxable refundable credit that supplements the earnings of low- and modest-income workers. The benefit is calculated based on 26 cents for every dollar of working income earned in excess of $3,000 up to $1,395 for single individuals (without dependants) or $2,403 for families (couples and single parents). - Increase the phase-in rate from 26 per cent to 27 per cent for single individuals without dependants as well as families;

- Increase the phase-out thresholds from $13,194 to $22,944 for single individuals without dependants and from $17,522 to $26,177 for families.

- Increase the phase-out rate from 12 percent to 15 per cent.

Currently, income earned by postdoctoral fellows does not qualify as earned income for the purpose of determining an individual’s contribution limit for a Registered Retirement Savings Plan (RRSP).

Currently, income earned by postdoctoral fellows does not qualify as earned income for the purpose of determining an individual’s contribution limit for a Registered Retirement Savings Plan (RRSP). Budget 2021 proposes to address this issue by allowing individuals the option to claim a deduction in respect of the repayment of a COVID-19 benefit amount in the year the benefit was received rather than the year in which the repayment was made. This option would be available for benefits repaid at any time before 2023.

Currently, COVID-19 benefits received by non-residents of Canada are not taxable given that the benefits are not one of the prescribed sources of Canadian taxable income earned by non-residents.

Currently, COVID-19 benefits received by non-residents of Canada are not taxable given that the benefits are not one of the prescribed sources of Canadian taxable income earned by non-residents. Budget 2021 proposes to address this inequality through amending the Income Tax Act to ensure that COVID-19 federal and provincial/territorial benefit amounts are taxable to individuals who live in Canada but are considered non-resident persons.

Currently, there is no rule in the Income Tax Act which would allow pension plan administrators to accept retroactive contributions in order to correct under-contribution errors.

Currently, there is no rule in the Income Tax Act which would allow pension plan administrators to accept retroactive contributions in order to correct under-contribution errors. Budget 2021 proposes to provide more flexibility to pension plan administrators to correct both under-contribution and over-contribution errors. The proposals would permit certain under-contribution errors to be corrected via additional contributions subject to a dollar limit.

The proposals would also permit plan administrators to correct for pension over-contribution errors in respect of an employee or employer for any of the five years prior to the year in which the excess amount is refunded to the employee or employer who made the excess contribution.

To simplify reporting requirements, the proposed rules would require the plan administrator to file a prescribed form in respect of each affected employee rather than amending T4 slips issued in prior years. To the extent that any adjustments are made which would cause an individual to have negative RRSP room, it would only impact the employee’s contribution in future years.

Budget 2021 proposes a number of amendments to the Income Tax Act in order to limit opportunities for the abuse of charitable registration status.

Budget 2021 proposes a number of amendments to the Income Tax Act in order to limit opportunities for the abuse of charitable registration status. Where a qualified donor is listed as a terrorist entity under the Criminal Code, Budget 2021 proposes to allow the Minister of National Revenue to immediately revoke the registration of the charity rather than having to follow the current administrative process.

Similarly, Budget 2021 proposes to give the Minister of National Revenue the ability to revoke the registration of a charity or Canadian amateur athletic association where the organization has an “ineligible individual” as a director, trustee, officer or where such an individual controls or manages the charity or association. Budget 2021 proposes to amend the ineligible individual definition so that it includes an individual who is a member of a listed terrorist entity.

Budget 2021 also proposes to allow the Minister of National Revenue the right to suspend the authority of a registered charity to issue official donation receipts for one year or to revoke its registration where a false statement amounting to culpable conduct was made for the purpose of maintaining its registration status.

To improve the administration of, and compliance with, the tax system, Budget 2021 proposes various changes. These proposed measures would improve the CRA’s ability to operate digitally, resulting in faster, more convenient and accurate service, while also enhancing security.

To improve the administration of, and compliance with, the tax system, Budget 2021 proposes various changes. These proposed measures would improve the CRA’s ability to operate digitally, resulting in faster, more convenient and accurate service, while also enhancing security.

- Notice of Assessment: Budget 2021 proposes to enable the CRA with the ability to send certain notices of assessment electronically without the taxpayer having to authorize the CRA to do so. This proposal would apply in respect to individuals who file their income tax return electronically and those who employ the services of a tax preparer that files their income tax return electronically.

- Correspondence With Businesses: Budget 2021 proposes to change the default method of correspondence for businesses that use the CRA My Business Account portal to electronic only. Businesses however could still choose to also receive paper correspondence.

- Information Returns: Budget 2021 proposes to allow issuers of T4A and T5 information returns to deliver the information returns electronically to the recipients without having to issue paper copies even without the authorization from the recipient to do so.

- Tax Preparers: Budget 2021 proposes to require professional preparers where they prepare more than 5 corporate income tax returns or 5 personal income tax returns to be required to file electronically.

Budget 2021 also proposes to limit the number of paper-filed returns to be filed by a tax preparer to a maximum of five income tax returns for corporations and five income tax returns for individuals.

- Filer of Information Returns: Budget 2021 proposes to lower the threshold for mandatory electronic filing of income tax information returns for a calendar year from 50 to 5 returns in respect of each particular type of information return.

- Corporations and GST/HST Registrants: Budget 2021 proposes to eliminate the mandatory electronic filing thresholds for corporate and GST/HST returns. As such, most corporate and GST/HST returns would be required to be filed electronically.

- Electronic Payments: Budget 2021 proposes that electronic payments be required for remittances over $10,000 under the Income Tax Act and that the threshold for mandatory remittances to be made at a financial institution under the Excise Tax Act, the Air Travellers Security Charge Act and Part 1 of the Greenhouse Gas Pollution Pricing Act to be lowered from $50,000 to $10,000. This measure would apply to payments made on or after January 1, 2022.

- Handwritten Signatures: Budget 2021 proposes to eliminate the requirement that signatures be in writing on certain prescribed forms, as follows:

- T183, Information Return for Electronic Filing of an Individual’s Income Tax and Benefit Return;

- T183CORP, Information Return for Corporations Filing Electronically;

- T2200, Declaration of Conditions of Employment;

- RC71, Statement of Discounting Transaction; and

- RC72, Notice of the Actual Amount of the Refund of Tax

Budget 2021 announces the government’s intention to implement a national, annual one per cent tax on the value of non-resident, non- Canadian owned residential real estate that is considered to be vacant or underused, effective January 1, 2022. The tax will require all owners, other than Canadian citizens or permanent residents of Canada, to file a declaration as to the current use of the property, with significant penalties for failure to file.

Budget 2021 announces the government’s intention to implement a national, annual one per cent tax on the value of non-resident, non- Canadian owned residential real estate that is considered to be vacant or underused, effective January 1, 2022. The tax will require all owners, other than Canadian citizens or permanent residents of Canada, to file a declaration as to the current use of the property, with significant penalties for failure to file.

In the coming months, the government will release a consultation paper to provide stakeholders with an opportunity to comment on the parameters of the proposed tax, including on whether special rules should be established for small tourism and resort communities.

Over the next five years, the government will work with provinces and territories to make meaningful progress towards building a Canada-wide, community-based child care system including:

Over the next five years, the government will work with provinces and territories to make meaningful progress towards building a Canada-wide, community-based child care system including:

- A 50 per cent reduction in average fees for regulated early learning and child care in all provinces outside of Quebec, to be delivered before or by the end of 2022.

- An average of $10 a day by 2025-26 for all regulated child care spaces in Canada.

- Ongoing annual growth in quality affordable child care spaces across the country, building on the approximately 40,000 new spaces already created through previous federal investments.

- Meaningful progress in improving and expanding before- and after-school care in order to provide more flexibility for working parents.

For families that have children with disabilities, Budget 2021 proposes to provide $29.2 million over two years, starting in 2021-22, to Employment and Social Development Canada through the Enabling Accessibility Fund to support child care centres as they improve their physical accessibility, such as the construction of ramps and accessible doors, washrooms, and play structures.

To ensure that the cost of post-secondary education in Canada remains predictable and affordable for everyone during the economic recovery, the government proposes to:

To ensure that the cost of post-secondary education in Canada remains predictable and affordable for everyone during the economic recovery, the government proposes to:

- Introduce legislation that would extend the waiver of interest accrual on Canada Student Loans and Canada Apprentice Loans until March 31, 2023;

- Increase the threshold for repayment assistance to $40,000 for borrowers living alone, so that nobody earning $40,000 per year or less will need to make any payments on their student loans; and

- Extend the doubling of the Canada Student Grants until the end of July 2023.

To ensure youth and students can access valuable job skills and experience, Budget 2021 is proposing to spend $721 million in the next two years to help connect them with employers and provide them with quality job opportunities by investing:

To ensure youth and students can access valuable job skills and experience, Budget 2021 is proposing to spend $721 million in the next two years to help connect them with employers and provide them with quality job opportunities by investing:

- $239.8 million in the Student Work Placement Program in 2021-22 to support work-integrated learning opportunities for post-secondary students. This funding would increase the wage subsidy available for employers to 75 per cent, up to $7,500 per student, while also increasing employers’ ability to access the program;

- $109.3 million in 2022-23 for the Youth Employment and Skills Strategy to better meet the needs of vulnerable youth facing multiple barriers to employment, while also supporting over 7,000 additional job placements for youth; and

- $371.8 million in new funding for Canada Summer Jobs in 2022-23 to support approximately 75,000 new job placements in the summer of 2022.

To help Canadians find affordable housing, spur job creation and local economic recovery, alleviate cost pressure in the housing market overall, and grow the middle class, Budget 2021 proposes to provide an additional $2.5 billion over seven years, starting in 2021-22, to the Canada Mortgage and Housing Corporation, including:

To help Canadians find affordable housing, spur job creation and local economic recovery, alleviate cost pressure in the housing market overall, and grow the middle class, Budget 2021 proposes to provide an additional $2.5 billion over seven years, starting in 2021-22, to the Canada Mortgage and Housing Corporation, including:

- An additional $1.5 billion for the Rapid Housing Initiative in 2021-22 to address the urgent housing needs of vulnerable Canadians by providing them with adequate affordable housing in short order. At least 25 per cent of this funding would go towards women-focused housing projects, and units would be constructed within 12 months of when funding is provided to program applicants.

- $600 million over seven years, starting in 2021-22, to renew and expand the Affordable Housing Innovation Fund, which encourages new funding models and innovative building techniques in the affordable housing sector.

- $315.4 million over seven years, starting in 2021-22, through the Canada Housing Benefit, to increase direct financial assistance for low-income women and children fleeing violence to help with their rent payments.

- $118.2 million over seven years, starting in 2021-22, through the Federal Community Housing Initiative, to support community housing providers that deliver long-term housing to many of our most vulnerable.

For Canadians experiencing homelessness, Budget 2021 also proposes to provide an additional $567 million over two years, beginning in 2022-23, to Employment and Social Development Canada for Reaching Home.

The government is proposing to launch planned disbursements of the $755 million Social Finance Fund and deploy up to $220 million over its first two years. It is estimated that the Social Finance Fund could attract up to $1.5 billion in private sector capital to support the development of the social finance market, create thousands of new jobs, and drive positive social change.

Budget 2021 also proposes to renew the Investment Readiness Program for $50 million over two years, starting in 2021-22. This program supports charities, non-profits, and social purpose organizations in capacity-building activities such as business plan development, expanding products and services, skills development, and hiring.

To continue to support the work of community organizations that empower and advocate for Black Canadians, Budget 2021 proposes to provide $200 million in 2021-22 to Employment and Social Development Canada to establish a new Black-led Philanthropic Endowment Fund. This fund would be led by Black Canadians and would create a sustainable source of funding, including for Black youth and social purpose organizations, and help combat anti-Black racism and improve social and economic outcomes in Black communities.

Related Posts

Contact Us