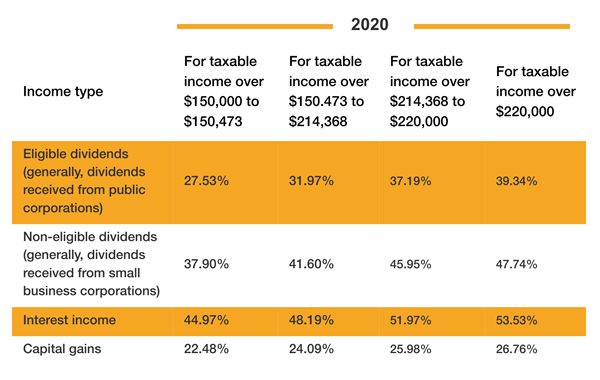

1. Tax rates are significantly more favourable for dividend income than interest income. The top personal tax rates in Ontario for 2020 are as follows:

The top personal tax rates are not expected to change for 2021.

You may want to re-evaluate your investment strategy by comparing the pre-tax dividend rates with the pre-tax interest rates using the chart provided in the Investment Income - A Closer Look section at the end of this chapter.

2. You can defer tax on interest to the following year by investing funds for a one-year term ending in the next calendar year.

3. You can also defer purchases of mutual funds until early in the next calendar year to minimize taxable income allocated in the current year from the mutual fund.

4. Existing companies that have built up refundable dividend tax on hand (RDTOH) may consider paying dividends to recover this tax. Depending on its year-end, the company may have up to 24 months to enjoy the benefits of the tax refund before the shareholder is required to pay personal tax on the dividend. The individual circumstances should be reviewed, including the marginal tax rate applicable to the recipient shareholder as compared to the dividend refund rate in the corporation (38.3 per cent).

5. If you own qualified small business corporation (QSBC) shares or qualified farm and fishing property, you may benefit from the lifetime capital gains exemption of $883,384 for 2020 ($892,218 for 2021) on the gain realized on the sale of these types of assets. The exemption is indexed to inflation annually.

The Government has maintained the exemption of $1,000,000 for qualified farm and fishing property. The exemption is available on dispositions made on or after April 21, 2015.

6. Consider realizing accrued losses on investments to shelter capital gains realized this year and/or in the previous three years.

Note that a loss realized from the disposition of an investment may be denied if you or your spouse or common-law partner repurchase the investment within a short period of time.

7. If you have significant trading activity, the disposition of your securities may be considered a business for income tax purposes.

If your disposition of securities is considered a business, your profits will be fully taxable as income (instead of being considered capital gains taxable at 50 per cent), and your losses will be fully deductible against any source of income.

If you are concerned about the disposition of your securities being considered a business, you can consider filing a one-time, non-revocable election with the Canada Revenue Agency (CRA).

This election will treat all your gains from dispositions of Canadian securities as capital gains (and all your losses as capital losses) for the current year and all future years.

For someone who has never contributed and has been eligible for the TFSA since its introduction in 2009 has contribution room of $75,500 available in 2021.

Contributions to a TFSA are not deductible for income tax purposes.

Interest on money borrowed to invest in a TFSA is not tax deductible.

Contributions to and income earned in a TFSA are tax-free. Withdrawals from a TFSA are also tax-free.

You can give money to your spouse for a TFSA contribution, and the income earned on the contributions in your spouse’s TFSA will not be attributed back to you.

You cannot contribute more than your TFSA contribution room in a given year, even if you make withdrawals from the account during the year. If you do so, you may be subject to a penalty tax for each month that you are in an excess contribution position.

9. Consider donating publicly-traded securities instead of cash.

A tax-advantaged gift of securities can be made to a private foundation as well as to public charities. Any appreciation in the value of the securities will not be subject to capital gains tax if the securities are donated to:

- A registered charity; or

- A private foundation after March 18, 2007. There are special rules that apply to persons not dealing at arm’s length with the foundation. For more information, please contact us.

The donation credit (for individuals) or deduction (for corporations) continues to be available for the fair market value of the securities donated.

To avoid capital gains tax on the appreciated securities, the securities themselves must be transferred to the charity or foundation.

Similar rules will apply to a capital gain on ecologically-sensitive land donated to a conservation charity (other than a private foundation). The donation of flow-through securities may trigger a capital gain to the donor.

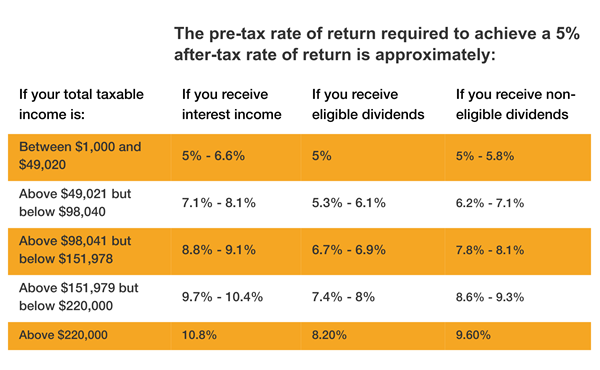

It may be a smart time for you to consider whether your investment income is tax efficient and consider investment alternatives.

The table below has been prepared to assist you in this matter. It assumes that your investment goal is to earn an after-tax rate of return of five per cent.

It compares the pre-tax yield required to achieve a 5 per cent after-tax rate of return by earning:

- Interest income;

- Eligible dividends (generally dividends received from public corporations); or

- Non-eligible dividends (generally dividends received from small business corporations).

Watch more here.

Contact Us