In my view, the most taxpayer-friendly rules in the Canadian tax system include the capital gains exemption on the sale of a Principal Residence, the capital gains exemption on the sale of qualifying small business corporate shares, and the Estate Freeze.

What is an Estate Freeze?

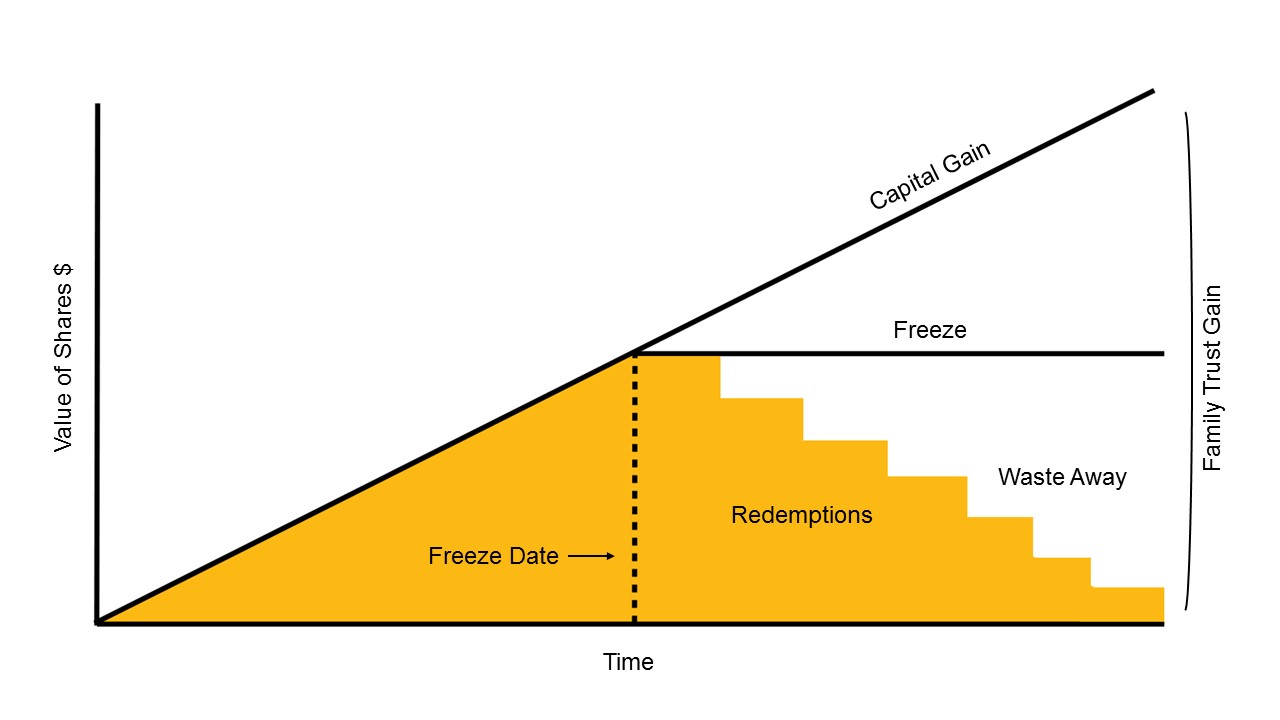

An Estate Freeze is a term given to a transaction where you lock-in or ‘freeze’ the value of private company shares. The planning is accomplished by exchanging the common ‘growth’ shares for ‘fixed value’ preferred shares. The share exchange allows new shareholders, often the next generation, to subscribe for the future growth of the company. For owners of successful private companies, an Estate Freeze is a ‘go-to’ planning tool. This is best illustrated with an example.

Example: The Smith family owns a successful car dealership. The business owners (first-generation) are 60 years old and the adult children (second-generation) are working in the business. In 2020, the car dealership is valued at $5 million.

The Smiths are reinvesting in the business, which is growing at a rate of 7% per year. At the projected rate of growth, in 20 years the company could be worth $20 million. If there is no change in the share ownership, and the value of the shares is $20 million, the first-generation shareholders will be deemed to have disposed of the shares on the death of the last surviving first-generation spouse. The tax liability could be approximately 25% or $5 million.

How could an Estate Freeze benefit the Smith family?

1. Flexibility

There were conversations in the tax community following the July 2017 private company tax changes asking if Family Trusts are dead. The short answer is no. Exchanging the first-generation shares for a fixed value ‘freeze share’ and introducing a Family Trust to subscribe for the new ‘growth’ shares will allow the first-generation to retain control of the company as Trustees. This provides flexibility to transfer the growth shares to either the first-generation or to the next generation at any time during the tax-deferred period of the Family Trust (generally 21 years).

2. Tax Deferral

Undertaking steps to freeze the value of the company in 2020 would provide the Smith family with the flexibility to transfer future growth, and the tax liability on death, to the next generation. In this example, freezing the current value could provide millions of dollars in tax deferrals.

3. Wasting Estate Freezing Strategy

It is not uncommon for first-generation shareholders to redeem or waste away the value of their freeze shares. Assuming the first-generation shareholders withdrawal $100,000 each from the business every year for the next 20 years; over time, the annual redemption would reduce the value of their shares by $4 million. In this example, the wasting estate freeze strategy could provide $1 million in tax savings.

4. Tax Liability and Life Insurance

Life insurance is an effective estate planning tool that is often used to plan for the tax liability on the death of a shareholder. However, the conversation should be about Life Insurance AND an Estate Freeze, not or. Fixed value freeze preferred shares should provide a reasonably ‘fixed value’ tax estimate for Life Insurance planning purposes. This should help ensure the Smith family is not grossly over or underinsured.

5. Estate Planning and Trusts

As the saying goes ‘all I want to know is where I am going to die so I never go there.’ The estate planning equivalent might be ‘if you plan to die in B.C., talk to your lawyer.’ B.C. is the land of high probate fees (roughly 1.4%) and the wills variation rules, as set out in the Wills, Estate, and Succession Act, allow the courts to modify a will after a person’s death. For these reasons, individuals sometimes use Trusts as a substitute for a will. In this example, upon death, assets in the Trust should pass outside of the will. This should provide privacy, mitigate probate fees, protect against estate litigation, and should be generally easier to administer, compared to executing a will.

Next steps –

Report the value of your business

Work with a Chartered Business Valuator (CBV) to report on the value of your business. A valuation provided by a CBV is the ‘gold standard’ and provides significant comfort that the value will not be challenged by the CRA.

Learn how your business could capitalize on a proactive estate freeze here.

Prepare legal documents

To prepare the appropriate legal documents work with a tax specialist and your lawyer. Often, during the course of tax planning, there are a number of value-added ‘extras’ that our clients wish to accomplish.