"Is your family business ready for its next chapter?"

For many family-owned enterprises, the dream is clear—passing a thriving business onto the next generation. This transition is more than an inheritance; it is a legacy, a symbol of shared values, and a route to sustained success across generations. However, the process of intergenerational business transfers has long been fraught with financial and regulatory challenges, often resulting in significant tax burdens when transferring ownership.

Enter the revised Section 84.1 of Canada's Income Tax Act (ITA), which offers family business owners new tax-efficient pathways to fulfill these dreams. Whether you're a first-generation founder looking to retire or a second-generation executive eager to take the reins, understanding these new tax rules is critical to a seamless transition.

In this article, our trusted advisors at Crowe MacKay explain the importance of Intergenerational Business Transfers, the new rules and conditions, and how to go from theory to practice.

The Importance of Intergenerational Business Transfers

Family businesses are a pillar of the Canadian economy, generating roughly 50% of the country's private sector gross domestic product (GDP). Yet, studies reveal that many family businesses have been unsuccessful in transitioning to the second generation, while even fewer continue into the third. Why? Challenges often arise in balancing financial considerations, succession planning, and family dynamics.

Until recently, the Canadian income tax system worked against family business owners choosing to sell or transfer the family business corporation to a corporation owned by their child(ren), leading many to contemplate selling to third parties instead. With updates to ITA Section 84.1, however, family businesses finally have practical solutions to retain ownership within the family without facing an unfair tax result.

This change isn't just about new tax rules—it's a fantastic opportunity for family businesses to grow and succeed across generations.

The New Rules for Intergenerational Business Transfers

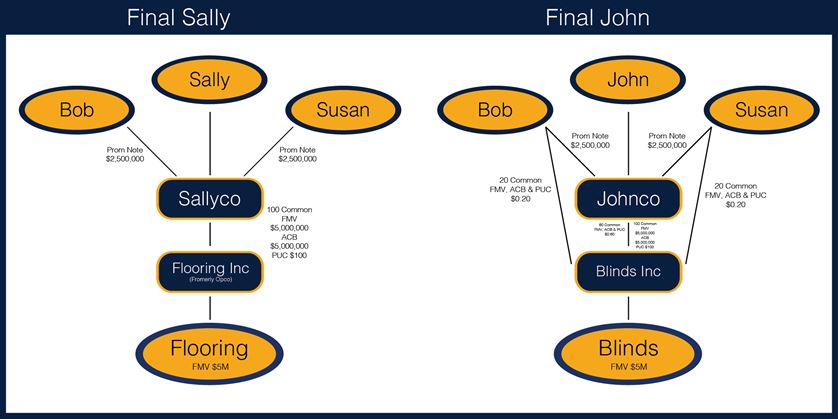

The updated ITA Section 84.1 introduces flexibility and fairness to the transfer process, explicitly addressing challenges with tax during ownership changes from one generation (G1) to the next (G2). Here's what you need to know about the two primary transfer types available under the new updated rules:

.jpg?la=en-us&rev=8c4db75455334575918b8e6555e13e63&hash=663910F8D2FD75931D3A62B54E515D38)