COVID -19 Impact on IFRS 16, Leases

Due to the current Covid-19 Impact, the entities across the industry are facing significant challenges and unique circumstances in evaluating the application of the Standards to relevant situations. IFRS 16, Leases, became effective for annual periods beginning on or after 1 January 2019 and the World went through with various challenges in dissecting the standard and its application in accounting for lease transactions and its disclosure in the financial statements. When many are yet to digest the standard fully, this current situation has posed additional challenges in evaluating application of standard to the current situation.

With current economic environment, there are lot of changes to various elements of lease arrangements between lessor and lessee. Such changes include several forms of lease concessions which may include Rent waivers, Payment Deferrals, and cash rebates and key assumptions made by lessee on lease period, impairment considerations etc. One of the key matter to be focused in the list of various changes is lease concessions, which could arise because of:

- terms in the lease arrangement or

- Government initiatives or

- ·voluntary support extended by Lessor or

- mutual arrangement between the lessee and the lessor.

These situations are to be carefully evaluated to ensure appropriate accounting treatment.

Key factor that needs to be considered in these situations are whether these result in lease modifications or not and how lessor and lessee needs to consider these in the accounting.

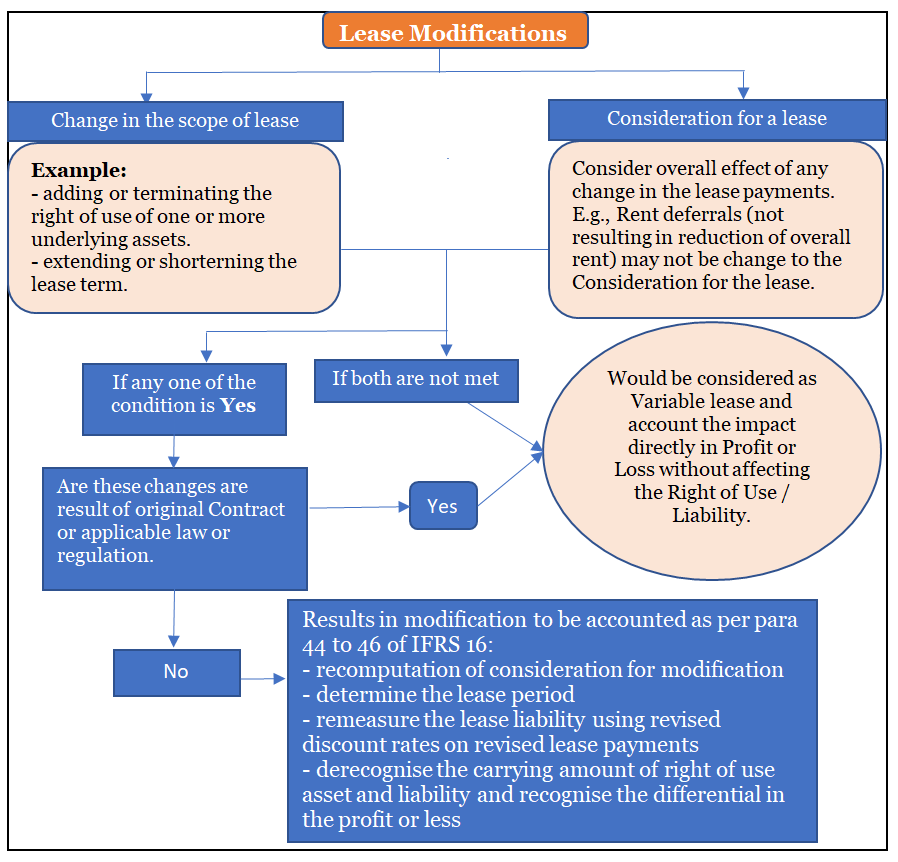

IFRS 16 defines a lease modification as a change in the scope of a lease, or the consideration for a lease, that was not part of the original terms and conditions of the lease.

Lease modification and accounting treatments:

There could be several challenges and complications that can arise in each stage.

Situations that may not result in lease modification and to account the impact in the Profit or Loss:

- Modifications are specifically covered in the original lease arrangement.

- Though not specifically covered but are due to government actions / imposition resulting into rent concessions which may fall under force majeure in the agreement.

- Rent Deferrals (proportionate) without change to overall consideration (However, PV of payments will change and the same needs to be accounted under IFRS 9, i.e., gain on interest to be recognised in P&L by lessee). This area may involve some judgments to be carefully considered by entities.

- Entity may need to consider necessary legal interpretation of certain rental arrangement, if needed.

When rent concessions results in lease modifications (i.e., it is neither covered in the lease agreement nor due to government action and not proportional deferrals etc.,), then entity needs to readjust the Right of Use and liabilities by reconsidering the revised discount rate, the revised lease payments and the lease period and make necessary accounting in the books of accounts.

Effect of adjustment to discount rates may vary whether the entity has transitioned to IFRS on January 1, 2019 under retrospective approach (impact on discount rate could be higher) or modified retrospective approach (impact on discount rate could be relatively lower).

Also, entities need to make necessary disclosures in the financial statements in relation to such modifications

IASB has issued a guidance in April 2020 in order to assist lessee and lessor in consistent application of the standard. Subsequently, in May 2020, IASB issued amendment to the standard to give optional exemption to lessee (only) to consider the rent concession as non-lease modification to address the operation challenges (with few terms and conditions attached to it, such as, no substantial change to consideration, arising due to Covid 19 impact and with impact arising in the specific period of 2020/2021) and the amendment is effective from June 1, 2020. Earlier application is permitted, including the financial statements not authorised for issue at 28 May 2020. This brings greater reliefs to lessees and avoids operational challenges in evaluating the rental concessions as lease modifications or not, subject to the fulfilment of certain terms and conditions laid out in the amendments to the standard. There are certain specific disclosure to be made in accordance with para 60A of the amendment to the Standard.

The application of modification accounting to a large portfolio of leases can be very challenging as it may involve the reallocation of consideration, the reassessment of lease classification, and the remeasurement of lease-related assets and liabilities. While the optional exemption granted by the amendment to standard is expected to simplify the accounting analysis required for concessions.

Few of the other considerations to be noted by entities may include:

- A rent holiday or rent reduction alone is not a change in the scope of a lease.

- When the terms of agreement to be reviewed, need to consider all other relevant facts and circumstances (para 2 of IFRS) which may include government orders during this pandemic to close stores. (e.g. force majeure).

- Reassessment of lease period – initial decision of lease term extension and any changes to that decision due to business environment.

- Impairment of right of use assets due to challenging business conditions.

- For lessor, lease receivables are subject to IFRS 9 impairment requirement and rent holidays may need to be factored in the impairment assessment.

Entities need to carefully evaluate the situation, consider whether to elect the optional exemption choice as per amendment of IFRS 16 standard or not and its related necessary accounting and disclosure in the financial statements.